Professional Documents

Culture Documents

Advanced Capital Structure

Uploaded by

musicshiva0 ratings0% found this document useful (0 votes)

70 views12 pagesAdvanced Capital Structure

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAdvanced Capital Structure

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

70 views12 pagesAdvanced Capital Structure

Uploaded by

musicshivaAdvanced Capital Structure

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 12

Capital structure

Capital structure decision stands for how to finance investments

The goal of capital structure decision is to maximize company

value by minimizing cost of capital (WACC)

Cost of capital is the cost to raise additional capital. So It is

marginal rate. It is the current rate (not the rate used to raise

capital in the past)

Modiglani & Miller

proposition

Assumptions

Expectations are homogenous: Investors have same expectations

regarding cash flows from investments in stocks or bonds

Bonds and shares of stock are traded in perfect capital markets

Perfect capital markets are characterized by the absence of

transaction costs, taxes, bankruptcy costs

Any two investments with identical cash flows and risk trade for

the same price in perfect capital markets

Investors can borrow and lend at the risk free rate

Managers always act to maximize shareholder wealth

MM Proposition 1 (Without taxes)

Market value of a company is not affected by the capital

structure of the company

The importance of Modiglani & Miller proposition is It shows that

increase in the value of company can not happen by changing the

capital structure

VL(Value of levered company) = VU (Value of unlevered company)

This happens as capital structure decision has no impact on cash

flows of the company and cost of capital of the company

MM Proposition 2 (Without taxes)

The cost of equity is a linear function of the companys

debt/equity ratio

Debt is a cheaper source of capital

Proposition 1 says that changes in capital structure have no

impact on cost of capital

Cost of equity increases when the use of debt in the total capital

increases so as to keep the cost of capital same

This happens as the risk of equity depends on financial leverage

also

Increased use of debt results in an increase in cost of equity

MM Proposition 1 (with taxes)

Interest paid is deductible from income for tax purposes

This translates into tax savings which has a value enhancing effect

on the company

MM Proposition 1 (with taxes) states that the value of a levered

company is higher than value of an unlevered company by an

amount equal to the tax rate multiplied by debt

MM Proposition 2( with taxes) states that cost of equity increases

with the increase in use of debt but the rise is less than in no-tax

environment

Modiglani & Miller proposition 1 & 2

Without taxes

With taxes

Proposition 1

VL=VU

VL=VU+tD

Proposition 2

Re=r0+(r0-rd)D/E

r0+(r0-rd)(1-t)D/E

Other arguments

Miller argued that if investors face higher tax on income from debt

instruments compared to dividends they may demand higher

return on debt. This will increase the cost of debt

In Miller model depending on tax rates adding debt may not have

any impact on value, increase the value, or decrease the value of

a company

However tax is not the only factor which has an impact on levered

company

Other factors like cost of financial distress, agency costs, and

asymmetric information also play a major role in the

determination of value of levered company

Costs of financial distress

Financial leverage has a negative effect during economic

downturns. It may lead to financial distress

Expected costs of financial distress can be classified into 1) direct

costs, and 2)indirect costs

Direct costs are the costs associated with bankruptcy process

Indirect costs include lost investment opportunities, and inability

to conduct business

Probability of bankruptcy has a linear relation with leverage

Agency costs

Agency costs arise as most of the companies are managed by nonowners

Agency costs have three components 1)Monitoring costs 2)Bonding

costs 3)Residual loss

Monitoring costs are the costs to monitor the management of the

company. Board of directors expense, and board meeting expense

come under this category

Bonding costs are borne by management to give the assurance to

the owners that they are working in the best interests of owners

Residual loss is the cost that is incurred in spite of monitoring and

bonding

Agency theory predicts that agency costs will come down with the

use of debt

Jensens free cash flow hypothesis states that higher debt levels

will instil discipline among agents as the company has to make

interest and principle payments

Costs of asymmetric information

Asymmetric information stands for unequal distribution of

information

Managers have more information about the company than

outsiders

Asymmetry in information is especially very high in high tech

industries

Providers of capital (both equity as well as debt) demand higher

rate of return from companies with high asymmetric information

Optimal capital structure static trade-off

theory

Modiglani & Miller theory proposes that any capital structure is

good

Static trade-off theory differs from MM theory as it proposes

optimal capital structure

Optimal capital structure is found at a point where any additional

debt would cause the costs (agency costs, financial distress costs,

asymmetric information costs) outweigh the benefits (tax benefits)

Optimal capital structure depends on companys business risk, tax

situation , corporate governance practices etc.....

