Professional Documents

Culture Documents

Chap 021

Uploaded by

Bob Rob0 ratings0% found this document useful (0 votes)

93 views16 pagesChapter 21: Real Estate Investment Trusts (REITs) McGraw-Hill / Irwin. The last time Mortgage REITs were popular was in the 1970's. Mortgage REITs have come back into favor again.

Original Description:

Original Title

Chap021.ppt

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentChapter 21: Real Estate Investment Trusts (REITs) McGraw-Hill / Irwin. The last time Mortgage REITs were popular was in the 1970's. Mortgage REITs have come back into favor again.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

93 views16 pagesChap 021

Uploaded by

Bob RobChapter 21: Real Estate Investment Trusts (REITs) McGraw-Hill / Irwin. The last time Mortgage REITs were popular was in the 1970's. Mortgage REITs have come back into favor again.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 16

Chapter 21:

Real Estate Investment Trusts

(REITs)

McGraw-Hill/Irwin

Copyright 2011 by the McGraw-Hill Companies, Inc. All rights reserved.

Real Estate Investment Trusts

Creation of the Internal Revenue Code

Pass-through entity: No corporate taxes

Asset requirements

75% test

Income requirements

Distribution requirements

90% rule

21-2

Real Estate Investment Trusts

Ownership requirements

100 person minimum

Pre-1986: Management Activity Restriction

1986 Tax Reform Act relaxed the

restriction and led to vertically integrated

operating companies

1991 Kimco Realty Offering

Taubman Realty Offering

Umbrella Partnership REIT (UPREIT)

21-3

Real Estate Investment Trusts

Tax treatment

Accelerated depreciation

40-Year asset life

REIT dividends

Taxed as ordinary income

1999 Real Estate Modernization Act

Usual and customary provision of services.

This was especially beneficial to REITs that

owned hotels.

Taxable REIT subsidiaries

21-4

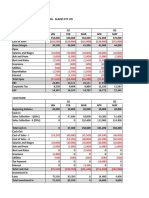

Exhibit 21-1

21-5

Real Estate Investment Trusts

Equity trusts

Specializations

Property type

Trust duration

Investment appeal

Diversified portfolio

Liquidity

21-6

Real Estate Investment Trusts

Equity trusts

Investment appeal

Mutual funds

Exchange traded funds

International REITs

Closed-end funds

21-7

Real Estate Investment Trusts

Equity trusts

Caveats

Purchase of original property not arms length

Conflicts of interest

Safeguards

Appraisals

Sarbanes-Oxley

21-8

Real Estate Investment Trusts

Private REITs

Targeted to institutional investors

Syndicated to investors

Incubator REITs

Mortgage REITs

Mortgage REITs have come back into favor

again. The last time Mortgage REITs were

popular was in the 1970s.

Hybrid REITs

21-9

Real Estate Investment Trusts

Funds from Operations (FFO)

REIT equivalent to earnings per share

Depreciation impact

Adjusted Funds from Operations (AFFO)

Funds Available for Distribution/Cash

Available for Distribution (FAD/CAD)

FAD/CAD is the amount of actual cash that is

left over.

21-10

Real Estate Investment Trusts

Expansion & Growth

Little Free Cash Flow

Income distribution rules

Secondary Stock Offering

Dilution vs. accretion

Debt Financing

21-11

Real Estate Investment Trusts

Growing income

Existing properties

Rental income

Redevelopment

Acquisitions

Purchase properties with cash at positive spreads.

Swap shares for property interests.

21-12

Real Estate Investment Trusts

Growing income

Development

Provision of services

Property management, brokerage, development,

etc.

Financial engineering

Improve financing terms and lower capital costs.

21-13

Real Estate Investment Trusts

Additional issues

Tenant improvements & free rent

Leasing commissions & costs

Straight-line rents

Income from managing other properties

Types of mortgage debt

Ground leases

21-14

Real Estate Investment Trusts

Additional issues

Lease renewal options

Occupancy numbers: occupied vs. leased

space

Retail REITs: Sales per square foot

Costs of being a public company

Sarbanes-Oxley

21-15

Real Estate Investment Trusts

Mortgage REITs

Does not own real property. Does own

mortgage paper.

