Professional Documents

Culture Documents

Chapter 1

Uploaded by

Shah NidaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 1

Uploaded by

Shah NidaCopyright:

Available Formats

FINANCIAL ACCOUNTING

Chapter 1

Accounting Concepts Review

Accounting

A system of providing quantitative

financial information, about economic

entities intended to be useful in

making economic decisions.

Accounting

A system of providing quantitative

financial information, about economic

entities intended to be useful in

making economic decisions.

A distinct economic

unit whose

transactions are kept

separate from those of

its owners.

Accounting

Information

The

accounting

process

Decision

makers

Economic

activities

Actions

(decisions)

Accounting

links decision

makers with

economic

activities and

with the results of

their decisions.

The Nature of Accounting

A function of specific countrys economic,

political, and social systems.

Changes over time to adapt to changes in

environment.

Basic Functions of an Accounting

Summarize

into Financial

Statements

and

communicate

information to

decision

makers.

Classify

similar

transactions

Record

business

transactions.

1

Business transaction

is business events of

an Enterprise,

measured in money

Basic Functions of an Accounting

Summarize

into Financial

Statements

and

communicate

information to

decision

makers.

Classify

similar

transactions

Record

business

transactions.

2

use descriptive

names for accounts

to put things in

categories

Basic Functions of an Accounting

Summarize

into Financial

Statements

and

communicate

information to

decision

makers.

Classify

similar

transactions

Interpret and

record

business

transactions.

3

Basic Functions of an Accounting

Summarize

into Financial

Statements

and

communicate

information to

decision

makers.

Classify

similar

transactions

Interpret and

record

business

transactions.

Financial statements shows:

1. The financial position of a business

2. The results of its operations

3

Basic Functions of an Accounting

Summarize

into Financial

Statements

and

communicate

information to

decision

makers.

Classify

similar

transactions

Interpret and

record

business

transactions.

Four Primary Financial

Statements:

1. Balance Sheet 2. Income

Statement 3. Statement of

Stockholders Equity 4. Statement of

Cash Flows

3

The Preparation and Dissemination of

Accounting Information

The financial activities of a firm

Income Statement

Balance Sheet

Statement of Cash Flows

are recorded, classified and

summarized by accountants

in the form of financial statements

that are used by interested parties.

Accounting and Forms of Business

Enterprises

Sole Proprietorships

Partnerships

Corporations

Users of Accounting Information

Present and Prospective Investors and Creditors

Governmental Agencies like SECP and CBR

General Public like customers, employees etc

External Users

Information about economic

resources, claims to resources, and

changes in resources and claims.

Information useful in assessing

amount, timing and uncertainty of

future cash flows.

Information useful in making

investment and credit decisions.

(Specific)

(General)

Objectives

of

Financial

Reporting

The process of

supplying

financial

information to

decision makers

outside the

organization is

called Financial

Reporting

Financial

Statements

Financial Statements:

A Lens to View Business

Users of Accounting Information

The Firms management

Managerial Accounting

Provide information to

management in planning

and controlling the

business

Board of Directors

Chief Executive

Officer

Chief Financial

Officer

Vice Presidents

Business Unit

Managers

Plant Managers

Store Managers

Line Supervisors

Internal Users

Information about decision-making

authority, for decision-making support, and

for evaluating and rewarding decision-making

performance.

Information useful in assessing

both the past performance and future

directions of the enterprise and information

from external and internal sources.

Information useful to help the enterprise

achieve its goal, objectives and mission.

Objectives

of

Managerial

Reporting

Accountants

Public Accounting

Variety of accounting services to individuals and firms

Chartered Accountants of Pakistan----ICAP

Tasks:

Auditing and Accounting Services

Tax Preparation and Planning

Management Advisory Services

Private Accounting

Practice of accounting in a single firm

Cost Accounting, Budgetary Planning and Control, Internal

Auditing, Taxation, and Financial Reporting.

