Professional Documents

Culture Documents

Retail FDI in India

Uploaded by

rohit17,1986Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Retail FDI in India

Uploaded by

rohit17,1986Copyright:

Available Formats

Foreign Direct Investment

in Indian Retail Sector

By:

Santosh Sahu

Rohit Tripathi

Sandeep Singh

Introduction

• The Retail Sector is the largest sector

in India after agriculture,

accounting for over 10 per cent of

the country’s GDP and around 8 per

cent of the employment.

• India has the most unorganized retail

market in the world. Most retailers

of the unorganized retail market

have their shop in the front and

house at the back.

Conti….

• Currently, the organized retail sector

accounts for only 5 per cent

indicating a huge potential market

opportunity.

• The Retail Industry in India is today

amongst the fastest growing

industries with several players

entering the market.

• India is being seen as most

attractive market by retail investors

Urban Market

• According to a study by the McKinsey

Global Institute (MGI), Indian

incomes are likely to grow three-

fold over the next two decades and

India will become the world's fifth-

largest consumer market by 2025.

• About 61 per cent of total urban

income comes from households

that can be classified as middle

class—earning between US$ 1,493

and US$ 9,955 a year.

Retail Sector in Urban

Market

• According to a report by McKinsey,

India's overall retail sector is likely to

grow to US$ 419.93 billion by 2015.

• The turnover of the organised retail

segment in India is pegged at around

US$ 30 billion. It is expected to reach

US$ 55- 60 billion by 2011.

• In urban India, modern retail is likely to

grow from the current 9.6 per cent of

total retail to 26 per cent in the next

five years, as per Technopak Advisors.

Retail in Rural Market

• The rural retail market is currently estimated at

US$ 112 billion, or around 40 per cent of the

US$ 280 billion retail market.

• Major domestic retailers like AV Birla, ITC, Godrej,

Reliance and many others have already set up

farm linkages.

• Hariyali Kisan Bazaars (DCM) and Aadhars

(Pantaloon-Godrej JV), Choupal Sagars (ITC),

Kisan Sansars (Tata), Reliance Fresh, Project

Shakti (Hindustan Unilever) and Naya Yug

Bazaar are established rural retail hub.

Flashback

• The traditional format of retailing was of

neighborhood ‘KIRANA.’ With the

passage of time chain stores run by

Khadi and Village Industries

Commission came up.

• Textile companies like Raymonds,

Grasim, Bombay Dyeing etc

witnessed the opening of retail

chains.

• Later Titan by opening watches

showrooms successfully created an

organized retailing concept.

• Since late 1990’s, new companies like-

Big Bazaar, Food World, Subhiksha,

Trends in Indian Retail

• As the current retail sector in India is

reflected in expansive shopping

centers, multiplex- malls and huge

complexes offer shopping,

entertainment and food all under one

roof, the concept of shopping has

altered in terms of format and

consumer buying behavior, ushering

in a revolution in shopping in India.

• This has also contributed to large scale

investments in the real estate

sector with major national and global

players investing in developing the

Conti…..

• The trends that are driving the

growth of the retail sector in India

are…

• Low share of organized retailing.

• Falling real estate prices.

• Increase in disposable income and

customer aspiration.

• Increase in expenditure for luxury

items.

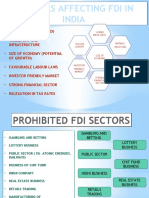

FDI in Retail Sector

• FDI in retail trading is not encouraged in any

form. Trading is permitted under automatic

route with FDI up to 51% provided it is primarily

limited to export activities, and the undertaking

is an export house/trading house/super trading

house/star trading house.

• However, under the FIPB route 100% FDI is

permitted in case of trading companies for the

following activities..

• Export

• bulk imports with ex-port/ex-bonded warehouse sale.

• other import of goods or services provided at least 75%

of it is for procurement and sale of goods and services

among the companies of the same group and not for

third party use or onward transfer/distribution/sales.

A few foreign retail names appearing in the

market like Marks & Spencer, Benetton, Lifestyle

are in the nature of franchisee.

Regulation In FDI

• Current Government policy prohibits

foreign direct investment in retail

trading except for single brand retail

that fulfils the following conditions:

• Foreign equity does not go beyond 51

percent,

• Foreign Investment Promotion Board

(FIPB)/Department of Industrial Policy

& Promotion (DIPP) approval has been

issued,

• Products to be sold are of a ‘single

brand’ only,

Conti….

• Single brand products’ covers products

that are branded during

manufacturing,

• Additions to the product categories to

be sold under ‘single brand’ require

fresh Government approval.

