Professional Documents

Culture Documents

PP For Chapter 2 - Analyzing Transactions - Final

Uploaded by

Sozia Tan0 ratings0% found this document useful (0 votes)

201 views49 pagesDescribe the characteristics of an account and record transactions using a chart of accounts and journal. Describe and illustrate the posting of journal entries to accounts. Prepare an unadjusted trial balance and explain how it can be used to discover errors. Discover and correct errors in recording transactions.

Original Description:

Original Title

PP for Chapter 2 - Analyzing Transactions - Final

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDescribe the characteristics of an account and record transactions using a chart of accounts and journal. Describe and illustrate the posting of journal entries to accounts. Prepare an unadjusted trial balance and explain how it can be used to discover errors. Discover and correct errors in recording transactions.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

201 views49 pagesPP For Chapter 2 - Analyzing Transactions - Final

Uploaded by

Sozia TanDescribe the characteristics of an account and record transactions using a chart of accounts and journal. Describe and illustrate the posting of journal entries to accounts. Prepare an unadjusted trial balance and explain how it can be used to discover errors. Discover and correct errors in recording transactions.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 49

1

Click to edit Master title style

1

1

Accounting: A Malaysian Perspective, 4

th

ed

(Adapted from Accounting 22

nd

ed)

Warren, Reeve and Duchac

ANALYZING

TRANSACTIONS

2

2

Click to edit Master title style

2

2

1. Describe the characteristics of an account and

record transactions using a chart of accounts

and journal.

2. Describe and illustrate the posting of journal

entries to accounts.

3. Prepare an unadjusted trial balance and

explain how it can be used to discover errors.

4. Discover and correct errors in recording

transactions.

3

Click to edit Master title style

3

3

Describe the characteristics of an account and

record transactions using a chart of accounts

and journal

Objective 1

2-1

4

Click to edit Master title style

4

4

Definitions

Book of first entry

Journal

Separate record showing increases and

decreases for each FS item

Account

A group of accounts for a

business entity

Ledger

A list of the accounts in a

ledger

Chart of

accounts

2-1

5

Click to edit Master title style

5

5

T Account

Title

Debit Credit

(left side) (right side)

2-1

6

Click to edit Master title style

6

6

T Account - example

Cash

Date Capital 25,000 Date Equipment 20,000

Fees 5,000 Rent exp 800

Wages exp 150

. Bal c/d 9,050

30,000 30,000

Bal b/d 9,050

Balance of the

account

2-1

7

Click to edit Master title style

7

7

Types of accounts

Accounts

Assets

Liabilities

Owners

equity

Drawing

Revenues

Expenses

2-1

8

Click to edit Master title style

8

8

Balance Sheet Accounts

Assets

resources

owned by

the business

Examples:

cash,

supplies, AR,

office

equipment

Liabilities

debts owed

to outsiders

(creditors)

Examples:

AP, salaries

payable

Owners

Equity

owners right

to the assets of

the business

Drawing

withdrawals

by owner

2-1

9

Click to edit Master title style

9

9

Income Statement Accounts

Revenues

increases in owners

equity as a result of

selling services or

products

Examples: fees earned,

commission revenue,

rent revenue

Expenses

cost of using up assets

or consuming services

in the process of

generating revenues

Examples: wages

expense, rent expense,

miscellaneous expense

2-1

10

Click to edit Master title style

10

10

Every transaction would

affect at least

2 accounts

IMPORTANT NOTE

2-1

11

Click to edit Master title style

11

11

Journal entries

Every transaction would first be recorded

in a journal

The process of recording a transaction in

the journal is called journalizing

J ournal Pg

Date Description PR Debit Credit

1

2

3

2-1

12

Click to edit Master title style

12

12

Journalizing steps

1. Record the date.

2. Record the title of the account debited in the

Description column.

3. Enter the amount in the Debit column.

4. Record the title of the account credited in the

Description column.

5. Enter the amount in the Credit column.

2-1

13

Click to edit Master title style

13

13

Journal entries Balance Sheet

Accounts

(a) On November 1, Idris Ismail opens a new

business and deposits RM25,000 in a bank

account in the name of NetSolutions.