Governmental Accounting

Practice of accounting in Governmental Organizations

Accounting Concepts and Convections

Business Entity

Going Concern

Quantifiability

Relevance

Reliability

Comparability

Consistency

Materiality

Full Disclosure

Historical Cost

Time Period

Matching Principle

Revenue Recognition/ Realization Principle

Generally Accepted Convections

Balance Sheet

Presents Financial Position of a firm at a

particular point in time.

Assess financial strength of a firm

Vagabond Travel Agency

Balance Sheet

December 31, 2002

Assets Liabilities & Owners' Equity

Cash 22,500 $ Liabilities:

Notes receivable 10,000 Notes payable 41,000 $

Accounts receivable 60,500 Accounts payable 36,000

Supplies 2,000 Salaries payable 3,000

Land 100,000 Total liabilities 80,000 $

Building 90,000 Owners' Equity:

Office equipment 15,000 Capital stock 150,000

Retained earnings 70,000

Total 300,000 $ Total 300,000 $

A Starting Point: Statement of

Financial Position

Vagabond Travel Agency

Balance Sheet

December 31, 2002

Assets Liabilities & Owners' Equity

Cash 22,500 $ Liabilities:

Notes receivable 10,000 Notes payable 41,000 $

Accounts receivable 60,500 Accounts payable 36,000

Supplies 2,000 Salaries payable 3,000

Land 100,000 Total liabilities 80,000 $

Building 90,000 Owners' Equity:

Office equipment 15,000 Capital stock 150,000

Retained earnings 70,000

Total 300,000 $ Total 300,000 $

Assets

Assets are

economic resources

that are owned by

the business and

are expected to

provide positive

future cash flows.

Vagabond Travel Agency

Balance Sheet

December 31, 2002

Assets Liabilities & Owners' Equity

Cash 22,500 $ Liabilities:

Notes receivable 10,000 Notes payable 41,000 $

Accounts receivable 60,500 Accounts payable 36,000

Supplies 2,000 Salaries payable 3,000

Land 100,000 Total liabilities 80,000 $

Building 90,000 Owners' Equity:

Office equipment 15,000 Capital stock 150,000

Retained earnings 70,000

Total 300,000 $ Total 300,000 $

Liabilities

Liabilities are

debts that

represent negative

future cash flows

for the enterprise.

Vagabond Travel Agency

Balance Sheet

December 31, 2002

Assets Liabilities & Owners' Equity

Cash 22,500 $ Liabilities:

Notes receivable 10,000 Notes payable 41,000 $

Accounts receivable 60,500 Accounts payable 36,000

Supplies 2,000 Salaries payable 3,000

Land 100,000 Total liabilities 80,000 $

Building 90,000 Owners' Equity:

Office equipment 15,000 Capital stock 150,000

Retained earnings 70,000

Total 300,000 $ Total 300,000 $

Owners Equity

Owners equity

represents the

owners claim

(residual interest)

to the assets of the

business.

Owners Equity

Changes in Owners Equity

Owners

Investments

Business

Earnings

Payments

to Owners

Business

Losses

Debit and Credit Rules

A = L + OE

ASSETS

Debit for

Increase

Credit for

Decrease

EQUITIES

Debit

for

Decrease

Credit for

Increase

LIABILITIES

Debit

for

Decrease

Credit for

Increase

Debits and credits affect accounts as follows:

The Accounting Equation

Historical Cost

Principle

Going-Concern

Assumption

Objectivity

Principle

Effect of

Inflation

These accounting

principles support

cost as the basis

for asset valuation.

Concepts and Convections related to

the Balance Sheet

Income Statement

Provides information regarding the firms

profitability for a period of time

Investments by and payments to the owners

are not included on the Income Statement.