21-16

You might also like

- Real Estate Investment Trusts (REITs)Document66 pagesReal Estate Investment Trusts (REITs)E Kay MutemiNo ratings yet

- Property Investment and FinanceDocument25 pagesProperty Investment and Finance10325680dNo ratings yet

- REITs (Public + Private)Document81 pagesREITs (Public + Private)Chris CarmenNo ratings yet

- 3bursa Lizan26May09pg61 90Document30 pages3bursa Lizan26May09pg61 90AbdullahNo ratings yet

- Presentation Materials on Hong Kong REITs regime_20210624Document13 pagesPresentation Materials on Hong Kong REITs regime_20210624blueocean8888No ratings yet

- ZSE Presentation On REITsDocument28 pagesZSE Presentation On REITsNelson MrewaNo ratings yet

- 10 The Down Re It StructureDocument13 pages10 The Down Re It StructureCorkn BottlesNo ratings yet

- RE Modeling Course Manual 5a538ee60299aDocument202 pagesRE Modeling Course Manual 5a538ee60299aMiguel RevillaNo ratings yet

- Buckwold11e Solutions Ch08Document63 pagesBuckwold11e Solutions Ch08Ravindra Joshi0% (1)

- Lect 1 Intro, Legal Background and Refresh Topics Lect 2 Main Frame N Biz Form (Sounds Not V Impt)Document7 pagesLect 1 Intro, Legal Background and Refresh Topics Lect 2 Main Frame N Biz Form (Sounds Not V Impt)jNo ratings yet

- Donell ByrdchenCTP 2023-24 Ch05Document92 pagesDonell ByrdchenCTP 2023-24 Ch05juliapaige2000No ratings yet

- ACCA P2 (International) : Course OverviewDocument121 pagesACCA P2 (International) : Course OverviewJoseNo ratings yet

- Buckwold 21e - CH 8 Selected SolutionsDocument19 pagesBuckwold 21e - CH 8 Selected SolutionsLucyNo ratings yet

- PowerPoint Presentation of Revenue Version of SMEs IFRSDocument42 pagesPowerPoint Presentation of Revenue Version of SMEs IFRSAdenrele SalakoNo ratings yet

- 2 Heads of ChargeDocument32 pages2 Heads of Chargexiu yingNo ratings yet

- Lect 1 Intro, Legal Background and Refresh Topics Lect 2 Main Frame N Biz Form (Sounds Not V Impt)Document5 pagesLect 1 Intro, Legal Background and Refresh Topics Lect 2 Main Frame N Biz Form (Sounds Not V Impt)jNo ratings yet

- Understanding Equity and Debt Financing for Real EstateDocument7 pagesUnderstanding Equity and Debt Financing for Real EstatejNo ratings yet

- KM Investment PropertyDocument4 pagesKM Investment Propertynikhilmandlecha6142No ratings yet

- Chap 010Document20 pagesChap 010Anonymous sZLcBAgNo ratings yet

- REITSDocument8 pagesREITSSaqib SoomroNo ratings yet

- CH 04Document16 pagesCH 04Faithlezz DdtankerNo ratings yet

- Fairtrading - Nsw.gov - Au-Levies and Capital Works Funds PDFDocument4 pagesFairtrading - Nsw.gov - Au-Levies and Capital Works Funds PDFKris VenkatNo ratings yet

- Topic 1.6 Section 23 Revenue: The Ifrs For SmesDocument42 pagesTopic 1.6 Section 23 Revenue: The Ifrs For SmesDuc BuiNo ratings yet

- Financial Accounting 2 SummaryDocument10 pagesFinancial Accounting 2 SummaryChoong Xin WeiNo ratings yet

- Cpa K Intermediate Financial ReportingDocument371 pagesCpa K Intermediate Financial ReportingHosea KanyangaNo ratings yet

- Real Estate Tax PlanningDocument4 pagesReal Estate Tax PlanningSuman SethNo ratings yet

- EY ITS Course Session 10 Capital GainsDocument36 pagesEY ITS Course Session 10 Capital Gainspj_chaudhary3796No ratings yet

- Real Estate Development - Accounting ChallengesCADocument35 pagesReal Estate Development - Accounting ChallengesCA891966100% (1)