Journal Pg

Date Description PR Debit Credit

Nov 1 Cash 25,000

Idris Ismail, Capital 25,000

Invested cash in NetSolutions.

2-1

14

Click to edit Master title style

14

14

Effect of the entry on the accounts

Cash

Nov 1 25000

Idris Ismail, Capital

Nov 1 25000

2-1

15

Click to edit Master title style

15

15

Journal entries Balance Sheet

Accounts

(b) On November 5, NetSolutions bought land for

RM20,000, paying cash.

Journal Pg

Date Description PR Debit Credit

Nov 5 Land 20,000

Cash 20,000

Purchased land for cash.

2-1

16

Click to edit Master title style

16

16

Journal entries Balance Sheet

Accounts

(c) On November 10, NetSolutions purchased

supplies on account for RM1,350.

Journal Pg

Date Description PR Debit Credit

Nov 10 Supplies 1,350

Accounts Payable 1,350

Purchased supplies on

account.

2-1

17

Click to edit Master title style

17

17

Journal entries Balance Sheet

Accounts

(f) On November 30, NetSolutions paid creditors

on account , RM950.

Journal Pg

Date Description PR Debit Credit

Nov 30 Accounts Payable 950

Cash 950

Paid creditors on account.

2-1

18

Click to edit Master title style

18

18

BS accounts debit & credit rule

Debit Credit

Asset accounts Increase (+) Decrease (-)

Liability accounts Decrease (-) Increase (+)

Owners equity (capital)

accounts

Decrease (-)

Increase (+)

Owners equity (drawing)

accounts

Increase (+) Decrease (-)

2-1

19

Click to edit Master title style

19

19

BS accounts debit & credit rule

Assets

Debit for Credit for

increases (+) decreases (-)

Liabilities & OE (Capital)

Debit for Credit for

decreases (+) increases (-)

2-1

20

Click to edit Master title style

20

20

Example exercise 2-1

Prepare a journal entry for the purchase of a

truck on June 3 for RM42,500, paying RM8,500

cash and the remainder on account.

Journal PG

June 3 Truck 42,500

Cash 8,500

Accounts Payable 34,000

2-1

21

Click to edit Master title style

21

21

Journal entries income statement

accounts

(d) On November 18, NetSolutions received fees

of RM7,500 from customers for services

provided during the month.

Journal Pg

Date Description PR Debit Credit

Nov 18 Cash 7,500

Fees Earned 7,500

Received fees from

customers.

2-1

22

Click to edit Master title style

22

22

Journal entries income statement

accounts

(e) Throughout the month, NetSolutions incurred the

following expenses: wages RM2,125; rent RM800;

utilities RM450; and miscellaneous RM275.

Journal Pg

Date Description PR Debit Credit

Nov 30 Wages expense 2,125

Rent expense 800

Utilities expense 450

Miscellaneous expense 275

Cash 3,650

Paid expenses for the month.

2-1

23

Click to edit Master title style

23

23

Journal entries income statement

accounts

(g) On November 30, a count revealed

that RM800 of the supplies inventory had

been used during the month.

Journal Pg

Date Description PR Debit Credit

Nov 30 Supplies expense 800

Supplies 800

Supplies used during the

month.

2-1

24

Click to edit Master title style

24

24

IS accounts debit & credit rule

Debit Credit

Revenue accounts Decrease (-) Increase (+)

Expenses accounts Increase (+) Decrease (-)

Revenues

Debit for Credit for

decreases (+) increases (-)

Expenses

Debit for Credit for

increases (+) decreases (-)

2-1

25

Click to edit Master title style

25

25

Net income / net loss

Revenues > Expenses = Net income

increases Owners equity (capital)

Revenues < Expenses = Net loss

decreases Owners equity (capital)

Revenues Expenses = Net income or Net loss

2-1

26

Click to edit Master title style

26

26

Example exercise 2-2

Prepare a journal entry on August 7 for

the fees earned on account, RM115,000.