Single Step Income Statement

JJ's Lawn Care Service

Income Statement

For the month ending May 31, 2003

Sales revenue 750 $

Operating expenses:

Gasoline expense 50 $

Depr. exp.: tools & eq. 50

Depr. exp.: truck 250 350

Net income 400 $

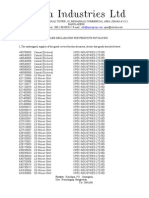

Engro Corporation

Income Statement

For the Year December, 31 2013

Sales

Cost of Goods Sold

Gross Profit

Expenses

Selling, General and Administrative

Expenses

EBIT (Operating Expenses)

Interest Expense

EBT

Income Tax

Net Income

Multiple Step Income Statement

Revenue and Expenses

The price for goods

sold

and services rendered

during a given

accounting period.

Increases owners

equity.

The costs of goods and

services used up in the

process of earning

revenue.

Decreases owners

equity.

The Realization Principle:

When To Record Revenue

Realization Principle

Revenue should be

recognized at the

time goods are sold

and services are

rendered.

The Matching Principle: When To

Record Expenses

Matching Principle

Expenses should be

recorded in the period

in which they are used

up.

Expenses of the period

are matched against the

revenue of the same

period

Net income is not an asset its an increase in

owners equity from profits of the business.

A = L + OE

Increase Decrease Increase

Either (or both) of these

effects occur as net income

is earned . . .

. . . but this is

what net income

really means.

Net Income

Accounting Periods

Time Period Principle

To provide users of financial

statements with timely

information, net income is

measured for relatively short

accounting periods of equal

length.

Debits and Credits for Revenue and

Expense

EQUITIES

Debit

for

Decrease

Credit

for

Increase

REVENUES

Debit

for

Decrease

Credit

for

Increase

EXPENSES

Credit

for

Decrease

Debit

for

Increase

Expenses

decrease

owners

equity.

Revenues

increase

owners

equity.

Cash Flow Statement/ SCFP

Describe changes in the financial resources of

an enterprise

JJ's Lawn Care Service

Statement of Cash Flows

For the Month Ended May 31, 2003

Cash flows from operating activities:

Cash received from revenue transactions 750 $

Cash paid for expenses (50)

Net cash provided by operating activities 700 $

Cash flows from investing activities:

Purchase of lawn mower (2,500) $

Purchase of truck (2,000)

Collection for sale of repair parts 75

Payment for repair parts (150)

Net cash used by investing activities (4,575)

Cash flows from financing activities:

Investment by owners 8,000

Increase in cash for month

Cash balance, May 1, 2003 4,125 $

Cash balance, May 31, 2003 4,125 $

JJ's Lawn Care Service

Statement of Cash Flows

For the Month Ended May 31, 2003

Cash flows from operating activities:

Cash received from revenue transactions 750 $

Cash paid for expenses (50)

Net cash provided by operating activities 700 $

Cash flows from investing activities:

Purchase of lawn mower (2,500) $

Purchase of truck (2,000)

Collection for sale of repair parts 75

Payment for repair parts (150)

Net cash used by investing activities (4,575)

Cash flows from financing activities:

Investment by owners 8,000

Increase in cash for month 4,125 $

Cash balance, May 1, 2003 -

Cash balance, May 31, 2003 4,125 $

Operating activities include the cash

effects of revenue and expense

transactions.

JJ's Lawn Care Service

Statement of Cash Flows

For the Month Ended May 31, 2003

Cash flows from operating activities:

Cash received from revenue transactions 750 $

Cash paid for expenses (50)

Net cash provided by operating activities 700 $

Cash flows from investing activities:

Purchase of lawn mower (2,500) $

Purchase of truck (2,000)

Collection for sale of repair parts 75

Payment for repair parts (150)

Net cash used by investing activities (4,575)

Cash flows from financing activities:

Investment by owners 8,000

Increase in cash for month 4,125 $

Cash balance, May 1, 2003 -

Cash balance, May 31, 2003 4,125 $

Investing activities include the cash

effects of purchasing and selling

assets.

