Professional Documents

Culture Documents

Chapter 01

Uploaded by

ShantamCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 01

Uploaded by

ShantamCopyright:

Available Formats

Finance for Non-Financial Managers Fifth Edition

Slides prepared by

Pierre G. Bergeron

University of Ottawa

2008 by Nelson, a division of Thomson Canada Limited

Transparency 1.1

Overview of Financial Management

Learning Objectives

1. Define the meaning of financial management. 2. Identify the individuals responsible for the finance function. 3. Explain the four financial objectives. 4. Comment on the three major types of business decisions.

Chapter Reference Chapter 1: Overview of Financial Management

2008 by Nelson, a division of Thomson Canada Limited Transparency 1.2

1. The Meaning of Financial Management

Balance sheet

Assets Investors

Return on

assets

Cost of

financing

15%

11%

How are we doing and is the business profitable? How much cash do we have on hand and can we pay our bills on time? What should we spend our funds on? Operating activities or capital assets?

Where will our funds come from? From internal operations? From lenders?

From shareholders? How will our investors interests be protected? How much will it cost?

2008 by Nelson, a division of Thomson Canada Limited

Transparency 1.3

2. The Changing Role of Financial Management

The Balance Sheet Today

Internal activities Working capital Capital budgeting Management information systems Focus Economy Efficiency Effectiveness Operating and financial matters

2008 by Nelson, a division of Thomson Canada Limited

Yesterday

External activities Mergers Acquisitions Reorganization Recapitalization

Focus: Raising funds

Legal matters

Transparency 1.4

Who is Responsible for the Finance Function?

CONTROLLER

General accounting Cost accounting Credit and collections Management information systems Accounts payable Corporate accounting Internal auditing Budgets and analysis Systems and procedures Planning and controlling Interpreting financial reports Evaluation and consultation Preparing reports for government agencies Reports on capital assets

TREASURER

Raising capital Investor relations Short-term financing Dividend and interest payments Insurance management Analysis of investment securities Retirement funds Property funds Property taxes Investment portfolio Cash flow requirements Actuarial Underwriting policy and manuals Tax administration

OPERATING MANAGERS

2008 by Nelson, a division of Thomson Canada Limited Transparency 1.5

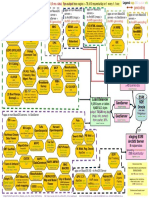

3. The Four Financial Objectives Efficiency

(Incubation)

R.O.S R.O.A R.O.I R.O.E Current assets Less: current liabilities Net working capital Sales revenue Working capital Capital assets Earnings Debt Assets Equity %

Transparency 1.6

%

$ $ $

Liquidity

(Cash shortage: must rely on credit)

Growth

(Financial insolvency = inaction)

Stability

(Total insolvency: debt is out of proportion)

2008 by Nelson, a division of Thomson Canada Limited

4. Types of Business Decisions

Balance Sheet

Investing decisions Managers

Current assets

Operating decisions Managers

Income Statement

Sales revenue

Financing decisions

CEO/CFO/Treasurer

Liabilities Current Long-term

Capital assets

Cost of sales

Gross profit Operating expenses Income before taxes Income taxes Net income

Equity

Capital

Retained earnings

Transparency 1.7

2008 by Nelson, a division of Thomson Canada Limited

Operating Decisions

Balance Sheet

Working Capital Management

Cash Accounts receivable

Inventory

Accounts payable

Income Statement

Demassing

Planned downsizing Productivity indicators Rewarding simplification Cutting back useless activities Rewarding quality work Empowering workers Zero-based budgeting

2008 by Nelson, a division of Thomson Canada Limited

Transparency 1.8

Financing Decisions The matching principle

Sources and forms of financing

Cost of borrowed funds Financing mix

2008 by Nelson, a division of Thomson Canada Limited Transparency 1.9

Investing Decisions

Capital Assets

Research and development

Expansions

New plants

Modernizations

Acquisitions

2008 by Nelson, a division of Thomson Canada Limited

Transparency 1.10

You might also like

- Dumpleader: Ensure Success With Money Back GuaranteeDocument9 pagesDumpleader: Ensure Success With Money Back GuaranteeShantamNo ratings yet