Ø Intense debate currently centers on

what percentage of foreign

ownership should be allowed and

whether further liberalisation of the

FDI rules should occur, particularly

in the retail sector.

Benefits of Foreign

Investment

Modern retail chains drive

efficiencies in the process of

distribution and invest in

infrastructure that would otherwise

be left to governments to build.Some

benefits that flow from foreign

investment in retailing are..

• Faster take up of modern retail

formats;

• Improved productivity and efficiency

of the retail sector;

Conti…

• Improved quality of employment;

• Investment in supply chain;

• Lower prices for consumers;

• Reduced number of intermediaries

because of closer integration of

suppliers, logistic service and

retailers;

• Linked local suppliers, farmers,

manufacturers to global markets;

• Improved product quality and service

for consumers;

Ø

WHAT WAS THE CRITERIA

FOR FDI

v Some time in 1991-92, the then Finance Minister and present

Prime Minister Dr. Manmohan Singhjireferred to certain

criteria for allowing Foreign Direct Investment. These

were :

v

1. Establishment of basic industries requiring huge capital and

advanced sophisticated technology.

2.

3. Infrastructure projects like electricity generation road building

etc.

4.

5. Projects which would generate employment

•

PRESENT CONDITION OF TRADERS

Fringe Benefit Tax

VAT

INEFFICIENT

ØLICENCES & PERMITS

ØINDUSTRIAL DISPUTE ACT

LABOURS

ØSHOP & ESTABLISHMENT ACT ØPREVENTION OF BLOCK MARKETING ACT

ØCOSUMER PROTECTION ACT ØANTI HOARDING & PROFEELING ACT

ØWEIGHT & MEASUREMENT ACT ØMONEY LENDING ACT

ØPACKAGING ACT ØPRODEND FUND ACT

ØPREVENTION OF FOOD ADULTRATION ACT ØMINIMUM WAGES ACT

ØESI ACT

ØGRATUITY ACT

ØBONUS ACT

ENTRY TAX

SERVICE TAX

FDI in Retail Trade

ANTI SOCAL ELEMENTS

OCTROI

WATER TAX

CENTRAL

EXCISE

POLITICIAL INTERFERANCE

PURCHASE TAX

SALES TAX INCOME TAX

POOR MARKET

CONDITION POWER PROBLEM

Cash Transaction Tax

INSPECTOR RAJ &

STAMP DUTY

Quarterly ‘C’ Form

WELTH TAX

HIGH BANK

CHARGES PROFESSIONAL TAX

New Naka Complex

ESSENTIAL COMMODITIES ACT

Supply Chain

• India has a particular need for foreign

investment in distribution on a large

scale.

• Approximately 20-40 percent of

perishable produce is wasted due to

multiple intermediaries, wastage

during transportation and storage,

high cycle times and an absence of

cold storage systems.

• The supply chain would be made more

efficient through economies of scale

in procurement and transportation,

bulk storage, trend forecasting and

M.N.C.

REGIME

CONTRACT FARMING

COLLECTION OF TO OWN FACTORY

AGRICALTURE PRODUCTS

TO CUSTOMER

TO OWN DEPT. STORE

Recommandation

• The retail sector in India is severely

constrained by limited availability of

bank finance.

• A National Commission must be

established to study the problems of

the retail sector and to evolve policies

that will enable it to cope with FDI.

• The proposed National Commission

should evolve a clear set of

conditionalities on giant foreign

retailers on the procurement of farm

produce, domestically manufactured

merchandise and imported goods.

Conti…

• Entry of foreign players must be gradual

and with social safeguards so that the

effects of the labour dislocation can be

analysed & policy finetuned.

• The government must actively encourage

setting up of co-operative stores to

procure and stock their consumer goods

and commodities from small producers.

• Quality regulation, certification & price

administration bodies can be created at

district and lower levels for upgrading the

technical and human interface in the rural

to urban supply chain.

Expected Investment

Sources says:

• Reliance Retail will invest US$5.5 billion by

2010-2011.

• Bharti-Wal-Mart will invest US$2.5 billion by

2015.

• Future Group (Pantaloon Retail) will invest

US$260 million by 2008.

• Metro AG is investing US$400 million over

the next three years.

• Targeting an emerging segment of night

shoppers, New Delhi-based round-the-

clock convenience chain Twenty Four

Seven Retail Stores Pvt. Ltd plans to

Conclusion

• Investing in organised retail sector in

India is a beneficial scheme for an

investor. The Retail Industry is

going to be the next boom industry

after I.T.

