Professional Documents

Culture Documents

David PPT Abbrev Ch03-1c

Uploaded by

sum7860 ratings0% found this document useful (0 votes)

18 views24 pageskhkhkj

Original Title

David_PPT_Abbrev_Ch03-1c

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentkhkhkj

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views24 pagesDavid PPT Abbrev Ch03-1c

Uploaded by

sum786khkhkj

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 24

Ch 3 -1

Copyright 2007 Prentice Hall

Competitors

Suppliers

Distributors

Creditors

Customers

Employees

Communities

Managers

Stockholders

Labor Unions

Special Interest Groups

Products

Services

Key

External

Forces

Opportunities

&

Threats

Key External Forces & the Organization

Beyond control of organization!

Ch 3 -2

Copyright Houghton Mifflin

Company. All rights reserved.

2 | 2

External Analysis requires an assessment of:

Industry environment in which company operates

Competitive structure of industry

Competitive position of the company

Competitiveness and position of major rivals

The country or national environments in

which company competes

The wider socioeconomic or macroenvironment that

may affect the company and its industry

Social

Government

Legal

International

Technological

External Analysis

The purpose of external analysis is to identify

the strategic opportunities and threats in the

organizations operating environment that

will affect how it pursues its mission.

Ch 3 -3

Copyright Houghton Mifflin

Company. All rights reserved.

2 | 3

External Analysis:

Opportunities and Threats

Analyzing the dynamics of the industry in which

an organization competes to help identify:

Opportunities

Conditions in the

environment that a

company can take

advantage of to

become more

profitable

Threats

Conditions in the

environment that

endanger the integrity

and profitability of

the companys

business

Ch 3 -4

Copyright Houghton Mifflin

Company. All rights reserved.

2 | 4

Industry Analysis: Defining an

Industry

Industry

A group of companies offering products or services that are close substitutes for

each other and that satisfy the same basic customer needs

Industry boundaries may change as customer needs evolve and technology

changes

Sector

A group of closely related industries

Market Segments

Distinct groups of customers within an industry

Can be differentiated from each other with distinct attributes and

specific demands

Industry analysis begins by focusing on

the overall industry

before considering market segment or sector-level issues

Ch 3 -5

Copyright Houghton Mifflin

Company. All rights reserved.

2 | 5

The Computer Sector: Industries and

Market Segments

Figure 2.1

Ch 3 -6

Copyright 2007 Prentice Hall

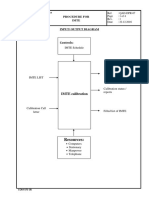

Performing External Audit

External

Factors

Measurable

Long-term orientation

Applicable to

competing firms

Hierarchical

Ch 3 -8

Copyright 2007 Prentice Hall

Ch 6 -8

Potential development

of substitute products

Rivalry among

competing firms

Bargaining power

of suppliers

Potential entry of new

competitors

Bargaining power

of consumers

Porters Five Forces

Ch 3 -10

Copyright 2007 Prentice Hall

Industry Analysis: The External Factor

Evaluation (EFE) Matrix

Competitive Political Cultural

Technological Environmental Social

Governmental Demographic Economic

Summarize & Evaluate

Ch 3 -11

Copyright 2007 Prentice Hall

Ch 3 -13

Copyright 2007 Prentice Hall

Total weighted score of 4.0

Organization response is outstanding to threats

and weaknesses

Industry Analysis EFE

Total weighted score of 1.0

Firms strategies not capitalizing on opportunities

or avoiding threats

Ch 3 -14

Copyright Houghton Mifflin

Company. All rights reserved.

2 | 14

Strategic Groups Within

Industries

Strategic Groups are groups of companies that

follow a business model similar to other companies

within their strategic group but are different from

that of other companies in other strategic groups.

Implications of Strategic Groups

1. The closest competitors are within the same Strategic Group

and may be viewed by customers as substitutes for each other.

2. Each Strategic Group can have different competitive forces

and may face a different set of opportunities and threats.

Mobility Barriers factors within an industry that inhibit the

movement of companies between strategic groups

Include barriers to enter another group or exit existing group

The basic differences between business models in

different strategic groups can be captured by a

relatively small number of strategic factors.

Ch 3 -15

Copyright Houghton Mifflin

Company. All rights reserved.

2 | 15

Strategic Groups in the Pharmaceutical

Industry

Figure 2.3

Ch 3 -16

Copyright Houghton Mifflin

Company. All rights reserved.