JJ's Lawn Care Service

Statement of Cash Flows

For the Month Ended May 31, 2003

Cash flows from operating activities:

Cash received from revenue transactions 750 $

Cash paid for expenses (50)

Net cash provided by operating activities 700 $

Cash flows from investing activities:

Purchase of lawn mower (2,500) $

Purchase of truck (2,000)

Collection for sale of repair parts 75

Payment for repair parts (150)

Net cash used by investing activities (4,575)

Cash flows from financing activities:

Investment by owners 8,000

Increase in cash for month 4,125 $

Cash balance, May 1, 2003 -

Cash balance, May 31, 2003 4,125 $

Financing activities include the cash

effects of transactions with the owners

and creditors.

Relationships Among Financial

Statements

Beginning of

period

End of

period

Balance

Sheet

Balance

Sheet

Time

Income Statement

Statement of Cash Flows

Retained Earnings Statement

Describe changes in the retained earnings

account of an enterprise for a certain period

of time.

JJ's Lawn Care Service

Statement of Retained Earnings

For the Month Ended May 31, 2003

Retained earnings, May 1, 2003 - $

Add: Net income for May 400

Subtotal 400 $

Less: Dividends 200

Retained earnings, May 31, 2003 200 $

You might also like

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- CSEC Principles of Accounts NotesDocument66 pagesCSEC Principles of Accounts NotesAbdullah Ali94% (32)

- Tender For Cable Car FeasibilityDocument26 pagesTender For Cable Car FeasibilityaqhammamNo ratings yet

- Profit & Loss AccountDocument38 pagesProfit & Loss AccountAbhirup Sengupta100% (1)

- Practice HSC Papers General 2Document47 pagesPractice HSC Papers General 2DarrenPurtillWrightNo ratings yet

- Employee Complaint FormDocument4 pagesEmployee Complaint FormShah NidaNo ratings yet

- Download Form 990 for Don and Mary Mitchell FoundationDocument1 pageDownload Form 990 for Don and Mary Mitchell FoundationSarah SportingNo ratings yet

- Accounting Basics for Business DecisionsDocument26 pagesAccounting Basics for Business DecisionsAhmad Fahrizal AsmyNo ratings yet

- Chapter 1 Analysis of Financial StatementsDocument55 pagesChapter 1 Analysis of Financial StatementsSonam Sanjay Dhameja100% (4)

- Official ReceiptsDocument1 pageOfficial ReceiptsCharlie HansNo ratings yet

- Accounting and The Business EnvironmentDocument46 pagesAccounting and The Business EnvironmentSatya JeetNo ratings yet

- CIR Vs Japan AirlinesDocument1 pageCIR Vs Japan AirlinesJR BillonesNo ratings yet

- Fundamental AnalysisDocument7 pagesFundamental AnalysisJyothi Kruthi PanduriNo ratings yet

- TopSteelmakers2013 PDFDocument32 pagesTopSteelmakers2013 PDFgobe86No ratings yet

- Accounting Survival Guide: An Introduction to Accounting for BeginnersFrom EverandAccounting Survival Guide: An Introduction to Accounting for BeginnersNo ratings yet

- Global Water IntelligenceDocument5 pagesGlobal Water IntelligenceKhyati MistryNo ratings yet

- TOPIK 1 - IntroductionDocument66 pagesTOPIK 1 - IntroductionkanasanNo ratings yet

- Tools For Business Decision Making, 4th Ed.: Kimmel, Weygandt, KiesoDocument60 pagesTools For Business Decision Making, 4th Ed.: Kimmel, Weygandt, KiesoKyleRodSimpsonNo ratings yet

- Chapter 10Document85 pagesChapter 10sherrybanoNo ratings yet

- Accounting & Financial AnalysisDocument35 pagesAccounting & Financial AnalysisVishal Ranjan100% (2)

- AFIN102 Notes Pack 1Document40 pagesAFIN102 Notes Pack 1boy.poo90No ratings yet

