Professional Documents

Culture Documents

Week 7 F06

Uploaded by

nadeemuzair0 ratings0% found this document useful (0 votes)

9 views15 pagesOriginal Title

Week_7_F06.ppt

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views15 pagesWeek 7 F06

Uploaded by

nadeemuzairCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 15

Module 5

Reporting and

Analyzing Operating

Assets

Inventory Issues

What is inventory?

What costs are included in inventory?

How do we separate COGS from End. Inv?

Inventory Cost Flows to

Financial Statements

Inventories

Inventory costs either are reported on the

balance sheet or they are transferred to

the income statement as an expense (cost

of goods sold) to match against sales

revenues.

The process for which costs are removed

from the balance sheet is important.

Capitalization Costs

Capitalization means that a cost is recorded

on the balance sheet and is not immediately

expensed on the income statement.

Once costs are capitalized, they remain on the

balance sheet as assets until they are used up,

at which time they are transferred from the

balance sheet to the income statement as

expense.

If costs are capitalized rather than expensed,

then assets, current income, and current equity

are all greater.

Cost of Goods Sold

When inventories are used up in

production or are sold, their cost is

transferred from the balance sheet to the

income statement as cost of goods sold

(COGS). COGS is then matched against

sales revenue to yield gross profit:

Sales revenue

- COGS

Gross profit

When Do You Transfer From

Inventory To COGS?

Every so often when you count the remaining

inventory.

Periodic

COGS = Beginning Inventory + Purchases

Ending Inventory

A Plug figure

At time of the sale

Perpetual

Effects of errors

Common source of manipulation

Often difficult for the auditor to catch

Affects two years

Example

Inventory Costing Methods

First-In. First-Out (FIFO). This method assumes

that the first units purchased are the first units

sold.

Last-In, First-Out (LIFO). The LIFO inventory

costing method assumes that the last units

purchased are the first to be sold.

Average cost. The average cost method assumes

that the units are sold without regard to the order

in which they are purchased. Instead, it computes

COGS and ending inventories as a simple

weighted average.

Specific identification. Uniquely identified items.

Inventory Costing Effects on

Cash Flows

One reason frequently cited for using LIFO is the

reduced tax liability in periods of rising prices.

The IRS requires, however, that companies using

LIFO for tax purposes also use it for financial

reporting. This is the LIFO conformity rule.

Companies using LIFO are also required to

disclose the amount at which inventories would

have been reported had it used FIFO. The

difference between these two amounts is called

the LIFO reserve.

LIFO vs FIFO

Compute gross profit, ending inventory, and

LIFO reserve for years 1 and 2

Year 1

Purchases

Sales

4@20

10

10

10

12

12

13

13

Year 2

Purchases

10

Sales

5@20

Impairment of Inventories

Companies are required to write down the carrying

amount of inventories on the balance sheet if, at the

statement date, the reported cost exceeds their market

value (determined as the current replacement cost).

This is called reporting inventories at the lower of

cost or market.

Inventory book value is written down to market value.

Inventory write-down is reflected as an expense (part

of cost of goods sold) on the income statement.

Inventory Turnover Rates for

Selected Companies

In Class Case

Joes TV

You might also like

- AudQuerry For IT AuditorsDocument13 pagesAudQuerry For IT AuditorsnadeemuzairNo ratings yet

- EDP Internal Control Questionnaire-FinalDocument3 pagesEDP Internal Control Questionnaire-FinalnadeemuzairNo ratings yet

- I7 - IT Service Request & Problem HandlingDocument1 pageI7 - IT Service Request & Problem HandlingnadeemuzairNo ratings yet

- IT Audit RDC Islamabad-2009Document55 pagesIT Audit RDC Islamabad-2009nadeemuzairNo ratings yet

- Risk Rating For IT Audit of BranchDocument12 pagesRisk Rating For IT Audit of BranchnadeemuzairNo ratings yet

- In Modern Banking EnvironmentDocument2 pagesIn Modern Banking EnvironmentnadeemuzairNo ratings yet

- I3 - IT Operational Change ManagementDocument1 pageI3 - IT Operational Change ManagementnadeemuzairNo ratings yet