Journal Pg

Aug 7 Accounts Receivable 115,000

Fees earned 115,000

2-1

27

Click to edit Master title style

27

27

Drawing account

When owner of a proprietorship withdraws cash

from the business for personal use

Decreases owners equity (capital)

2-1

28

Click to edit Master title style

28

28

Drawing account - example

On November 30, Idris Ismail withdrew

RM2,000 in cash from NetSolutions for

personal use.

Journal

Nov 30 Idris Ismail, Drawing 2,000

Cash 2,000

Owner withdrew cash for

personal use.

2-1

29

Click to edit Master title style

29

29

Example exercise 2-3

Prepare a journal entry on December 29

for the payment of RM12,000 to the

owner of Smart Consulting Services,

Danny Wong, for personal use.

Dec 29 Danny Wong, Drawing 12,000

Cash 12,000

Owner withdrew cash for

personal use.

2-1

30

Click to edit Master title style

30

30

Debit & credit rule and normal

balance

Increase

Decrease

Normal

balance

BS accounts:

Asset Debit Credit Debit

Liability Credit Debit Credit

Owners equity

Capital Credit Debit Credit

Drawing Debit Credit Debit

IS accounts:

Revenue Credit Debit Credit

Expense Debit Credit Debit

2-1

31

Click to edit Master title style

31

31

Example exercise 2-4

State for each account whether it is likely to have (a) debit

entries only, (b) credit entries only, or (c) both debit and

credit entries. Also, indicate its normal balance.

1. Amber, Drawing

2. Accounts Payable

3. Cash

4. Fees Earned

5. Supplies

6. Utilities Expense

2-1

32

Click to edit Master title style

32

32

Dr entries only

Normal Dr balance

Amber, Drawing

Dr and Cr balances

Normal Cr balance

Accounts payable

Dr and Cr balances

Normal Dr balance

Cash

Cr entries only

Normal Cr balance

Fees Earned

Dr and Cr entries

Normal Dr balance

Supplies

Dr entries only

Normal Dr balance

Utilities Expense

2-1

33

Click to edit Master title style

33

33

Accounting equation

The accounting system is known as the double entry

accounting system

Each transaction would affect at least 2 accounts

Total debits would always equal total credits

ASSETS = LIABILITIES + OWNERS EQUITY

2-1

34

Click to edit Master title style

34

34

Transaction analysis

Determine which account is affected by the transaction.

Determine whether the account increases or decreases.

Determine whether the account should be debited or credited.

Record the transaction using journal entry.

Post the journal entries to the accounts in the ledger.

Prepare an unadjusted trial balance at the end of the period.

2-1

35

Click to edit Master title style

35

35

Describe and illustrate the posting of journal

entries to the accounts

Objective 2

2-2

36

Click to edit Master title style

36

36

Posting

The process of transferring the debits and credits

from the journal entries to the accounts

2-2

37

Click to edit Master title style

37

37

example

Dec.1 NetSolutions paid a premium of RM2,400 for a

comprehensive insurance policy covering a one-year

period.

The entry would then be posted to the accounts (using

the 3-column account) refer Exhibit 5

Refer to the text book for the full example

Dec 1 Prepaid Insurance 2,400

Cash 2,400

2-2

38

Click to edit Master title style

38

38

Example exercise 2-5

On March 1, the cash account balance was RM22,350.

During March, cash receipts totaled RM241,880 and the

March 31 balance was RM19,125. Determine the cash

payments made during March.

Refer to the text book to solve using T-account

Alternatively:

Opening balance + Cash receipts Cash payments

= Closing balance

2-2

39

Click to edit Master title style

39

39

Prepare an unadjusted trial balance and explain

how it can be used to discover errors

Objective 3

2-3

40

Click to edit Master title style

40

40

Trial balance

A list of all the accounts maintained by

the business entity, along with their

respective balances

Refer Exhibit 7 for an example of a Trial

Balance

2-3

41

Click to edit Master title style

41

41

Example exercise 2-6

Indicate whether the errors would cause the TB totals to be

unequal. If so, indicate whether the Dr or Cr total is

higher and by how much.

a. Cash withdrawal of RM5,600 was journalized and

posted as a debit of RM6,500 to Salary Expense and a

credit of RM6,500 to Cash.