- Chapter 1Document38 pagesChapter 1mukundentegloriaNo ratings yet

- Financial Accounting Lecture EssentialsDocument105 pagesFinancial Accounting Lecture Essentialsmukesh697No ratings yet

- Introduction To AccountingDocument35 pagesIntroduction To Accountingaanu1234No ratings yet

- Introduction To Accounting and BusinessDocument54 pagesIntroduction To Accounting and BusinessAje AndiartaNo ratings yet

- Income StatementDocument42 pagesIncome StatementS100% (1)

- Chapter 1 - Financial Statements and ReportsDocument44 pagesChapter 1 - Financial Statements and ReportsNguyễn Yến Nhi100% (1)

- Basic Accounting: Concepts, Techniques, Conventions. Read and Interpret The Basic Financial StatementsDocument42 pagesBasic Accounting: Concepts, Techniques, Conventions. Read and Interpret The Basic Financial StatementsATORNIIINo ratings yet

- Week 1 OneslideperpageDocument73 pagesWeek 1 OneslideperpageBarry AuNo ratings yet

- Introduction to Accounting FundamentalsDocument15 pagesIntroduction to Accounting FundamentalsSubhra DasNo ratings yet

- ACC100 Accounting FundamentalsDocument23 pagesACC100 Accounting FundamentalsscribdpdfsNo ratings yet

- Financial Statement Project 1 1Document38 pagesFinancial Statement Project 1 1ABHISHEK SHARMANo ratings yet

- Financial Accounting: Fakhri Mammadov Azerbaijan State Economic UniversityDocument39 pagesFinancial Accounting: Fakhri Mammadov Azerbaijan State Economic UniversityFaxri MammadovNo ratings yet

- Accounting Notes - 1Document55 pagesAccounting Notes - 1Rahim MashaalNo ratings yet

- Accounting & Financial Systems MCPC 606: Service ExcellenceDocument90 pagesAccounting & Financial Systems MCPC 606: Service ExcellenceRight Karl-Maccoy HattohNo ratings yet

- Acc 6 CH 01Document46 pagesAcc 6 CH 01Md. Rubel HasanNo ratings yet

- Financial Management-Financial Statements-Chapter 2Document37 pagesFinancial Management-Financial Statements-Chapter 2Bir kişi100% (1)

- Learning Guide Learning Guide: Nefas Silk Poly Technic CollegeDocument36 pagesLearning Guide Learning Guide: Nefas Silk Poly Technic CollegeNigussie BerhanuNo ratings yet

- Accounting FundamentalsDocument76 pagesAccounting FundamentalsGlory UsoroNo ratings yet

- MR Ranjit SinghDocument77 pagesMR Ranjit SinghMonu MehanNo ratings yet

- Financial Reporting MethodsDocument10 pagesFinancial Reporting Methods85sunaNo ratings yet

- Accounting For Managers: Basics of Business Accounting (Learner Friendly Approach)Document45 pagesAccounting For Managers: Basics of Business Accounting (Learner Friendly Approach)Sasi Kesanasetty KiranNo ratings yet

- Chapter 1Document132 pagesChapter 1Joyce Ann Santos100% (1)

- AN Introduction To Financial StatmentsDocument67 pagesAN Introduction To Financial StatmentsirquadriNo ratings yet

- Introduction To Financial Accounting: Key Terms and Concepts To KnowDocument16 pagesIntroduction To Financial Accounting: Key Terms and Concepts To KnowAmit SharmaNo ratings yet

- Class NotesDocument45 pagesClass NotesNaveed Whatsapp Status100% (1)

- CH 1Document42 pagesCH 1Jewad MohammedNo ratings yet

- Engineering Economics: Ali SalmanDocument16 pagesEngineering Economics: Ali SalmanSalman AhmedNo ratings yet