Costs of both debt as well as equity increase as the proportion of

debt increases in capital. So WACC has U shape

You might also like

- Get Started with IDoc BasicsDocument26 pagesGet Started with IDoc Basicsmusicshiva100% (2)

- PDFDocument12 pagesPDFmusicshivaNo ratings yet

- PDFDocument12 pagesPDFmusicshivaNo ratings yet

- 1Document48 pages1musicshivaNo ratings yet

- Resume: M.B.A. Dual (H.R.D.) M.B.A. (Marketing) LL.B. H.S.EDocument2 pagesResume: M.B.A. Dual (H.R.D.) M.B.A. (Marketing) LL.B. H.S.Eanil_049No ratings yet

- Sap MM AccDeterminationountDocument10 pagesSap MM AccDeterminationountmusicshivaNo ratings yet

- Resume: M.B.A. Dual (H.R.D.) M.B.A. (Marketing) LL.B. H.S.EDocument2 pagesResume: M.B.A. Dual (H.R.D.) M.B.A. (Marketing) LL.B. H.S.Eanil_049No ratings yet

- Resume: M.B.A. Dual (H.R.D.) M.B.A. (Marketing) LL.B. H.S.EDocument2 pagesResume: M.B.A. Dual (H.R.D.) M.B.A. (Marketing) LL.B. H.S.Eanil_049No ratings yet

- 143sap Fico Free Study MaterialDocument9 pages143sap Fico Free Study Materialganesanmani1985No ratings yet

- Significance of Material Type SAP MMDocument1 pageSignificance of Material Type SAP MMmusicshivaNo ratings yet

- 16 Fields in MM Pricing ProcedureDocument5 pages16 Fields in MM Pricing Proceduremusicshiva50% (2)

- Matirial TypesDocument6 pagesMatirial TypesmusicshivaNo ratings yet

- Introduction SAP R/3 - MM: Dr. Djamal Ziani King Saud UniversityDocument65 pagesIntroduction SAP R/3 - MM: Dr. Djamal Ziani King Saud UniversitymusicshivaNo ratings yet

- Introduction SAP R/3 - MM: Dr. Djamal Ziani King Saud UniversityDocument65 pagesIntroduction SAP R/3 - MM: Dr. Djamal Ziani King Saud UniversitymusicshivaNo ratings yet

- Advanced Corporate Finance Policies and Strategies Download LinksDocument29 pagesAdvanced Corporate Finance Policies and Strategies Download Linksmusicshiva0% (1)

- 1.Dr. Moloy Ghoshal - Ms. Maninder BediDocument17 pages1.Dr. Moloy Ghoshal - Ms. Maninder Bedimusicshiva100% (1)

- Significance of Material Type SAP MMDocument1 pageSignificance of Material Type SAP MMmusicshivaNo ratings yet

- Excitation Systems: Click To Edit Master Subtitle StyleDocument4 pagesExcitation Systems: Click To Edit Master Subtitle StylemusicshivaNo ratings yet

- Advanced Corporate Finance Policies and Strategies Download LinksDocument29 pagesAdvanced Corporate Finance Policies and Strategies Download Linksmusicshiva0% (1)

- Paper On Private Lable BrandsDocument10 pagesPaper On Private Lable BrandsmusicshivaNo ratings yet

- 1111Document4 pages1111musicshivaNo ratings yet

- Paper On Private Lable BrandsDocument10 pagesPaper On Private Lable BrandsmusicshivaNo ratings yet

- Load Flow NotesDocument20 pagesLoad Flow NotesMike CerreroNo ratings yet

- Excitation Systems: Click To Edit Master Subtitle StyleDocument4 pagesExcitation Systems: Click To Edit Master Subtitle StylemusicshivaNo ratings yet

- Excitation Systems: Click To Edit Master Subtitle StyleDocument4 pagesExcitation Systems: Click To Edit Master Subtitle StylemusicshivaNo ratings yet

- Load Flow NotesDocument20 pagesLoad Flow NotesMike CerreroNo ratings yet

- Resignation Letter TemplateDocument1 pageResignation Letter TemplatemusicshivaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- MIS - Systems Planning - CompleteDocument89 pagesMIS - Systems Planning - CompleteDr Rushen SinghNo ratings yet