- On Resiste A L Invasions Des Armees On Ne Resiste Pas A L Invasion Des Idees (Victor Hugo - 1852)Document28 pagesOn Resiste A L Invasions Des Armees On Ne Resiste Pas A L Invasion Des Idees (Victor Hugo - 1852)liewk86No ratings yet

- Leased Computer $150,690 Accumulated Depreciation ($25,115)Document13 pagesLeased Computer $150,690 Accumulated Depreciation ($25,115)nineteeneightyNo ratings yet

- FR NotesDocument371 pagesFR Notessharrie0004No ratings yet

- REITS FAQsDocument3 pagesREITS FAQsFaisalNo ratings yet

- Reporting Interview GuideDocument7 pagesReporting Interview Guideidrees bajjarNo ratings yet

- Fusion Real Estate Development Trust - Offering MemorandumDocument124 pagesFusion Real Estate Development Trust - Offering MemorandumAnonymous JQZgPm50% (2)

- ACTL5303Week6 2019 Property PE HedgeFundsDocument46 pagesACTL5303Week6 2019 Property PE HedgeFundsZara KhanNo ratings yet

- NBFC Regulations OverviewDocument60 pagesNBFC Regulations OverviewVikas AroraNo ratings yet

- Translation of Foreign Currency TransactionsDocument82 pagesTranslation of Foreign Currency TransactionsVijayabhaskarareddy VemireddyNo ratings yet

- AEC 118 - L1 - Investment Property FinalDocument35 pagesAEC 118 - L1 - Investment Property FinalRoi PeñalesNo ratings yet

- The Multinational Finance FunctionDocument24 pagesThe Multinational Finance FunctionNishant100% (1)

- Investment PropertyDocument28 pagesInvestment PropertydedYno1100% (1)

- Teaser Self Storage v4Document7 pagesTeaser Self Storage v4Martin MasloNo ratings yet

- REIT-Alternative To Real Estate Investment: Chris TanDocument28 pagesREIT-Alternative To Real Estate Investment: Chris TankmtengNo ratings yet

- Mergers, Lbos, Divestitures, and Holding CompaniesDocument47 pagesMergers, Lbos, Divestitures, and Holding Companiesike4546No ratings yet

- Non Banking Financial Companies (NBFCS) : Presentation by Saurabh Suman & Tarun RaiDocument59 pagesNon Banking Financial Companies (NBFCS) : Presentation by Saurabh Suman & Tarun RaiShresth KotishNo ratings yet

- Inctax1stquizsemis4 12Document4 pagesInctax1stquizsemis4 12Jerica CaballesNo ratings yet

- IBA EMBA Class - Security Market & MF - Aug 28 2023 - FinalDocument66 pagesIBA EMBA Class - Security Market & MF - Aug 28 2023 - FinalAbhinandanNo ratings yet

- Commercial Real Estate Investing 101Document4 pagesCommercial Real Estate Investing 101Madhurima Guha RoyNo ratings yet

- Understanding Financial Statements, Taxes, and Cash Flows: Chapter 2Document49 pagesUnderstanding Financial Statements, Taxes, and Cash Flows: Chapter 2Cherry BlasoomNo ratings yet

- Chapter 17 Mergers and AcquisitionsDocument52 pagesChapter 17 Mergers and AcquisitionsAd MobnewbieNo ratings yet

- Financial Asset at Fair ValueDocument38 pagesFinancial Asset at Fair ValueShiela Marie SolisNo ratings yet

- Capital Budgeting CashDocument95 pagesCapital Budgeting CashSetya BudiNo ratings yet

- Legal Regulatory AspectsDocument82 pagesLegal Regulatory AspectsManavAgarwalNo ratings yet

- The Spanish REIT Opportunity: Unlocking Value in Real EstateDocument11 pagesThe Spanish REIT Opportunity: Unlocking Value in Real EstateRamon FinnNo ratings yet

- CH 23Document81 pagesCH 23Fawaz KhaledNo ratings yet

- 16 Revenue Version2010 8 TransDocument42 pages16 Revenue Version2010 8 TransvictorNo ratings yet

- DT Combined CA INTERDocument203 pagesDT Combined CA INTERkarthick rajNo ratings yet

- Chapter 6 Capital Allowance A231Document55 pagesChapter 6 Capital Allowance A231Patricia TangNo ratings yet