- Foundations of Entrepreneurship: Basic Accounting and Financial StatementsDocument89 pagesFoundations of Entrepreneurship: Basic Accounting and Financial StatementsTejaswi BandlamudiNo ratings yet

- ACC Lecture 1Document58 pagesACC Lecture 1Tinashe ChikwenhereNo ratings yet

- Management Accounting InsightsDocument36 pagesManagement Accounting InsightsYashwardhan KrNo ratings yet

- FRA-NewDocument31 pagesFRA-NewAbhishek DograNo ratings yet

- Accounting Principles ExplainedDocument39 pagesAccounting Principles ExplainedramiNo ratings yet

- Chap 01-Introduction To AccountingDocument56 pagesChap 01-Introduction To AccountingJean CoulNo ratings yet

- Cash Flow Analysis: 15.511 Corporate AccountingDocument31 pagesCash Flow Analysis: 15.511 Corporate AccountingAnanda RamanNo ratings yet

- Impacting The Financial StatementsclassDocument23 pagesImpacting The Financial StatementsclassMonkey2111No ratings yet

- Week 1 - Introduction and Balance Sheet PDFDocument84 pagesWeek 1 - Introduction and Balance Sheet PDFHisham ShihabNo ratings yet

- Finance Primer - 2016Document26 pagesFinance Primer - 2016Gurram Sarath KumarNo ratings yet

- Accounting Process and Financial StatementsDocument21 pagesAccounting Process and Financial StatementsSenthil Kumar BellanNo ratings yet

- CH 1 Part 1Document41 pagesCH 1 Part 1hstptr8wdwNo ratings yet

- The Role of Accounting in Business DecisionsDocument41 pagesThe Role of Accounting in Business DecisionsAlvaro CarrerasNo ratings yet

- Chapter 2Document83 pagesChapter 2Korubel Asegdew YimenuNo ratings yet

- How To Take Charge of Your Farm's Financial Management: Terry Betker P.Ag., CAC, CMCDocument70 pagesHow To Take Charge of Your Farm's Financial Management: Terry Betker P.Ag., CAC, CMCTurner McKayNo ratings yet

- Financial Accounting 1213527362725423 9Document259 pagesFinancial Accounting 1213527362725423 9Surendra Sharma100% (1)

- Accounting Financial: ManagementDocument259 pagesAccounting Financial: ManagementAdil Akbar Janjua100% (1)

- Financial Reporting & Analysis Session Provides InsightsDocument41 pagesFinancial Reporting & Analysis Session Provides InsightspremoshinNo ratings yet

- Accounting BasicsDocument68 pagesAccounting BasicsEd Caty100% (1)

- Introduction to Accounting and BusinessDocument36 pagesIntroduction to Accounting and BusinessHồng NgọcNo ratings yet

- Introduction To Accounting and BusinessDocument42 pagesIntroduction To Accounting and BusinessCris LuNo ratings yet

- E-Tailing in IndiaDocument28 pagesE-Tailing in IndiaAnurag VermaNo ratings yet

- b2b Ecommerce Trends 2012 1503041 PDFDocument9 pagesb2b Ecommerce Trends 2012 1503041 PDFvdshfdhchvNo ratings yet

- Elements of Statistics and Probability: Lecture SlidesDocument23 pagesElements of Statistics and Probability: Lecture SlidesShah NidaNo ratings yet

- Economics of PakistanDocument5 pagesEconomics of PakistanShah NidaNo ratings yet

- Accounting For Merchandising ActivitiesDocument52 pagesAccounting For Merchandising ActivitiesShah NidaNo ratings yet

- Chapter 4Document57 pagesChapter 4Shah NidaNo ratings yet

- Literature Review Analysis in Tabular Form NewDocument8 pagesLiterature Review Analysis in Tabular Form NewShah NidaNo ratings yet

- Case Study 1Document1 pageCase Study 1Shah NidaNo ratings yet

- Financial Stament Review-2Document8 pagesFinancial Stament Review-2Shah NidaNo ratings yet