The totals are equal since both the debit and credit

entries were journalized and posted for RM6,500.

2-3

42

Click to edit Master title style

42

42

b. A fee of RM2,850 earned from a client

was debited to Accounts Receivable for

RM2,580 and credited to Fees Earned for

RM2,850.

The totals are unequal. The credit total is higher by RM270

(RM2,850 RM2,580).

2-3

43

Click to edit Master title style

43

43

c. A payment of RM3,500 to a creditor was

posted as a debit of RM3,500 to Accounts

Payable and a debit of RM3,500 to Cash.

The totals are unequal. The debit total is higher by

RM7,000 (RM3,500 + RM3,500).

2-3

44

Click to edit Master title style

44

44

Discover and correct errors in recording

transactions

Objective 4

2-4

45

Click to edit Master title style

45

45

Types of errors

Refer Exhibit 8

Transposition - occurs when the order of

the digits is changed mistakenly, such as

writing RM542 as RM452 or RM524.

Slide - the entire number is mistakenly

moved one or more spaces to the right or

the left, such as writing RM542.00 as

RM54.20.

2-4

46

Click to edit Master title style

46

46

Example exercise 2-7

Prepare correcting entries for the following errors:

a. A withdrawal of RM6,000 by Cheri Ramey,

owner of the business, was recorded as a debit

to Office Salaries Expense and a credit to Cash.

b. Utilities Expense of RM4,500 paid for the

current month was recorded as a debit to

Miscellaneous Expense and a credit to Accounts

Payable.

2-4

47

Click to edit Master title style

47

47

(a) A withdrawal was debited to Office Salaries

Expense and credited to Cash.

The wrong entry:

The correct entry:

The correcting entry:

Office Salaries Expense 6,000

Cash 6,000

Cherie Ramey, Drawing 6,000

Cash 6,000

Cheri Ramey, Drawing 6,000

Office Salaries Expense 6,000

2-4

48

Click to edit Master title style

48

48

(b) Utilities Expense for the current month was debited to Miscellaneous

Expense and credited to Accounts payable.

The wrong entry:

The correct entry:

Miscellaneous Expense 4,500

Accounts Payable 4,500

Utilities Expense 4,500

Cash 4,500

2-4

49

Click to edit Master title style

49

49

The correcting entry:

The first entry reverses the incorrect entry, and the

second entry records the correct entry

Accounts Payable 4,500

Miscellaneous Expense 4,500

Utilities Expense 4,500

Cash 4,500

2-4

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Statement of Comprehensive IncomeDocument11 pagesStatement of Comprehensive IncomeKhiezna PakamNo ratings yet

- Accounting For MerchandisingDocument2 pagesAccounting For MerchandisingEvelyn MaligayaNo ratings yet

- Answers 5Document101 pagesAnswers 5api-308823932100% (1)

- Certified Bookkeeper Program: January 12, 19, 26 and February 2, 2007 ADB Ave. OrtigasDocument63 pagesCertified Bookkeeper Program: January 12, 19, 26 and February 2, 2007 ADB Ave. OrtigasAllen CarlNo ratings yet

- 1 How To Prepare An Income StatementDocument4 pages1 How To Prepare An Income Statementapi-299265916No ratings yet

- NC Bacctg1 Final Exam Part 1Document3 pagesNC Bacctg1 Final Exam Part 1Danica Onte0% (1)

- FABM1 Lesson8-1 Five Major Accounts-LIABILITIESDocument13 pagesFABM1 Lesson8-1 Five Major Accounts-LIABILITIESWalter MataNo ratings yet

- Statement of Comprehensive Income (SCI) Single StepDocument11 pagesStatement of Comprehensive Income (SCI) Single StepNikolai MarasiganNo ratings yet

- CHAPTER 6 - Adjusting EntriesDocument25 pagesCHAPTER 6 - Adjusting EntriesMuhammad AdibNo ratings yet

