Professional Documents

Culture Documents

IFRS

Uploaded by

rathnakotariCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IFRS

Uploaded by

rathnakotariCopyright:

Available Formats

Presentation on:

International Financial

Reporting Standards

Presented by:

Ajay Pai T

Date: 06/11/2012

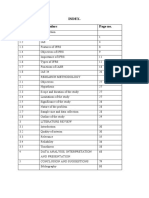

CONTENTS

Introduction

Meaning

Adoption of IFRS

Why IFRS?

IFRS in India

Benefits of adopting IFRS

IFRS challenges

Introduction to IFRS

MEANING

International Financial Reporting Standards

are common accounting rules

that define how transactions should be

reported and what information should be

disclosed in financial statements

IFRS are developed and approved by

IASB(International Accounting Standard

Board).

Adoption of IFRS

Implementation of IFRS

Phase 1(1 April 2011)

1. Companies which are part of BSE & NSE

2. Companies whose shares or other

securities are listed outside India.

3. Companies whether listed or not, having

net worth of more then 1,000 crores.

PHASE 2:(1 April 2013)

Companies not covered in PHASE 1 and

having net worth exceeding Rs 500 crores.

PHASE 3:(1 April 2014)

Separate road map would be prepared for

banking and insurance companies.

Why IFRS?

Global reporting standards for financial

statements.

National GAAP becoming rare.

Preference of IFRS.

Uniform Accounting platform.

Proposal of bringing the entire world on

single financial standards..

Benefits of adopting IFRS

Benefit to the economy.

It would encourage international investing.

Relaible,relevant and timely information.

Better understanding of financial

statements.

Provides professional opportunities..

It would reduce different accounting

requirements..

IFRS Challenges

Increase in cost.

Deeply affected by laws and regulations of

the domestic country.

Training is required.

Difference between GAAP And IFRS May

impact business decesions.

Thank you

You might also like

- Fundamentals of AccountingDocument512 pagesFundamentals of AccountingCalmguy Chaitu91% (35)

- ASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesFrom EverandASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesNo ratings yet

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- IFRSDocument26 pagesIFRSSuchetana Anthony50% (2)

- How Big Is a Tone of GoldDocument3 pagesHow Big Is a Tone of GoldrathnakotariNo ratings yet

- A Project ON: (Impact On Banking Sector)Document21 pagesA Project ON: (Impact On Banking Sector)Akshay BhandeNo ratings yet

- What is IFRS? International accounting standards explainedDocument8 pagesWhat is IFRS? International accounting standards explainedRagvi BaluNo ratings yet

- Personal Details Name: Purvesh Jobanputra MFM: Sem 5, Div: B Roll No: 220 Project:On IFRS Submitted To: Professor Hemant JunarkarDocument12 pagesPersonal Details Name: Purvesh Jobanputra MFM: Sem 5, Div: B Roll No: 220 Project:On IFRS Submitted To: Professor Hemant JunarkarKhwahish ArmanNo ratings yet

- Corporate Governance, Firm Profitability, and Share Valuation in the PhilippinesFrom EverandCorporate Governance, Firm Profitability, and Share Valuation in the PhilippinesNo ratings yet

- IFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsFrom EverandIFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsRating: 4 out of 5 stars4/5 (11)

- International Financial Reporting Standards (IFRS)Document10 pagesInternational Financial Reporting Standards (IFRS)soorajsooNo ratings yet

- Guide to Understanding Key Concepts of Small BusinessDocument10 pagesGuide to Understanding Key Concepts of Small BusinessChetan Metkar100% (1)

- Business CycleDocument29 pagesBusiness Cyclesamrulezzz100% (1)

- Business CycleDocument29 pagesBusiness Cyclesamrulezzz100% (1)

- An Executive Guide to IFRS: Content, Costs and Benefits to BusinessFrom EverandAn Executive Guide to IFRS: Content, Costs and Benefits to BusinessNo ratings yet

- IFRS Adoption in India: Key ChallengesDocument8 pagesIFRS Adoption in India: Key ChallengesMehak AyoubNo ratings yet

- A Study On The Impact of International Financial Reporting Standards Convergence On Indian Corporate SectorDocument8 pagesA Study On The Impact of International Financial Reporting Standards Convergence On Indian Corporate SectorKiran KumarNo ratings yet

- Harmonizing Financial Reporting A Study of International Financial Reporting Standards (IFRS)Document57 pagesHarmonizing Financial Reporting A Study of International Financial Reporting Standards (IFRS)pomater270No ratings yet

- Convergence of IAS With IFRS in IndiaDocument12 pagesConvergence of IAS With IFRS in Indiaksmuthupandian2098No ratings yet

- India: - Key AspectsDocument100 pagesIndia: - Key Aspectsadi08642No ratings yet

- Harmonization of Financial Accounting With IFRS Opportunities and Challenges For Indian FirmsDocument21 pagesHarmonization of Financial Accounting With IFRS Opportunities and Challenges For Indian Firmsdvpatel66No ratings yet