THANK YOU

You might also like

- Etsy Success POD Launch Your T-Shirt Business Coaching Book 927Document53 pagesEtsy Success POD Launch Your T-Shirt Business Coaching Book 927A MNo ratings yet

- CSEC POB June 2014 P1 PDFDocument9 pagesCSEC POB June 2014 P1 PDFschool yourschool50% (2)

- Zappos CaseDocument10 pagesZappos Casebirla64No ratings yet

- Wood Road Townhomes ProposalDocument17 pagesWood Road Townhomes ProposalWSET0% (1)

- KPMG Gems Jewellery ReportDocument124 pagesKPMG Gems Jewellery ReportHardeep NebhaniNo ratings yet

- CODESDocument207 pagesCODESHoa Nghê ThườngNo ratings yet

- Somany Tiles & CeramicsDocument15 pagesSomany Tiles & Ceramicssanjurkl4uNo ratings yet

- Book in VoiceDocument1 pageBook in VoiceSanjeet RaizadaNo ratings yet

- Anthony Robbins - Interviews Jay Abraham - How To Get Any Business Going and GrowingDocument24 pagesAnthony Robbins - Interviews Jay Abraham - How To Get Any Business Going and Growingapi-38044790% (1)

- Cuegis EssayDocument11 pagesCuegis EssayMaurya GhelaniNo ratings yet

- 14 Supply Chain IntegrationDocument35 pages14 Supply Chain Integrationmuath wardatNo ratings yet

- Somaliland: Private Sector-Led Growth and Transformation StrategyFrom EverandSomaliland: Private Sector-Led Growth and Transformation StrategyNo ratings yet

- Small Business ManagementDocument77 pagesSmall Business ManagementParamiedu Finance100% (1)

- Mang Inasal Term PaperDocument6 pagesMang Inasal Term PaperJennifer Dizon100% (1)

- Modern Small Business Institutional SupportDocument49 pagesModern Small Business Institutional SupportB03Kavya MNo ratings yet

- Lower Wage Rates - Labour Skills (Skilled) - Transport andDocument4 pagesLower Wage Rates - Labour Skills (Skilled) - Transport andZeenat MehboobNo ratings yet

- Competition Act-2002: DR Sanjay Bang Associate Professor LawDocument45 pagesCompetition Act-2002: DR Sanjay Bang Associate Professor LawNeha SardanaNo ratings yet

- Fdi in Retail Sector: BY: Ankit Chawla (1211310007)Document30 pagesFdi in Retail Sector: BY: Ankit Chawla (1211310007)ankit161019893980No ratings yet

- MSMEDocument36 pagesMSMEBHANUPRIYANo ratings yet

- Sme'S Past, Present & FutureDocument109 pagesSme'S Past, Present & Futureqwertyuiop_6421100% (2)

- Small and Medium Enterprises: BE - Mech - EDP SMSMPITR, AklujDocument36 pagesSmall and Medium Enterprises: BE - Mech - EDP SMSMPITR, AklujAjij MujawarNo ratings yet

- LIBERALISATION REFORMS IN INDIADocument8 pagesLIBERALISATION REFORMS IN INDIAmr IndiaNo ratings yet

- Lec 4 India BizDocument57 pagesLec 4 India BizJia MakhijaNo ratings yet

- BE Presentation FinalDocument20 pagesBE Presentation Finalmanoj_yadav_9No ratings yet

- Pros and Cons of FDI in Multi-Brand RetailDocument14 pagesPros and Cons of FDI in Multi-Brand RetailSushant MishraNo ratings yet

- Dr. Purvi Pujari: Liberalisation, Privatisation and GlobalisationDocument26 pagesDr. Purvi Pujari: Liberalisation, Privatisation and GlobalisationKalpita DhuriNo ratings yet

- What You Need To Know Before Doing Business in Myanmar PDFDocument30 pagesWhat You Need To Know Before Doing Business in Myanmar PDFmuhammad5rezi5rahmanNo ratings yet

- Pakistan's Market Access Initiative Challenges and OpportunitiesDocument37 pagesPakistan's Market Access Initiative Challenges and OpportunitieszakavisionNo ratings yet

- FDI R S: IN Etail EctorDocument30 pagesFDI R S: IN Etail EctorAsheesh MishraNo ratings yet

- "Comparison of Equity Traders WithDocument16 pages"Comparison of Equity Traders Withlalitarora1984No ratings yet

- Secretary Presentation at Bankers' Summer SchoolDocument17 pagesSecretary Presentation at Bankers' Summer SchoolRobert ChitsuroNo ratings yet

- Small Scale IndustriesDocument37 pagesSmall Scale IndustriesMRINAL KAUL100% (1)