- Wright Technological College of Antique Senior High School Sibalom Branch Sibalom, AntiqueDocument6 pagesWright Technological College of Antique Senior High School Sibalom Branch Sibalom, AntiqueLen PenieroNo ratings yet

- Book of Accounts Part 1. JournalDocument12 pagesBook of Accounts Part 1. JournalJace AbeNo ratings yet

- Test Question For Exam Chapter 1 To 6Document4 pagesTest Question For Exam Chapter 1 To 6Cherryl ValmoresNo ratings yet

- Exercises Short ProblemsDocument6 pagesExercises Short ProblemsKlaire SwswswsNo ratings yet

- FABM Week 8 - Bank Accounts, Transactions and DocumentsDocument26 pagesFABM Week 8 - Bank Accounts, Transactions and Documentsvmin친구No ratings yet

- Accounting EquationDocument55 pagesAccounting EquationRahul VermaNo ratings yet

- Analysis of Common Business TransactionsDocument18 pagesAnalysis of Common Business TransactionsClarisse RosalNo ratings yet

- Perpetual Inventory SystemDocument5 pagesPerpetual Inventory SystemRey ArudNo ratings yet

- Exercise Cash ControlDocument6 pagesExercise Cash ControlYallyNo ratings yet

- Buying & Selling For TeachersDocument46 pagesBuying & Selling For Teachersnino sulit100% (1)

- Adjusting Entries Company A ExercisesDocument19 pagesAdjusting Entries Company A ExercisesRodolfo CorpuzNo ratings yet

- Module in Fundamentals of Accountancy, Business and Management (Grade 12) Statement of Comprehensive Income (SCI)Document7 pagesModule in Fundamentals of Accountancy, Business and Management (Grade 12) Statement of Comprehensive Income (SCI)Jocelyn Estrella Prendol SorianoNo ratings yet

- Week 6Document11 pagesWeek 6Kim Albero CubelNo ratings yet

- FOA Final OutputDocument18 pagesFOA Final OutputGwyneth MogolNo ratings yet

- Essential Accounting Concepts and ExamplesDocument17 pagesEssential Accounting Concepts and ExamplesMarryRose Dela Torre FerrancoNo ratings yet

- CFS ComponentsDocument11 pagesCFS ComponentsAlyssa Nikki VersozaNo ratings yet

- I. Multiple Choice: Read and Analyze Each Item. Circle The Letter of The Best Answer. 1Document3 pagesI. Multiple Choice: Read and Analyze Each Item. Circle The Letter of The Best Answer. 1HLeigh Nietes-GabutanNo ratings yet

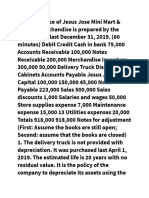

- E Trial Balance of Jesus Jose Mini MartDocument3 pagesE Trial Balance of Jesus Jose Mini Martshamsa ynnaNo ratings yet

- Lesson 4 - The Steps in The Accounting CycleDocument5 pagesLesson 4 - The Steps in The Accounting Cycleamora elyseNo ratings yet

- FabmDocument18 pagesFabmYangyang Leslie100% (1)

- Business Finance (Quarter 1 - Weeks 3 & 4)Document11 pagesBusiness Finance (Quarter 1 - Weeks 3 & 4)Francine Dominique CollantesNo ratings yet

- How To Calculate Gross ProfitDocument3 pagesHow To Calculate Gross ProfitQais WaqasNo ratings yet

- Financial StatementDocument5 pagesFinancial StatementJubelle Tacusalme PunzalanNo ratings yet

- Introduction To AccountingDocument37 pagesIntroduction To AccountingRey ViloriaNo ratings yet

- Elements of Accounting LectureDocument43 pagesElements of Accounting LectureRaissa Mae100% (1)

- Quiz 5 Books of Accounts Without AnswerDocument5 pagesQuiz 5 Books of Accounts Without AnswerHello KittyNo ratings yet

- Case 2-4 - SceDocument3 pagesCase 2-4 - SceNica CabradillaNo ratings yet

- Adjusting Journal EntriesDocument11 pagesAdjusting Journal EntriesKatrina RomasantaNo ratings yet