- IFRS Adoption in IndonesiaDocument20 pagesIFRS Adoption in IndonesiaGinda Rafiel Sitorus PaneNo ratings yet

- International Financial Reporting Standards (IFRS) : Compiled By: Yogesh Bhanushali Internal Guidance: Dr. Shama ShahDocument22 pagesInternational Financial Reporting Standards (IFRS) : Compiled By: Yogesh Bhanushali Internal Guidance: Dr. Shama ShahYogesh BhanushaliNo ratings yet

- Convergence of Indian Accounting Standards With Ifrs Prospects and ChallengesDocument11 pagesConvergence of Indian Accounting Standards With Ifrs Prospects and Challengesksmuthupandian2098No ratings yet

- IFRS Global Reporting StandardsDocument12 pagesIFRS Global Reporting StandardsArpit JainNo ratings yet

- Accounts Project IFRSDocument27 pagesAccounts Project IFRSShivam SenNo ratings yet

- IfrsDocument24 pagesIfrsJeevan JainNo ratings yet

- IAS 34 Part 1Document20 pagesIAS 34 Part 1anjali sharmaNo ratings yet

- Pawan Jain - FINALDocument12 pagesPawan Jain - FINALAvi KoolNo ratings yet

- IFRS India Japan Vineet ChouhanDocument18 pagesIFRS India Japan Vineet ChouhanVineet ChouhanNo ratings yet

- The Need For The Common Set of Accounting and Financial Reporting StandardsDocument21 pagesThe Need For The Common Set of Accounting and Financial Reporting StandardsSamiyah SohailNo ratings yet

- What Is IfrsDocument11 pagesWhat Is IfrsSandy Gill GillNo ratings yet

- Synthesis - IFRSDocument37 pagesSynthesis - IFRSRoseJeanAbingosaPernito0% (1)

- Training On: International Financial Reporting Standards (IFRS)Document54 pagesTraining On: International Financial Reporting Standards (IFRS)Yaqeeroo TubeNo ratings yet

- Ifrs As A Tool For Cross Border Reporting ImzakariDocument27 pagesIfrs As A Tool For Cross Border Reporting ImzakariBayodele7No ratings yet

- IMPLEMENTATION OF IFRS AND DETECTION OF FINANCIAL MANIPULATION - A CASE STUDY by KamakshiDocument13 pagesIMPLEMENTATION OF IFRS AND DETECTION OF FINANCIAL MANIPULATION - A CASE STUDY by KamakshiKamakshi Seth MehtaNo ratings yet

- Ifrs - 08jan2014Document8 pagesIfrs - 08jan2014Polite ManNo ratings yet

- Literature Review On Ifrs in IndiaDocument7 pagesLiterature Review On Ifrs in Indiaafmzxppzpvoluf100% (1)

- India IFRS ProfileDocument7 pagesIndia IFRS ProfileAnonymous iUYr6k63pNo ratings yet

- IFRS Implementation in India: Opportunities, Challenges and SolutionsDocument20 pagesIFRS Implementation in India: Opportunities, Challenges and SolutionsMohdRAnsari0% (1)

- IFRSDocument11 pagesIFRSShekhar SinghNo ratings yet

- Final Seminar 4Document20 pagesFinal Seminar 4Sumit GuptaNo ratings yet

- Ifrs ProjectDocument12 pagesIfrs Projectpurvesh_200180% (5)

- Introduction Iasb Conceptual FrameworkDocument82 pagesIntroduction Iasb Conceptual FrameworkYared HussenNo ratings yet

- IFRS in ETHIOPiaDocument13 pagesIFRS in ETHIOPiaANTENEH ENDALE DILNESSANo ratings yet

- IFRS Challenges and OpportunitiesDocument12 pagesIFRS Challenges and OpportunitiesSubbu PuvvadaNo ratings yet

- Advance Accounts Part 2Document4 pagesAdvance Accounts Part 2ashish.jhaa756No ratings yet

- IFRS 2016 Pocket GuideDocument107 pagesIFRS 2016 Pocket GuideAhsan Zaidi100% (1)

- Ifrs Literature ReviewDocument4 pagesIfrs Literature ReviewAsfawosen DingamaNo ratings yet

- Financial Reporting and Regulations GuideDocument47 pagesFinancial Reporting and Regulations GuideShivangi Aggarwal100% (1)

- Scrip Midterm AccountingDocument8 pagesScrip Midterm AccountingThanh MaiNo ratings yet

- Cert IFRDocument301 pagesCert IFRmohasincrNo ratings yet

- 8568 Financial Reporting IIDocument13 pages8568 Financial Reporting IIMaryam AslamNo ratings yet

- 8568 Financial Reporting IIDocument13 pages8568 Financial Reporting IIMaryam AslamNo ratings yet