- Capital Allowances Slides 2023Document50 pagesCapital Allowances Slides 2023molemothekaNo ratings yet

- Mastering REIT Investments - A Comprehensive Guide to Wealth Building: Real Estate Investing, #3From EverandMastering REIT Investments - A Comprehensive Guide to Wealth Building: Real Estate Investing, #3No ratings yet

- Chapter 4 BF TextDocument28 pagesChapter 4 BF TextBob RobNo ratings yet

- Chap 016Document20 pagesChap 016Bob RobNo ratings yet

- Chap 007Document19 pagesChap 007Bob RobNo ratings yet

- Wills, Trusts, and Estates: Week 3 Spring 2015Document38 pagesWills, Trusts, and Estates: Week 3 Spring 2015Bob RobNo ratings yet

- Chap 013Document19 pagesChap 013Bob RobNo ratings yet

- Spring 2015 - WTE - Week 5-6 - TrustsDocument52 pagesSpring 2015 - WTE - Week 5-6 - TrustsBob RobNo ratings yet

- Chap 010Document27 pagesChap 010Bob RobNo ratings yet

- Chap 012Document17 pagesChap 012Bob RobNo ratings yet

- Chap 011Document28 pagesChap 011Bob RobNo ratings yet

- Chap 009Document23 pagesChap 009Bob RobNo ratings yet

- Spring+2015+-+WTE+-+Week+1+ IntroDocument4 pagesSpring+2015+-+WTE+-+Week+1+ IntroBob RobNo ratings yet

- Chap 005Document29 pagesChap 005Bob RobNo ratings yet

- Spring+2015+-+WTE+-+Week+2+ Estate+Planning+Process+and+PropertyDocument51 pagesSpring+2015+-+WTE+-+Week+2+ Estate+Planning+Process+and+PropertyBob RobNo ratings yet

- Spring 2015 - WTE - Review Exam 1Document8 pagesSpring 2015 - WTE - Review Exam 1Bob RobNo ratings yet

- Spring+2015+-+WTE+-+Week+2+ Estate+Planning+Process+and+PropertyDocument51 pagesSpring+2015+-+WTE+-+Week+2+ Estate+Planning+Process+and+PropertyBob RobNo ratings yet

- Week 8Document1 pageWeek 8Bob RobNo ratings yet

- Spring+2015+-+WTE+-+Week+11+ GSTTDocument19 pagesSpring+2015+-+WTE+-+Week+11+ GSTTBob RobNo ratings yet

- Week 8Document1 pageWeek 8Bob RobNo ratings yet

- Wills, Trusts, and Estates: Week 3 Spring 2015Document38 pagesWills, Trusts, and Estates: Week 3 Spring 2015Bob RobNo ratings yet

- Nonforfeiture TableDocument1 pageNonforfeiture TableBob RobNo ratings yet

- Linear Programming: Model Formulation and Graphical SolutionDocument39 pagesLinear Programming: Model Formulation and Graphical SolutionBob RobNo ratings yet

- Insurance Ch.9cDocument31 pagesInsurance Ch.9cBob RobNo ratings yet

- Linear Programming: Model Formulation and Graphical SolutionDocument39 pagesLinear Programming: Model Formulation and Graphical SolutionBob RobNo ratings yet

- Insurance+Needs+-+Ch +9Document7 pagesInsurance+Needs+-+Ch +9Bob RobNo ratings yet

- Computer Solution and Sensitivity Analysis of Linear Programming ProblemsDocument38 pagesComputer Solution and Sensitivity Analysis of Linear Programming ProblemsBob RobNo ratings yet

- What Is Financial Planning?Document41 pagesWhat Is Financial Planning?Bob RobNo ratings yet

- Life Insurance 2. Annuities 3. Health Insurance & Hsas 4. Long-Term Care 5. DisabilityDocument44 pagesLife Insurance 2. Annuities 3. Health Insurance & Hsas 4. Long-Term Care 5. DisabilityBob RobNo ratings yet

- Management Science Models for Problem SolvingDocument17 pagesManagement Science Models for Problem SolvingBob RobNo ratings yet

- Computer Solution and Sensitivity Analysis of Linear Programming ProblemsDocument38 pagesComputer Solution and Sensitivity Analysis of Linear Programming ProblemsBob RobNo ratings yet