- Teddy BearDocument3 pagesTeddy BearKrisha Joy MercadoNo ratings yet

- Handout 6 Accounting For Service Merchandising and Manufacturing BusinessesDocument8 pagesHandout 6 Accounting For Service Merchandising and Manufacturing BusinessesSevi MendezNo ratings yet

- Adjusting Entries for Uncollectible AccountsDocument6 pagesAdjusting Entries for Uncollectible AccountsKristine IvyNo ratings yet

- Analyzing Business TransactionsDocument13 pagesAnalyzing Business TransactionsEricJohnRoxasNo ratings yet

- Account TitlesDocument5 pagesAccount TitlesalyNo ratings yet

- Lesley Dela Cruz Clearners Financial StatementsDocument7 pagesLesley Dela Cruz Clearners Financial StatementsJasmine ActaNo ratings yet

- Accounting Cycle Journal Entries With Chart of AccountsDocument3 pagesAccounting Cycle Journal Entries With Chart of AccountsMay Rojas MortosNo ratings yet

- Chapter 7 Books of Accounts Journals and LedgersDocument28 pagesChapter 7 Books of Accounts Journals and Ledgersjcxes Del rosarioNo ratings yet

- Accounting Cycle of A Merchandising Business: Prepared By: Prof. Jonah C. PardilloDocument41 pagesAccounting Cycle of A Merchandising Business: Prepared By: Prof. Jonah C. PardilloRoxe XNo ratings yet

- Fabm 2Document170 pagesFabm 2Asti GumacaNo ratings yet

- Cash BudgetDocument3 pagesCash Budgetmanoj kumarNo ratings yet

- 2 Adjusting Journal EntriesDocument6 pages2 Adjusting Journal EntriesJerric CristobalNo ratings yet

- Saint Louis College-Cebu: (Servant Leaders For Mission)Document4 pagesSaint Louis College-Cebu: (Servant Leaders For Mission)Marc Graham NacuaNo ratings yet

- Adjusting Entries ProblemsDocument5 pagesAdjusting Entries ProblemsDirck VerraNo ratings yet

- BUS 142 - Slides Chap 3. The Adjusting ProcessDocument50 pagesBUS 142 - Slides Chap 3. The Adjusting ProcessJess Ica100% (1)

- Philippine high school student's accounting worksheetDocument7 pagesPhilippine high school student's accounting worksheetCha Eun WooNo ratings yet

- Fundamentals of Accountancy 1 Trial BalanceDocument12 pagesFundamentals of Accountancy 1 Trial BalanceRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Practice Problem 11.0: Name Date Course/Year ScoreDocument5 pagesPractice Problem 11.0: Name Date Course/Year ScoreCatherine GonzalesNo ratings yet

- Financial Statement Analysis TechniquesDocument38 pagesFinancial Statement Analysis TechniquesmercyvienhoNo ratings yet

- What Is Bank Reconciliation.Document11 pagesWhat Is Bank Reconciliation.Sabrena FennaNo ratings yet

- Shs Abm Gr12 Fabm2 q1 m2 Statement-Of-comprehensive-IncomeDocument14 pagesShs Abm Gr12 Fabm2 q1 m2 Statement-Of-comprehensive-IncomeKye RauleNo ratings yet

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityFrom EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityNo ratings yet

- Chapter 5 - Acc. OperationsDocument42 pagesChapter 5 - Acc. OperationsSozia TanNo ratings yet

- Chapter 1 - Acc - in BusinessDocument54 pagesChapter 1 - Acc - in BusinessSozia TanNo ratings yet

- Budgeting Tools for Merchandising BusinessesDocument55 pagesBudgeting Tools for Merchandising BusinessesSozia TanNo ratings yet

- PP For Chapter 10 - Variance Analysis - FinalDocument52 pagesPP For Chapter 10 - Variance Analysis - FinalSozia TanNo ratings yet

- UUM Business Accounting Course OverviewDocument5 pagesUUM Business Accounting Course OverviewSozia TanNo ratings yet

- Chapter 3 - Adj - Ncial StateDocument34 pagesChapter 3 - Adj - Ncial StateSozia TanNo ratings yet