- 02feb 350-022.v2012-09-29.by - BOB.408q PDFDocument153 pages02feb 350-022.v2012-09-29.by - BOB.408q PDFShantamNo ratings yet

- 01feb 350-029.v2015-05-21.by - Lorena.414q PDFDocument245 pages01feb 350-029.v2015-05-21.by - Lorena.414q PDFShantamNo ratings yet

- 6e Brewer Ch01 B Eoc (2) t224Document11 pages6e Brewer Ch01 B Eoc (2) t224Jason ShaoNo ratings yet

- Are Multiple-Choice Questions with Partial Credit as Effective as Constructed Response for STEM AssessmentsDocument13 pagesAre Multiple-Choice Questions with Partial Credit as Effective as Constructed Response for STEM AssessmentsShantamNo ratings yet

- Sts in Tin Put Headlines Sent 1Document1 pageSts in Tin Put Headlines Sent 1ShantamNo ratings yet

- Guidance For Readings, 081008: Latour's Immutable Mobiles: and Centres of CalculationDocument5 pagesGuidance For Readings, 081008: Latour's Immutable Mobiles: and Centres of CalculationShantamNo ratings yet

- Accounting Questions Week 3Document2 pagesAccounting Questions Week 3milleranNo ratings yet

- Dev Ops 5Document35 pagesDev Ops 5ShantamNo ratings yet

- Eengaging With The MediaDocument32 pagesEengaging With The MediaShantamNo ratings yet

- Course EvalDocument10 pagesCourse EvalShantamNo ratings yet

- G - 100 Top Digital Marketing McqsDocument9 pagesG - 100 Top Digital Marketing McqsShantam75% (4)

- MassGIS Online MappingDocument1 pageMassGIS Online MappingShantamNo ratings yet

- KK 10E 2010 SpringDocument4 pagesKK 10E 2010 SpringShantamNo ratings yet

- Module 11Document8 pagesModule 11ShantamNo ratings yet

- The Finance Career Cluster ExamDocument35 pagesThe Finance Career Cluster ExamShantamNo ratings yet

- Assessment HandbookDocument51 pagesAssessment HandbookShantamNo ratings yet

- Bahan Syllabus AriDocument3 pagesBahan Syllabus AriShantamNo ratings yet

- Simpson ParadoxDocument1 pageSimpson ParadoxShantamNo ratings yet

- C S E T: Test GuideDocument16 pagesC S E T: Test GuideShantamNo ratings yet

- Must Long Course Application Form 2017Document4 pagesMust Long Course Application Form 2017ShantamNo ratings yet

- Chapter 1 - NIST Cybersecurity FrameworkDocument2 pagesChapter 1 - NIST Cybersecurity FrameworkShantamNo ratings yet

- Core Clinical Pharmacology TrainingDocument3 pagesCore Clinical Pharmacology TrainingShantamNo ratings yet

- Agency Theory and Auditing StandardsDocument10 pagesAgency Theory and Auditing StandardsShantamNo ratings yet

- Bahan SilabusDocument3 pagesBahan SilabusShantamNo ratings yet

- SOX Risk ManagementDocument10 pagesSOX Risk ManagementShantamNo ratings yet

- Wireless Wearable T-Shirt For Posture Monitoring During Rehabilitation ExercisesDocument10 pagesWireless Wearable T-Shirt For Posture Monitoring During Rehabilitation ExercisesShantamNo ratings yet

- Bahan Silabus 020617Document3 pagesBahan Silabus 020617ShantamNo ratings yet

- Cats 20112 Bowden 1Document16 pagesCats 20112 Bowden 1ShantamNo ratings yet

- TemplateDocument1 pageTemplateShantamNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Modulo 7, RepasoDocument39 pagesModulo 7, RepasoAngel MuñozNo ratings yet

- Share Based PaymentDocument19 pagesShare Based PaymentFahmi AbdullaNo ratings yet