- ForceDocument24 pagesForcenadeemuzairNo ratings yet

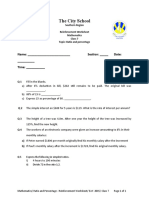

- The City School: Name: - SecDocument2 pagesThe City School: Name: - SecnadeemuzairNo ratings yet

- Stability and Financial Performance of IDocument64 pagesStability and Financial Performance of InadeemuzairNo ratings yet

- HandwritingresoucesDocument50 pagesHandwritingresoucesnadeemuzairNo ratings yet

- Class 7 Reinforcement Worksheet Ratio and PercentageDocument1 pageClass 7 Reinforcement Worksheet Ratio and PercentagenadeemuzairNo ratings yet

- Algebra 1 Reinforcement WorksheetDocument2 pagesAlgebra 1 Reinforcement WorksheetnadeemuzairNo ratings yet

- Chapter 12Document8 pagesChapter 12nadeemuzairNo ratings yet

- The City School: North Nazimabad Girls Campus Ratio and Rate Revision Worksheet (Mathematics Class - 7)Document2 pagesThe City School: North Nazimabad Girls Campus Ratio and Rate Revision Worksheet (Mathematics Class - 7)nadeemuzairNo ratings yet

- Class 6 9 Reinforcement Worksheet Algebra 3Document2 pagesClass 6 9 Reinforcement Worksheet Algebra 3nadeemuzairNo ratings yet

- Class 7 Reinforcement Worksheet Algebra 2Document3 pagesClass 7 Reinforcement Worksheet Algebra 2nadeemuzairNo ratings yet

- Class 7 Extended Worksheet of Ratio and RateDocument2 pagesClass 7 Extended Worksheet of Ratio and RatenadeemuzairNo ratings yet

- Web ResourcesDocument1 pageWeb ResourcesnadeemuzairNo ratings yet

- The City School: Abc BadDocument3 pagesThe City School: Abc BadnadeemuzairNo ratings yet

- Class 6 8 Reinforcement Worksheet Algebra 2Document4 pagesClass 6 8 Reinforcement Worksheet Algebra 2nadeemuzairNo ratings yet

- Film ReviewDocument1 pageFilm ReviewnadeemuzairNo ratings yet

- Class 7 Reinforcement Worksheet Ratio and PercentageDocument1 pageClass 7 Reinforcement Worksheet Ratio and PercentagenadeemuzairNo ratings yet

- Class 6 7 Reinforcement Worksheet Algebra 1Document2 pagesClass 6 7 Reinforcement Worksheet Algebra 1nadeemuzairNo ratings yet

- Algebra 1 Reinforcement WorksheetDocument2 pagesAlgebra 1 Reinforcement WorksheetnadeemuzairNo ratings yet

- Class 7 Reinforcement Worksheet Algebra 2Document3 pagesClass 7 Reinforcement Worksheet Algebra 2nadeemuzairNo ratings yet

- Sea Breeze - Causes, Diagram and Effects - JotscrollDocument5 pagesSea Breeze - Causes, Diagram and Effects - JotscrollnadeemuzairNo ratings yet

- Lecture 3: Requirements Quality: Requirements Management and Systems Engineering (ITKS451), Autumn 2008Document31 pagesLecture 3: Requirements Quality: Requirements Management and Systems Engineering (ITKS451), Autumn 2008nadeemuzairNo ratings yet

- Topic - Ratio Rate and SpeedDocument4 pagesTopic - Ratio Rate and SpeednadeemuzairNo ratings yet

- Lecture 3: Requirements Quality: Requirements Management and Systems Engineering (ITKS451), Autumn 2008Document31 pagesLecture 3: Requirements Quality: Requirements Management and Systems Engineering (ITKS451), Autumn 2008nadeemuzairNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ch7 Variable Absoorption Extra ExcersisesDocument7 pagesCh7 Variable Absoorption Extra ExcersisesSarah Al MuallaNo ratings yet

- Philippine Review Institute for Accountancy (PRIA) Cost Accounting NotesDocument7 pagesPhilippine Review Institute for Accountancy (PRIA) Cost Accounting NotesPau SantosNo ratings yet

- Case Analysis: Tenalpina Tools The Entrepreneurs DilemmaDocument5 pagesCase Analysis: Tenalpina Tools The Entrepreneurs DilemmaGodz gAMERNo ratings yet