- Ias MergedDocument157 pagesIas MergedAnalou LopezNo ratings yet

- 4357 8498 1 SMDocument12 pages4357 8498 1 SMAnu ReetNo ratings yet

- 19, International Financial Reporting Standards-I Paper: 02, Accounting & Financial AnalysisDocument13 pages19, International Financial Reporting Standards-I Paper: 02, Accounting & Financial AnalysisMohit RanaNo ratings yet

- Indian Accounting Standard: (1) To Provide Information: The Main Objectives of Accounting Standards Is To ProvideDocument8 pagesIndian Accounting Standard: (1) To Provide Information: The Main Objectives of Accounting Standards Is To ProvideAkrutNo ratings yet

- Present at in On IFRSDocument7 pagesPresent at in On IFRSRamendra SinghNo ratings yet

- Ind As, IfRS and Applicability-2Document2 pagesInd As, IfRS and Applicability-2sandeepNo ratings yet

- An Analysis of Impact of Transition From Igaap To Ind-As: R. Yogesh Dr. R. AmudhaDocument11 pagesAn Analysis of Impact of Transition From Igaap To Ind-As: R. Yogesh Dr. R. AmudhaPreethi NaiduNo ratings yet

- Perkembangan Ifrs Di IndonesiaDocument8 pagesPerkembangan Ifrs Di IndonesiaFajar D. yuliantaNo ratings yet

- ContentServer Asp-12 PDFDocument17 pagesContentServer Asp-12 PDFharunraajNo ratings yet

- Foreign Institutional Investors in IndiaDocument12 pagesForeign Institutional Investors in IndiaMRINAL KUMARNo ratings yet

- KAUSHIK'S RESUME FOR PLACEMENT COORDINATORDocument3 pagesKAUSHIK'S RESUME FOR PLACEMENT COORDINATORrathnakotariNo ratings yet

- AirportDocument24 pagesAirportLokeshSharmaNo ratings yet

- Intro EntrepreneurshipDocument24 pagesIntro EntrepreneurshiprathnakotariNo ratings yet

- MS-DOS Operating System BasicsDocument32 pagesMS-DOS Operating System BasicsrathnakotariNo ratings yet

- What are Participatory Notes - Understanding P-NotesDocument2 pagesWhat are Participatory Notes - Understanding P-NotesrathnakotariNo ratings yet

- GAAR Alert - July 2012Document4 pagesGAAR Alert - July 2012rathnakotariNo ratings yet

- India's New Capital Restrictions: What Are They, Why Were They Created, and Have They Been Effective?Document21 pagesIndia's New Capital Restrictions: What Are They, Why Were They Created, and Have They Been Effective?rathnakotariNo ratings yet

- Data AnalysisDocument73 pagesData AnalysisrathnakotariNo ratings yet

- Data AnalysisDocument73 pagesData AnalysisrathnakotariNo ratings yet

- Lesson 1 PDFDocument15 pagesLesson 1 PDFEddy Espinoza AldazNo ratings yet

- The Impact of Participatory Notes on the Indian Rupee Exchange RateDocument50 pagesThe Impact of Participatory Notes on the Indian Rupee Exchange RaterathnakotariNo ratings yet

- Research Methodology & Findings of a CompanyDocument7 pagesResearch Methodology & Findings of a CompanyrathnakotariNo ratings yet

- Question Papers Sample Papers Ibps Cwe Clerk Exam Question Paper 11 Dec 2011Document16 pagesQuestion Papers Sample Papers Ibps Cwe Clerk Exam Question Paper 11 Dec 2011rathnakotariNo ratings yet

- Introduction TemplateDocument2 pagesIntroduction TemplatePraveen Mattimani MattimaniNo ratings yet

- Presentation On:: International Financial Reporting StandardsDocument11 pagesPresentation On:: International Financial Reporting StandardsrathnakotariNo ratings yet

- Training & Entrepreneurship DevelopmentDocument12 pagesTraining & Entrepreneurship DevelopmentP K Senthil KumarNo ratings yet

- OscarDocument1 pageOscarrathnakotariNo ratings yet

- Lesson 1 PDFDocument15 pagesLesson 1 PDFEddy Espinoza AldazNo ratings yet

- Einstein College Engineering Guide Entrepreneurship DevelopmentDocument47 pagesEinstein College Engineering Guide Entrepreneurship DevelopmentSarim AhmedNo ratings yet

- Lesson 1 PDFDocument15 pagesLesson 1 PDFEddy Espinoza AldazNo ratings yet

- Intro EntrepreneurshipDocument24 pagesIntro EntrepreneurshiprathnakotariNo ratings yet

- Training & Entrepreneurship DevelopmentDocument12 pagesTraining & Entrepreneurship DevelopmentP K Senthil KumarNo ratings yet

- Starting Your Own Business: The Entrepreneurship AlternativeDocument23 pagesStarting Your Own Business: The Entrepreneurship AlternativerathnakotariNo ratings yet

- Intro EntrepreneurshipDocument24 pagesIntro EntrepreneurshiprathnakotariNo ratings yet