- Comparison of Equity Mutual FundsDocument29 pagesComparison of Equity Mutual Fundsabhishekbehal5012No ratings yet

- Prosper September 2020 Small Business SurveyDocument17 pagesProsper September 2020 Small Business SurveyStuff NewsroomNo ratings yet

- Partnership - I: Change in Profit Sharing RatioDocument33 pagesPartnership - I: Change in Profit Sharing RatioUjjwal BeriwalNo ratings yet

- A122 Exercises QDocument30 pagesA122 Exercises QBryan Jackson100% (1)

- ST 2 PDFDocument2 pagesST 2 PDFEbenezer SamedwinNo ratings yet

- Joint Venture Master AgreementDocument176 pagesJoint Venture Master AgreementHaYoung KimNo ratings yet

- Zillow 2Q22 Shareholders' LetterDocument17 pagesZillow 2Q22 Shareholders' LetterGeekWireNo ratings yet

- Esteriana Haskasa - General ResumeDocument3 pagesEsteriana Haskasa - General ResumeEster HaskaNo ratings yet

- Sinhgad Institute of Management - Research TopicsDocument17 pagesSinhgad Institute of Management - Research TopicsAnmol LimpaleNo ratings yet

- Taxmann - Budget Highlights 2022-2023Document42 pagesTaxmann - Budget Highlights 2022-2023Jinang JainNo ratings yet

- Module 5Document3 pagesModule 5RyuddaenNo ratings yet

- Financial AidDocument1 pageFinancial Aidshb100% (1)

- Step by Step Guide On Discounted Cash Flow Valuation Model - Fair Value AcademyDocument25 pagesStep by Step Guide On Discounted Cash Flow Valuation Model - Fair Value AcademyIkhlas SadiminNo ratings yet

- LTD Report Innocent Purchaser For ValueDocument3 pagesLTD Report Innocent Purchaser For ValuebcarNo ratings yet

- Internship Report (11504725) PDFDocument39 pagesInternship Report (11504725) PDFpreetiNo ratings yet

- Delhi Rent Control Act, 1958Document6 pagesDelhi Rent Control Act, 1958a-468951No ratings yet

- NMIMS MUMBAI NAVI MUMBAI Student Activity Sponsorship and Exp - POLICYDocument5 pagesNMIMS MUMBAI NAVI MUMBAI Student Activity Sponsorship and Exp - POLICYRushil ShahNo ratings yet

- Major Assignment #3Document17 pagesMajor Assignment #3Elijah GeniesseNo ratings yet

- Modifying Restrictive CovenantsDocument45 pagesModifying Restrictive CovenantsLonaBrochenNo ratings yet

- BASO Presentation PDFDocument25 pagesBASO Presentation PDFGEOEXPLOREMINPERU MINERÍA Y GEOLOGIANo ratings yet

- CMA Case Study Blades PTY LTDDocument6 pagesCMA Case Study Blades PTY LTDMuhamad ArdiansyahNo ratings yet

- Act 248 Innkeepers Act 1952Document10 pagesAct 248 Innkeepers Act 1952Adam Haida & CoNo ratings yet

- Engineering EconomyDocument23 pagesEngineering EconomyFaten Nabilla Nordin100% (1)

- E Stamp ArticleDocument2 pagesE Stamp ArticleShubh BanshalNo ratings yet

- Private Employers Are Required To Allow The Inspection of Its Premises Including Its Books and Other Pertinent Records" and Philhealth CircularDocument2 pagesPrivate Employers Are Required To Allow The Inspection of Its Premises Including Its Books and Other Pertinent Records" and Philhealth CircularApostol RogerNo ratings yet

- Ch.3 Size of BusinessDocument5 pagesCh.3 Size of BusinessRosina KaneNo ratings yet

- Ali Mousa and Sons ContractingDocument1 pageAli Mousa and Sons ContractingMohsin aliNo ratings yet

- Questionnaire ThesisDocument3 pagesQuestionnaire ThesisAnonymous 0kDzzBgr15No ratings yet

- Impact of The Tax System On The Financial Activity of Business EntitiesDocument6 pagesImpact of The Tax System On The Financial Activity of Business EntitiesOpen Access JournalNo ratings yet