- PP For Chapter 7 - Introduction To Managerial Accounting - FinalDocument40 pagesPP For Chapter 7 - Introduction To Managerial Accounting - FinalSozia TanNo ratings yet

- Chapter 3 - Adj - Ncial StateDocument34 pagesChapter 3 - Adj - Ncial StateSozia TanNo ratings yet

- Chapter 4 - Com - Nting CycleDocument44 pagesChapter 4 - Com - Nting CycleSozia TanNo ratings yet

- Chapter 2 - Ana - RansactionsDocument35 pagesChapter 2 - Ana - RansactionsSozia TanNo ratings yet

- Chapter 3 - Adj - Ncial StateDocument34 pagesChapter 3 - Adj - Ncial StateSozia TanNo ratings yet

- PP For Chapter 8 - Cost Volume Profit - FinalDocument91 pagesPP For Chapter 8 - Cost Volume Profit - FinalSozia TanNo ratings yet

- Chapter 14 - Co - It AnalysisDocument68 pagesChapter 14 - Co - It AnalysisSozia TanNo ratings yet

- Budgeting As A Tool For Planning and Controlling: Budget????Document73 pagesBudgeting As A Tool For Planning and Controlling: Budget????Sozia TanNo ratings yet

- PP For Chapter 6 - Financial Statement Analysis - FinalDocument67 pagesPP For Chapter 6 - Financial Statement Analysis - FinalSozia TanNo ratings yet

- Chapter 6Document63 pagesChapter 6Sozia TanNo ratings yet

- Click To Edit Master Title Style: Completing The Accounting CycleDocument54 pagesClick To Edit Master Title Style: Completing The Accounting CycleSozia TanNo ratings yet

- Chapter 6 - Acc. OperationsDocument44 pagesChapter 6 - Acc. OperationsSozia TanNo ratings yet

- Chapter 8Document30 pagesChapter 8Sozia TanNo ratings yet

- Chapter 13 - Fi - NT AnalysisDocument64 pagesChapter 13 - Fi - NT AnalysisSozia TanNo ratings yet

- PP For Chapter 1 - Introduction To Accounting - FinalDocument97 pagesPP For Chapter 1 - Introduction To Accounting - FinalSozia TanNo ratings yet

- PP For Chapter 2 - Analyzing Transactions - FinalDocument49 pagesPP For Chapter 2 - Analyzing Transactions - FinalSozia TanNo ratings yet

- Power Notes: Company Annual ReportDocument14 pagesPower Notes: Company Annual ReportSozia TanNo ratings yet

- Chapter 6Document24 pagesChapter 6Sozia TanNo ratings yet

- Chapter 7Document24 pagesChapter 7Sozia TanNo ratings yet

- Chapter 4Document26 pagesChapter 4Sozia TanNo ratings yet

- Topic 12Document19 pagesTopic 12Sozia TanNo ratings yet

- Chapter 5 ContDocument55 pagesChapter 5 ContSozia TanNo ratings yet

- Financial Markets and Institutions: Required Reading: Mishkin, Chapter 1 andDocument43 pagesFinancial Markets and Institutions: Required Reading: Mishkin, Chapter 1 andVivek Roy100% (1)

- Chapter 6Document63 pagesChapter 6Sozia TanNo ratings yet

- ms3 Seq 01 Expressing Interests With Adverbs of FrequencyDocument3 pagesms3 Seq 01 Expressing Interests With Adverbs of Frequencyg27rimaNo ratings yet

- 1120 Assessment 1A - Self-Assessment and Life GoalDocument3 pages1120 Assessment 1A - Self-Assessment and Life GoalLia LeNo ratings yet

- Icici Bank FileDocument7 pagesIcici Bank Fileharman singhNo ratings yet

- Science 10-2nd Periodical Test 2018-19Document2 pagesScience 10-2nd Periodical Test 2018-19Emiliano Dela Cruz100% (3)

- The Neteru Gods Goddesses of The Grand EnneadDocument16 pagesThe Neteru Gods Goddesses of The Grand EnneadKirk Teasley100% (1)