- Chapter 4Document57 pagesChapter 4Shah NidaNo ratings yet

- 10 1 1 198Document40 pages10 1 1 198Shah NidaNo ratings yet

- Case Study 2.1 Corporate GovernanceDocument4 pagesCase Study 2.1 Corporate GovernanceShah NidaNo ratings yet

- Primary Objectives of Monetary PolicyDocument1 pagePrimary Objectives of Monetary PolicyShah NidaNo ratings yet

- How to Navigate ChangeDocument27 pagesHow to Navigate ChangeShah NidaNo ratings yet

- Psycho Metric TestDocument15 pagesPsycho Metric TestShah NidaNo ratings yet

- JOB Application Form: 1. Position Applied ForDocument4 pagesJOB Application Form: 1. Position Applied ForShah NidaNo ratings yet

- Metro: Agenda - FinalDocument16 pagesMetro: Agenda - FinalMetro Los AngelesNo ratings yet

- Jackson's Goldman LoanDocument1 pageJackson's Goldman LoanThe WrapNo ratings yet

- Annuity Calculator: Withdrawal PlanDocument2 pagesAnnuity Calculator: Withdrawal PlanAjay SinghNo ratings yet

- InsuranceDocument2 pagesInsurancefahim_ibaNo ratings yet

- TVM Exercises in Cash Flow Mapping 1Document2 pagesTVM Exercises in Cash Flow Mapping 1Cherry Anne TolentinoNo ratings yet

- A Metropolitan Transport System OverviewDocument49 pagesA Metropolitan Transport System OverviewuntoniNo ratings yet

- Management Summary: 6.1 Personnel PlanDocument24 pagesManagement Summary: 6.1 Personnel Planrichelle andayaNo ratings yet

- The Time Value Of Money ExplainedDocument40 pagesThe Time Value Of Money Explainedeshkhan100% (1)

- ZuluTrade WSJ ArticleDocument2 pagesZuluTrade WSJ ArticleMinura MevanNo ratings yet

- Garp FRM Candidate Guide 2015 11515Document20 pagesGarp FRM Candidate Guide 2015 11515Roy Malpica RojasNo ratings yet

- Calpers Real Estate ReviewDocument2 pagesCalpers Real Estate ReviewFortune100% (1)

- Mahindra SsangyongDocument21 pagesMahindra Ssangyongakshay_minhas82100% (1)

- Letter PADDocument151 pagesLetter PADBogra BograaNo ratings yet

- Task (3.4) Calculate RatiosDocument7 pagesTask (3.4) Calculate RatiosAnonymous xOqiXnW9No ratings yet

- Title 2 - Parties To The Contract (Insurance Laws)Document5 pagesTitle 2 - Parties To The Contract (Insurance Laws)YieMaghirangNo ratings yet

- Bond ValuationDocument46 pagesBond ValuationNor Shakirah ShariffuddinNo ratings yet

- Related Parties Problem 4-1: D. Two Ventures Simply Because They Share Joint Control Over Joint VentureDocument3 pagesRelated Parties Problem 4-1: D. Two Ventures Simply Because They Share Joint Control Over Joint Venturejake doinogNo ratings yet

- Bombardier Annual Report 2004Document142 pagesBombardier Annual Report 2004bombardierwatchNo ratings yet

- Assignment Chapter: 04 & 05: Submitted ToDocument3 pagesAssignment Chapter: 04 & 05: Submitted ToSha D ManNo ratings yet

- MS08 Quantitative TechniquesDocument3 pagesMS08 Quantitative TechniquesRodlyn LajonNo ratings yet

- Guillermo and Sons Automotive Repair Shop Business Plan 1Document19 pagesGuillermo and Sons Automotive Repair Shop Business Plan 1api-241466802No ratings yet

- Company Law-Executive PDFDocument127 pagesCompany Law-Executive PDFDev SharmaNo ratings yet