- FDI PPT IBDocument11 pagesFDI PPT IBsonal jainNo ratings yet

- Entrepreneur & Economic DevelopmentDocument37 pagesEntrepreneur & Economic DevelopmentSupragyan RaiguruNo ratings yet

- Chapter 5 (BOM)Document19 pagesChapter 5 (BOM)Ritika GosainNo ratings yet

- External Influences On A Company GovernanceDocument22 pagesExternal Influences On A Company GovernanceAre EbaNo ratings yet

- Index: 1. Introdu Ction 2. An Ove Rview of Idbi Bank Idbi Ca Pital Se Rvices LTDDocument50 pagesIndex: 1. Introdu Ction 2. An Ove Rview of Idbi Bank Idbi Ca Pital Se Rvices LTDAnshul JainNo ratings yet

- Unit 7Document10 pagesUnit 7bubbles82No ratings yet

- IEPR Module-2Document64 pagesIEPR Module-2MadhurNo ratings yet

- Unit 2Document133 pagesUnit 2RahmathnishaNo ratings yet

- How Can We ExportDocument94 pagesHow Can We ExportUdit PradeepNo ratings yet

- India's Industrial Sector - Role of MSMEsDocument14 pagesIndia's Industrial Sector - Role of MSMEsBiswajit PrustyNo ratings yet

- FDI in Retail Industry: Group 6Document12 pagesFDI in Retail Industry: Group 6Akhilesh DalalNo ratings yet

- 2schemes Policies Part II PDFDocument62 pages2schemes Policies Part II PDFShashiSameerNo ratings yet

- Pestel AnalysisDocument48 pagesPestel AnalysistallatafshnNo ratings yet

- Lecture 21 - Competition Policy and Economic RegulationDocument17 pagesLecture 21 - Competition Policy and Economic RegulationRanjeet SinghNo ratings yet

- Economic Implications of Foreign Portfolio InvestmentsDocument16 pagesEconomic Implications of Foreign Portfolio Investmentssharukh lakhaniNo ratings yet

- Group 3 K Sree Manojna Sejal Malhotra Vishakha Rai Parul TusharDocument22 pagesGroup 3 K Sree Manojna Sejal Malhotra Vishakha Rai Parul TusharVishakha RaiNo ratings yet

- Micro, Small and Medium Enterprises in India: An OverviewDocument23 pagesMicro, Small and Medium Enterprises in India: An OverviewAdr HRNo ratings yet

- Fdi & Its Impact On Indian Economy: Akhil Mehta 11112001 Ankit Agarwal 11112002 Jasvinder Singh 11112016Document56 pagesFdi & Its Impact On Indian Economy: Akhil Mehta 11112001 Ankit Agarwal 11112002 Jasvinder Singh 11112016Abhishek guptaNo ratings yet

- Msme ActDocument20 pagesMsme Actsirisha_reddy2209No ratings yet

- Post Liberalization Reforms in IndiaDocument15 pagesPost Liberalization Reforms in IndialibrangodNo ratings yet

- 4A - Sumamry 2009 HIC English TexDocument11 pages4A - Sumamry 2009 HIC English Texbeat99No ratings yet

- Micro, Small and Medium Enterprises in India: An OverviewDocument23 pagesMicro, Small and Medium Enterprises in India: An OverviewBharti KumariNo ratings yet

- Role of FDI in India's EconomyDocument11 pagesRole of FDI in India's EconomyRohit SinghNo ratings yet

- Small Business Startup Guide: Key Rules, Regulations and Acts for Small Scale EnterprisesDocument59 pagesSmall Business Startup Guide: Key Rules, Regulations and Acts for Small Scale Enterprisesअक्षय फलफलेNo ratings yet

- ROLE OF INDUSTRYDocument38 pagesROLE OF INDUSTRYHetvi ShahNo ratings yet

- A278955818 - 14952 - 16 - 2019 - UNIT 3 LastDocument33 pagesA278955818 - 14952 - 16 - 2019 - UNIT 3 LastLuser AnomousNo ratings yet

- L2 Pestle AnalysisDocument44 pagesL2 Pestle AnalysisRajat ShettyNo ratings yet

- EOPDocument16 pagesEOPDrManiprakash AravelliNo ratings yet

- India Apparel Retail Research ReportDocument18 pagesIndia Apparel Retail Research ReportRohina SinghNo ratings yet

- FDI in Retail Sector of India: Current Scenario, Trends and Future OutlookDocument18 pagesFDI in Retail Sector of India: Current Scenario, Trends and Future Outlookqari saibNo ratings yet