- III.7 Corporate NationalityDocument12 pagesIII.7 Corporate Nationalitychristine jimenezNo ratings yet

- Memorandum of AssociationDocument6 pagesMemorandum of AssociationKiran Reshi100% (1)

- Awami Supermarkets LTDDocument16 pagesAwami Supermarkets LTDdeepakjontyNo ratings yet

- 5 PLDT Vs National Telecommunications CouncilDocument4 pages5 PLDT Vs National Telecommunications CouncilMichelle CatadmanNo ratings yet

- Analysis On The Acquisition of LVMH On Tiffany CoDocument5 pagesAnalysis On The Acquisition of LVMH On Tiffany CoOsman KüçükNo ratings yet

- P&G Cost of Capital AnalysisDocument64 pagesP&G Cost of Capital Analysiskuch bhi75% (4)

- Financial Accounting: Sherif El-HalabyDocument23 pagesFinancial Accounting: Sherif El-Halaby512781No ratings yet

- Paramount V QVC AnnotatedDocument13 pagesParamount V QVC AnnotatedGeorge Jugeli100% (1)

- Glencore Announces Significant Reserves Increase at Kazzinc MinesDocument4 pagesGlencore Announces Significant Reserves Increase at Kazzinc Mines2fercepolNo ratings yet

- Unit - 1 - Mob - Scheme - of - Work-Carol A. Clarke-WatsonDocument8 pagesUnit - 1 - Mob - Scheme - of - Work-Carol A. Clarke-Watsondaesha johnsonNo ratings yet

- Notice: Premerger Notification Waiting Periods Early TerminationsDocument4 pagesNotice: Premerger Notification Waiting Periods Early TerminationsJustia.comNo ratings yet

- For Question Numbers 1 To 3Document6 pagesFor Question Numbers 1 To 3Cheveem Grace EmnaceNo ratings yet

- SPH Ar 2016Document228 pagesSPH Ar 2016Sassy TanNo ratings yet

- California PizzaDocument4 pagesCalifornia PizzaMaria Fe Callejas0% (1)

- A Critical Analysis of Twitter Inc. Sense of MissionDocument11 pagesA Critical Analysis of Twitter Inc. Sense of MissionMark Johnson100% (1)

- First Semester Business English Exams Agenla 2016-2017 Level II AccountingDocument2 pagesFirst Semester Business English Exams Agenla 2016-2017 Level II AccountingLysongo OruNo ratings yet

- Assignment 4 AnswersDocument2 pagesAssignment 4 Answerssainath reddy100% (1)

- Isbr College: Bba 3 SEMESTER (2019-2020)Document13 pagesIsbr College: Bba 3 SEMESTER (2019-2020)bhargava-reddyNo ratings yet

- Chapter 4Document33 pagesChapter 4Muhammad Saddam SofyandiNo ratings yet

- Sacombank (STB VN) A Turnaround Story For The Long Haul: Target Price: VND 14,049Document26 pagesSacombank (STB VN) A Turnaround Story For The Long Haul: Target Price: VND 14,049Hòa Trần VănNo ratings yet

- Technical Notice: Distribution in Specie of The Issued Shares of Wharf REICDocument3 pagesTechnical Notice: Distribution in Specie of The Issued Shares of Wharf REICEdwin ChanNo ratings yet

- LSE OpinionDocument4 pagesLSE OpinionAnonymous ThCzznqNo ratings yet

- MeaningDocument2 pagesMeaningHappy BawaNo ratings yet

- Almaha Ceramics ProspectusDocument148 pagesAlmaha Ceramics ProspectusAbdoKhaledNo ratings yet

- Financial Performance of Rinl Using Financial Ratios and Comparision With Tata, Sail and JSWDocument6 pagesFinancial Performance of Rinl Using Financial Ratios and Comparision With Tata, Sail and JSWNIHANTH MALAPATINo ratings yet

- AbstractDocument3 pagesAbstractpecmba12No ratings yet

- Redemption of Preference SharesDocument11 pagesRedemption of Preference SharesJustin RamirezNo ratings yet