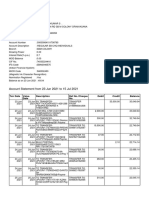

- Account Statement From 23 Jun 2021 To 15 Jul 2021Document8 pagesAccount Statement From 23 Jun 2021 To 15 Jul 2021R S enterpriseNo ratings yet

- Google SWOT 2013Document4 pagesGoogle SWOT 2013Galih Eka PutraNo ratings yet

- The Builder's Project Manager - Eli Jairus Madrid PDFDocument20 pagesThe Builder's Project Manager - Eli Jairus Madrid PDFJairus MadridNo ratings yet

- The History of ConverseDocument39 pagesThe History of Conversebungah hardiniNo ratings yet

- Core Banking PDFDocument255 pagesCore Banking PDFCông BằngNo ratings yet

- Expertise in trade finance sales and distributionDocument4 pagesExpertise in trade finance sales and distributionGabriella Njoto WidjajaNo ratings yet

- Allen Solly (Retail Managemant Project Phase 1) (Chandrakumar 1501009)Document9 pagesAllen Solly (Retail Managemant Project Phase 1) (Chandrakumar 1501009)Chandra KumarNo ratings yet

- Analyzing Transactions and Double Entry LectureDocument40 pagesAnalyzing Transactions and Double Entry LectureSuba ChaluNo ratings yet

- General Mcqs On Revenue CycleDocument6 pagesGeneral Mcqs On Revenue CycleMohsin Kamaal100% (1)

- EMPLOYEE PARTICIPATION: A STRATEGIC PROCESS FOR TURNAROUND - K. K. VermaDocument17 pagesEMPLOYEE PARTICIPATION: A STRATEGIC PROCESS FOR TURNAROUND - K. K. VermaRaktim PaulNo ratings yet

- Acca FeeDocument2 pagesAcca FeeKamlendran BaradidathanNo ratings yet

- Managing Human Resources at NWPGCLDocument2 pagesManaging Human Resources at NWPGCLMahadi HasanNo ratings yet

- AMUL Market AnalysisDocument59 pagesAMUL Market AnalysisHacking Master NeerajNo ratings yet

- Chapter 4 - Fire InsuranceDocument8 pagesChapter 4 - Fire InsuranceKhandoker Mahmudul HasanNo ratings yet

- 03-F05 Critical Task Analysis - DAMMAMDocument1 page03-F05 Critical Task Analysis - DAMMAMjawad khanNo ratings yet

- Delhi Bank 2Document56 pagesDelhi Bank 2doon devbhoomi realtorsNo ratings yet

- Manage Greenbelt Condo UnitDocument2 pagesManage Greenbelt Condo UnitHarlyne CasimiroNo ratings yet

- Notary CodeDocument36 pagesNotary CodeBonnieClark100% (2)

- Cyber Security Assignment - Patent BasicsDocument6 pagesCyber Security Assignment - Patent BasicsTatoo GargNo ratings yet

- Prince2 - Sample Paper 1Document16 pagesPrince2 - Sample Paper 1ikrudisNo ratings yet

- 1 MDL299356Document4 pages1 MDL299356Humayun NawazNo ratings yet

- SHELF CORP SECRETS 3 FLIPPING CORPORATIONSDocument24 pagesSHELF CORP SECRETS 3 FLIPPING CORPORATIONSRamon RogersNo ratings yet

- Gestion de La Calidad HoqDocument8 pagesGestion de La Calidad HoqLuisa AngelNo ratings yet

- Bangalore University SullabusDocument35 pagesBangalore University SullabusJayaJayashNo ratings yet

- Software PatentsDocument13 pagesSoftware PatentsIvan Singh KhosaNo ratings yet

- How industrial engineering can optimize mining operationsDocument6 pagesHow industrial engineering can optimize mining operationsAlejandro SanchezNo ratings yet

- 1 Deed of Absolute Sale Saldua - ComvalDocument3 pages1 Deed of Absolute Sale Saldua - ComvalAgsa ForceNo ratings yet

- Paper 5 PDFDocument529 pagesPaper 5 PDFTeddy BearNo ratings yet

- GA3-240202501-AA2. Presentar Funciones de Su OcupaciónDocument2 pagesGA3-240202501-AA2. Presentar Funciones de Su OcupaciónDidier Andres Núñez OrdóñezNo ratings yet