- DINDIGULDocument10 pagesDINDIGULAnonymous BqLSSexONo ratings yet

- Examination of InvitationDocument3 pagesExamination of InvitationChoi Rinna62% (13)

- 05 Gregor and The Code of ClawDocument621 pages05 Gregor and The Code of ClawFaye Alonzo100% (7)

- Compound SentenceDocument31 pagesCompound Sentencerosemarie ricoNo ratings yet

- Supply Chain AssignmentDocument29 pagesSupply Chain AssignmentHisham JackNo ratings yet

- Chapter 12 The Incredible Story of How The Great Controversy Was Copied by White From Others, and Then She Claimed It To Be Inspired.Document6 pagesChapter 12 The Incredible Story of How The Great Controversy Was Copied by White From Others, and Then She Claimed It To Be Inspired.Barry Lutz Sr.No ratings yet

- Tata Hexa (2017-2019) Mileage (14 KML) - Hexa (2017-2019) Diesel Mileage - CarWaleDocument1 pageTata Hexa (2017-2019) Mileage (14 KML) - Hexa (2017-2019) Diesel Mileage - CarWaleMahajan VickyNo ratings yet

- Neligence: Allows Standards of Acceptable Behavior To Be Set For SocietyDocument3 pagesNeligence: Allows Standards of Acceptable Behavior To Be Set For SocietyransomNo ratings yet

- GASB 34 Governmental Funds vs Government-Wide StatementsDocument22 pagesGASB 34 Governmental Funds vs Government-Wide StatementsLisa Cooley100% (1)

- Addendum Dokpil Patimban 2Document19 pagesAddendum Dokpil Patimban 2HeriYantoNo ratings yet

- Mundane AstrologyDocument93 pagesMundane Astrologynikhil mehra100% (5)

- Communication Tourism PDFDocument2 pagesCommunication Tourism PDFShane0% (1)

- RumpelstiltskinDocument7 pagesRumpelstiltskinAndreia PintoNo ratings yet

- Amway Health CareDocument7 pagesAmway Health CareChowduru Venkat Sasidhar SharmaNo ratings yet

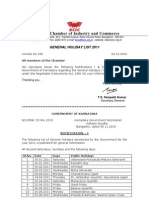

- BCIC General Holiday List 2011Document4 pagesBCIC General Holiday List 2011Srikanth DLNo ratings yet

- DLL - Science 6 - Q3 - W3Document6 pagesDLL - Science 6 - Q3 - W3AnatasukiNo ratings yet

- TITLE 28 United States Code Sec. 3002Document77 pagesTITLE 28 United States Code Sec. 3002Vincent J. Cataldi91% (11)

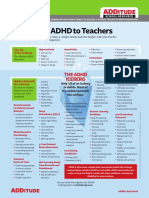

- Explaining ADHD To TeachersDocument1 pageExplaining ADHD To TeachersChris100% (2)

- Wonder at The Edge of The WorldDocument3 pagesWonder at The Edge of The WorldLittle, Brown Books for Young Readers0% (1)

- 110 TOP Survey Interview QuestionsDocument18 pages110 TOP Survey Interview QuestionsImmu100% (1)

- Introduction To Computing (COMP-01102) Telecom 1 Semester: Lab Experiment No.05Document7 pagesIntroduction To Computing (COMP-01102) Telecom 1 Semester: Lab Experiment No.05ASISNo ratings yet

- FOCGB4 Utest VG 5ADocument1 pageFOCGB4 Utest VG 5Asimple footballNo ratings yet

- List of Parts For Diy Dremel CNC by Nikodem Bartnik: Part Name Quantity BanggoodDocument6 pagesList of Parts For Diy Dremel CNC by Nikodem Bartnik: Part Name Quantity Banggoodyogesh parmarNo ratings yet

- Setting MemcacheDocument2 pagesSetting MemcacheHendra CahyanaNo ratings yet

- Pale Case Digest Batch 2 2019 2020Document26 pagesPale Case Digest Batch 2 2019 2020Carmii HoNo ratings yet