2 | 16

Industry Life Cycle Model analyzes the affects of

industry evolution on competitive forces over time

and is characterized by five distinct life cycle stages:

Industry Life Cycle Analysis

1. Embryonic industry just beginning to develop

Rivalry based on perfecting products, educating customers, and opening

up distribution channels.

2. Growth first-time demand takes-off with new customers

Low rivalry as focus is on keeping up with high industry growth.

3. Shakeout demand approaches saturation, replacements

Rivalry intensifies with emergence of excess productive capacity.

4. Mature market totally saturated with low to no growth

Industry consolidation based on market share, driving down price.

5. Decline industry growth becomes negative

Rivalry further intensifies based on rate of decline and exit barriers.

Ch 3 -17

Copyright Houghton Mifflin

Company. All rights reserved.

2 | 17

Stages in the Industry Life Cycle

Strength and nature of five forces change as industry evolves Figure 2.4

Ch 3 -18

Copyright Houghton Mifflin

Company. All rights reserved.

2 | 18

Growth in Demand and Capacity

Industry Shakeout:

Rivalry Intensifies

with growth in

excess capacity

Anticipate how forces will change and formulate appropriate strategy Figure 2.5

Ch 3 -19

Copyright Houghton Mifflin

Company. All rights reserved.

2 | 19

Limitations of Models for Industry

Analysis

Life Cycle Issues

Industry cycles do not always follow the life cycle generalization.

In rapid growth situations embryonic stage is sometimes skipped.

Industry growth revitalized through innovation or social change.

The time span of the stages can vary from industry to industry.

Innovation and Change

Punctuated Equilibrium occurs when an industrys long term stable structure is

punctuated with periods of rapid change by innovation.

Hypercompetitive industries are characterized by permanent and ongoing

innovation and competitive change.

Company Differences

There can be significant variances in the profit rates of individual

companies within an industry.

In addition to industry attractiveness, company resources and capabilities

are also important determinants of its profitability.

Models provide useful ways of thinking about competition

within an industry but be aware of their limitations.

Ch 3 -20

Copyright Houghton Mifflin

Company. All rights reserved.

2 | 20

Punctuated Equilibrium and

Competitive Structure

Periods of long

term stability

Periods of long

term stability

Industry

Structure

revolutionized

by innovation

Figure 2.6

Ch 3 -21

Copyright 2007 Prentice Hall

Industry Analysis: Competitive Profile

Matrix (CPM)

Identifies firms major competitors

and their strengths & weaknesses

in relation to a sample firms

strategic positions

Ch 3 -22

Copyright 2007 Prentice Hall

Gateway Apple Dell

CSFs

Wt Rating Wtd

Score

Ratin

g

Wtd

Score

Rating Wtd

Score

Market share 0.15 3 0.45 2 0.30 4 0.60

Inventory sys 0.08 2 0.16 2 0.16 4 0.32

Fin. position 0.10 2 0.20 3 0.30 3 0.30

Prod. Quality 0.08 3 0.24 4 0.32 3 0.24

Cons. Loyalty 0.02 3 0.06 3 0.06 4 0.08

Sales Distr 0.10 3 0.30 2 0.20 3 0.30

Global Exp. 0.15 3 0.45 2 0.30 4 0.60

Org. Structure 0.05 3 0.15 3 0.15 3 0.15

Ch 3 -23

Copyright 2007 Prentice Hall

Gateway Apple Dell

CSFs (contd)

Wt Rating Wtd

Score

Ratin

g

Wtd

Score

Rating Wtd

Score

Prod. Capacity 0.04 3 0.12 3 0.12 3 0.12

E-commerce 0.10 3 0.30 3 0.30 3 0.30

Customer Serv 0.10 3 0.30 2 0.20 4 0.40

Price

competitive

0.02 4 0.08 1 0.02 3 0.06

Mgt.

experience

0.01 2 0.02 4 0.04 2 0.02

Total 1.00 2.83 2.47 3.49

Ch 3 -24

Copyright 2007 Prentice Hall

Mission Statement (proposed)

Our mission is to provide cruise and travel services (2) to travelers

worldwide (1, 3), to develop household name brand awareness, to

respect and protect the earth and seas on which we sail (6), to serve the

communities in which our consumers and employees reside (8,9), and to

stay an innovator by bringing cutting edge technology and research for

our consumers benefit (4). We recognize that we must stay financially

solvent and must make those decisions that will capitalize on

opportunities for growth and longevity (5). We believe we must exceed

every consumers expectations, supplying lasting memories, and

enticing repeat business all at a fair value. We recruit, compensate and

retain the best staff and ship employees in the business (7, 9).