- A Simple Guide To Registering A Corporation in The PhilippinesDocument5 pagesA Simple Guide To Registering A Corporation in The PhilippinesAike SadjailNo ratings yet

- Income Taxation by NickAduana (Answer Key)Document113 pagesIncome Taxation by NickAduana (Answer Key)Samantha Andrea Grefaldia100% (2)

- Low Income HousingDocument19 pagesLow Income HousingAnonymous XUFoDm6dNo ratings yet

- SUBSTITUTION and INCOME EFFECTDocument8 pagesSUBSTITUTION and INCOME EFFECTJada CallisteNo ratings yet

- Inventories and Cost of Sales What Is Inventory?: Financial Accounting For BusinessDocument19 pagesInventories and Cost of Sales What Is Inventory?: Financial Accounting For BusinessĐàm Quang Thanh TúNo ratings yet

- Thambivilas Business Proposal PDFDocument94 pagesThambivilas Business Proposal PDFkangayanNo ratings yet

- Effects of Public Expenditure On Economy Production DistributionDocument6 pagesEffects of Public Expenditure On Economy Production DistributionNøthîñgLîfèNo ratings yet

- Productivity Analysis of Steel Industry in IndiaDocument9 pagesProductivity Analysis of Steel Industry in IndiaDr-Abhijit SinhaNo ratings yet

- Turbo Widget Case SolutionDocument2 pagesTurbo Widget Case Solutionshivam chughNo ratings yet

- Discounted Cash FlowDocument5 pagesDiscounted Cash FlowEKANGNo ratings yet

- Chapter Two Company and Marketing StrategyDocument10 pagesChapter Two Company and Marketing StrategyMatt MNo ratings yet

- BDD Product CostingDocument5 pagesBDD Product CostingPramod ShettyNo ratings yet

- Paper 15 New PDFDocument364 pagesPaper 15 New PDFAnwesha SinghNo ratings yet

- RJR Nabisco Case ValuationDocument2 pagesRJR Nabisco Case ValuationJorge SmithNo ratings yet

- Difference Between IPO and Secondary OfferingDocument2 pagesDifference Between IPO and Secondary OfferingUsman Khan100% (1)

- 101 HWK 5 KeyDocument2 pages101 HWK 5 KeyEldana BukumbayevaNo ratings yet

- Module 1 of CA Inter GR-1Document362 pagesModule 1 of CA Inter GR-1shivam raiNo ratings yet

- Reasons Behind The Fall of Keya GroupDocument4 pagesReasons Behind The Fall of Keya Grouptanjinrahmankhan038No ratings yet

- Southwest Airlines: Brand AuditDocument28 pagesSouthwest Airlines: Brand AuditosmadniNo ratings yet

- NAKED FOREX NOTES: KEY QUESTIONS FOR TRADING SUCCESSDocument11 pagesNAKED FOREX NOTES: KEY QUESTIONS FOR TRADING SUCCESSMaricar San PedroNo ratings yet

- Khadi & Village Industries Commission Project Profile For Gramodyog Rozgar Yojana PlumbingDocument2 pagesKhadi & Village Industries Commission Project Profile For Gramodyog Rozgar Yojana PlumbingMohammed Mohsin YedavalliNo ratings yet

- Statistics For Economics Class 11 Notes Chapter 8 Index Numbers - Learn CBSEDocument10 pagesStatistics For Economics Class 11 Notes Chapter 8 Index Numbers - Learn CBSEKanan TiwariNo ratings yet

- Financial Statement Analysis of Target and TescoDocument15 pagesFinancial Statement Analysis of Target and TesconormaltyNo ratings yet

- RATE CARD 2023 - CompressedDocument6 pagesRATE CARD 2023 - CompressedsatriaNo ratings yet

- HDFC Recruitment of Financial Consultant of HDFC Standard Charterd Life InsuranceDocument98 pagesHDFC Recruitment of Financial Consultant of HDFC Standard Charterd Life InsuranceRajni MadanNo ratings yet

- IMP For Purchase OrderDocument8 pagesIMP For Purchase OrderPalashNo ratings yet

- Macrobook EnglishDocument236 pagesMacrobook EnglishJohann LambsdorffNo ratings yet