- Small Scale Industry Madhu MamDocument16 pagesSmall Scale Industry Madhu MamAjay YadavNo ratings yet

- ZGM Nsic Ravi KumarDocument59 pagesZGM Nsic Ravi KumarVinay ChagantiNo ratings yet

- The OLI Paradigm June 13Document15 pagesThe OLI Paradigm June 13ChandanNo ratings yet

- Group No. 04: Presenter Name: Ruhul Amin ID: B150203107 Name: Maria Islam Sowad ID: B150203062Document16 pagesGroup No. 04: Presenter Name: Ruhul Amin ID: B150203107 Name: Maria Islam Sowad ID: B150203062Ruhul AminNo ratings yet

- Current Affairs: Upsc Cse 2021 NOV 2020: PART-3: Extra Notes On MsmeDocument10 pagesCurrent Affairs: Upsc Cse 2021 NOV 2020: PART-3: Extra Notes On MsmeStudentNo ratings yet

- Economic EnvironmentDocument41 pagesEconomic Environmentrochelle baclayNo ratings yet

- Bagedari SectorDocument32 pagesBagedari SectorswathiNo ratings yet

- Nairobi County Trade and Markets Policy plus the Trade, Markets and Infrastructure BillFrom EverandNairobi County Trade and Markets Policy plus the Trade, Markets and Infrastructure BillNo ratings yet

- Nairobi County Trade and Markets Policy plus the Trade, Markets and Infrastructure BillFrom EverandNairobi County Trade and Markets Policy plus the Trade, Markets and Infrastructure BillNo ratings yet

- Amul Icecream PresentationDocument19 pagesAmul Icecream Presentationrohit17,198675% (4)

- Brand PositioningDocument24 pagesBrand Positioningrohit17,198650% (2)

- Cancers in IndiaDocument5 pagesCancers in Indiarohit17,1986No ratings yet

- Financial Service MarketingDocument12 pagesFinancial Service Marketingrohit17,1986No ratings yet

- Tripathi SSIDocument26 pagesTripathi SSIrohit17,1986No ratings yet

- Dell Barriers To EntryDocument16 pagesDell Barriers To Entryapi-5769214100% (1)

- Marketing Resume Jasmeet SinghDocument2 pagesMarketing Resume Jasmeet SinghJasmeetsingh09No ratings yet

- Introducing Gain Detergent in ChinaDocument44 pagesIntroducing Gain Detergent in ChinawlonghiniNo ratings yet

- Value Proposition and USPDocument16 pagesValue Proposition and USPMoto FlashNo ratings yet

- Concord and Associates CaseDocument2 pagesConcord and Associates CaseAngad Singh0% (1)

- Consumer Behaviour - OriflameDocument6 pagesConsumer Behaviour - OriflameMubeen0% (1)

- Vendor-managed inventory software manages retailer relationshipsDocument5 pagesVendor-managed inventory software manages retailer relationshipsAjay Sharma0% (1)

- 50 Case DigestDocument1 page50 Case DigestShervilyn JaradilNo ratings yet

- #Guide - Are Sony Batteries Out of Production + VTC Date CodesDocument2 pages#Guide - Are Sony Batteries Out of Production + VTC Date CodesnenjaminzeNo ratings yet

- 2012 Cricket Players and Beards Revolution Product ConceptDocument3 pages2012 Cricket Players and Beards Revolution Product Conceptankush aroraNo ratings yet

- Tata Starbucks SWOT Analysis for Indian Market EntryDocument1 pageTata Starbucks SWOT Analysis for Indian Market EntryAnik ChakrabortyNo ratings yet

- Edi Wow ResearchDocument12 pagesEdi Wow ResearchElma BayaniNo ratings yet

- DaburDocument16 pagesDaburUma BhartiNo ratings yet

- Facts and Figures Airport MunichDocument13 pagesFacts and Figures Airport MunichBunescu TeodoraNo ratings yet

- Ca-Cpt: Chapter 1 - The Indian Contract Act, 1872Document5 pagesCa-Cpt: Chapter 1 - The Indian Contract Act, 1872Yamini SanthanakrishnanNo ratings yet

- 3i Final Part1Document35 pages3i Final Part1RS BuenavistaNo ratings yet

- 10 Key Functions of Marketing ChannelsDocument24 pages10 Key Functions of Marketing ChannelsStephen John Hernandez MendozaNo ratings yet

- Hyperlocal last mile delivery solution for groceries and fresh meatDocument11 pagesHyperlocal last mile delivery solution for groceries and fresh meatkhushi kumariNo ratings yet