Ch 3 -25

Copyright 2007 Prentice Hall

Competitive Profile Matrix Royal Caribbean

RCL CCL POC

Critical Success

Factors

Weight Rating Weighted

Score

Rating Weighted

Score

Rating Weighted

Score

Market Share

Customer Loyalty

Distribution Network

Financial Position

Global Expansion

Advertising

Product Quality

Expansion of

departure ports

0.20

0.15

0.15

0.10

0.05

0.05

0.15

0.15

3

3

4

1

4

3

4

4

0.60

0.45

0.60

0.10

0.20

0.15

0.60

0.60

4

4

3

4

3

4

3

3

0.80

0.60

0.45

0.40

0.15

0.20

0.45

0.45

2

2

2

3

2

2

2

2

0.40

0.30

0.30

0.30

0.10

0.10

0.30

0.30

Total 1.00 3.30 3.50 2.10

Ch 3 -26

Copyright 2007 Prentice Hall

EFE Matrix

Key External Factors

Weight

Rating

Weighted Score

Opportunities

Nearly 88% of North Americans have never been on

a cruise.

0.15 4 0.60

Cruise vacations are seen as a choice of older

travelers; leaving minorities and young adult markets

virtually untapped

0.08 3 0.24

Distribution networks at home and abroad may be an

untapped source for generating increased business

0.07 3 0.21

Internet use is increasing; commonly the tool used to

secure reservations for many travelers

0.08 3 0.24

Several markets overseas, such as, France, Italy, have

a market of would be cruisers

0.10 2 0.20

Threats

Increase in regulation by US regarding

environmental issues and economic downturns

0.08 2 0.16

Alaskan legislators are considering a $50 tax per

cruise ship passenger

0.05 2 0.10

Location and severity of terrorist attacks; namely

September 11

th

events

0.10 3 0.30

War and political uprisings 0.10 3 0.30

Drastic changes in the world oil market and currency

exchange

0.02 1 0.02

Existing and potential litigation 0.02 1 0.02

Increased capacity of competitors and pricing wars 0.05 2 0.10

Transfer of information through collective bargaining

agreements

0.03 1 0.03

Competitors: Carnival and P & O 0.07 2 0.14

Total 1.00 2.56

Ch 3 -27

Copyright Houghton Mifflin

Company. All rights reserved.

2 | 27

The Role of the Macroenvironment

Changes in the

forces in the macro-

environment can

directly impact:

The Five Forces

Relative Strengths

Industry

Attractiveness

Figure 2.7

You might also like

- Nokia Chennai Plant - IbDocument4 pagesNokia Chennai Plant - Ibsum786No ratings yet

- InsuranceDocument2 pagesInsurancesum786No ratings yet

- 3 Layout and FlowDocument39 pages3 Layout and Flowsum786No ratings yet

- General Agreement On Trade in ServicesDocument33 pagesGeneral Agreement On Trade in Servicessum786No ratings yet

- Brochure 2014Document2 pagesBrochure 2014sum786No ratings yet

- Service MarketingDocument25 pagesService Marketingsum786No ratings yet

- 02 EL Bus Comm CH 02Document30 pages02 EL Bus Comm CH 02tejcd1234No ratings yet

- Raguram Rajan's ThesisDocument14 pagesRaguram Rajan's Thesissum786No ratings yet

- Service MarketingDocument25 pagesService Marketingsum786No ratings yet

- The Neiman Marcus Group IncDocument31 pagesThe Neiman Marcus Group Incsum786No ratings yet

- Cracks in ConcreteDocument4 pagesCracks in Concretesum786No ratings yet

- Financial ServicesDocument53 pagesFinancial Servicessum786No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Design of A 120 In.-Diameter Steel Bifurcation With A Small Acute Angle For A High-Pressure PenstockDocument10 pagesDesign of A 120 In.-Diameter Steel Bifurcation With A Small Acute Angle For A High-Pressure PenstockStalynMEcNo ratings yet

- IG 55 CalculationDocument11 pagesIG 55 CalculationNoridhamNo ratings yet

- Roof Slab of Guard RoomDocument3 pagesRoof Slab of Guard RoomAditya KumarNo ratings yet

- DIMENSIONAL TOLERANCES FOR COLD CLOSE RADIUS PIPE BENDINGDocument11 pagesDIMENSIONAL TOLERANCES FOR COLD CLOSE RADIUS PIPE BENDINGpuwarin najaNo ratings yet

- LR Phono PreampsDocument44 pagesLR Phono PreampsMartin FernandezNo ratings yet

- VHF Low Loss Band-Pass Helical Filter For 145 MHZ - English NewDocument33 pagesVHF Low Loss Band-Pass Helical Filter For 145 MHZ - English NewSharbel AounNo ratings yet

- V 2172 0020 0031 - Rev - 6 (3458748) PDFDocument262 pagesV 2172 0020 0031 - Rev - 6 (3458748) PDFLG Milton LuisNo ratings yet

- Ref Paper 2Document4 pagesRef Paper 2Subhanjali MyneniNo ratings yet

- Form 1 Lesson 88 SpeakingDocument2 pagesForm 1 Lesson 88 Speakinga multifandom fangirlNo ratings yet

- Write Like An Academic: Designing An Online Advanced Writing Course For Postgraduate Students and ResearchersDocument9 pagesWrite Like An Academic: Designing An Online Advanced Writing Course For Postgraduate Students and ResearchersLexi TronicsNo ratings yet

- Teradata Version DifferencesDocument3 pagesTeradata Version DifferencesShambuReddy100% (1)

- !K Kanji Kaku - StrokesDocument18 pages!K Kanji Kaku - StrokeschingkakaNo ratings yet

- Atmel 42238 Uart Based Sam Ba Bootloader For Sam d20 AP Note At04189Document12 pagesAtmel 42238 Uart Based Sam Ba Bootloader For Sam d20 AP Note At04189manasaNo ratings yet

- LNMIIT Course Information Form: A. B. C. D. E. FDocument2 pagesLNMIIT Course Information Form: A. B. C. D. E. FAayush JainNo ratings yet

- Surging & Blow Out of Loop Seals in A CFBC BoilerDocument9 pagesSurging & Blow Out of Loop Seals in A CFBC Boilermohamed faragNo ratings yet

- OkDocument29 pagesOkgouthamlabsNo ratings yet

- 7.qad-Dpr-11 ImteDocument4 pages7.qad-Dpr-11 ImteDhinakaranNo ratings yet

- Nord Motors Manual BookDocument70 pagesNord Motors Manual Bookadh3ckNo ratings yet

- Qcs 2010 Section 5 Part 8 Transportation and Placing of ConcreteDocument7 pagesQcs 2010 Section 5 Part 8 Transportation and Placing of Concretebryanpastor106No ratings yet

- E12817 GT AC5300 Manual EnglishDocument152 pagesE12817 GT AC5300 Manual Englishlegato1984No ratings yet

- Strategic Information Systems Planning: Course OverviewDocument18 pagesStrategic Information Systems Planning: Course OverviewEmmy W. RosyidiNo ratings yet

- The Next 20 Billion Digital MarketDocument4 pagesThe Next 20 Billion Digital MarketakuabataNo ratings yet

- 1893 Shadow RunDocument6 pages1893 Shadow RungibbamonNo ratings yet

- Stereoscopic Restitution Instruments: Materi Kuliah GD3204 Fotogrametri I, Semester I-2009/2010Document50 pagesStereoscopic Restitution Instruments: Materi Kuliah GD3204 Fotogrametri I, Semester I-2009/2010ththaalNo ratings yet

- Sources of Release Schedule For Hazardous Area ClassificationDocument1 pageSources of Release Schedule For Hazardous Area ClassificationMachmud Ragil'sNo ratings yet

- Brake Pedals and ValveDocument4 pagesBrake Pedals and Valveala17No ratings yet

- Product Data Sheet: Linear Switch - iSSW - 2 C/O - 20A - 250 V AC - 3 PositionsDocument2 pagesProduct Data Sheet: Linear Switch - iSSW - 2 C/O - 20A - 250 V AC - 3 PositionsMR. TNo ratings yet

- Over View On 5 S TechnicDocument14 pagesOver View On 5 S TechnicSachleen Singh BajwaNo ratings yet

- Rob Thomas Digital Booklet - Cradle SongDocument15 pagesRob Thomas Digital Booklet - Cradle SongAgnieszka ŁukowskaNo ratings yet