Professional Documents

Culture Documents

1332348993taxability of House Property

Uploaded by

Aniket Gupta0 ratings0% found this document useful (0 votes)

15 views77 pagestaxation

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenttaxation

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views77 pages1332348993taxability of House Property

Uploaded by

Aniket Guptataxation

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 77

Welcome to presentation on Taxability of

House Property

Prepared by: CA. V.K. SAINI

(9999772095) 1

Taxability of House Property

Income Tax Act,1961 Wealth Tax Act,1957

Prepared by: CA. V.K. SAINI

(9999772095) 2

Income Tax Act,1961

Income From House Property Income from the head Capital Gain

Prepared by: CA. V.K. SAINI

(9999772095) 3

Income from House Property

Prepared by: CA. V.K. SAINI

(9999772095) 4

What consist of House Property?

Property must be consist of any building

or land appurtenant thereto.

Prepared by: CA. V.K. SAINI

(9999772095) 5

Conditions for Taxability

Property must be in the ownership of the

Assessee

Property should not be use in the

business of Assessee

Prepared by: CA. V.K. SAINI

(9999772095) 6

Is location of property relevant?

No, it does not matter that Property is situated

in India or outside India.

In both of the cases Property shall be taxable in

the head of Income from House Property.

Prepared by: CA. V.K. SAINI

(9999772095) 7

Deemed Owner

Transfer to spouse or

to a minor child who

is not a married

daughter

Holder of impartible

estate

Member of co-

operative society

Prepared by: CA. V.K. SAINI

(9999772095) 8

Deemed Owner

Person in possession of property.

(Sec 53A)

In case of HUF which have not been

partitioned to members, the Karta of

HUF

Person having right in a property for

a period not less than 12 years.

Prepared by: CA. V.K. SAINI

(9999772095) 9

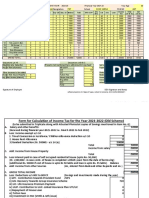

Computation of Taxable Income from

House Property

Gross Annual Value xxxxx

Less: Municipal Tax xxxxx

Net Annual Value xxxxx

Less: Deduction u/s 24

(i) S.D. of 30% of Annual Value xxxxx

(ii) Interest on Loan xxxxx

Taxable Income from H.P. xxxxx

Prepared by: CA. V.K. SAINI

(9999772095) 10

What is Gross Annual Value?

Sec 23(1)(a)

Sum for which Property might reasonably

be expected to be let from year to year.

It is something like notional rent which

could have been derived, had the property

been let.

Prepared by: CA. V.K. SAINI

(9999772095) 11

Calculation of Annual Value

Where Rent Control Act apply. Where Rent Control Act does not apply

Prepared by: CA. V.K. SAINI

(9999772095) 12

Types of House Property

Let out House Propertys Self occupied House Property Partly let out House Property

Prepared by: CA. V.K. SAINI

(9999772095) 13

Let out House Property

Where Rent Control Act Where Rent Control Act

Apply does not apply

Step-A Step-A

Higher of the Fair Value and Higher of the Fair Value and

Municipal Value Municipal Value

In any case above amount

can not exceed the

Standard Rent

Step-B Step-B

Higher of the actual rent

received or receivable and Higher of the actual rent

Annual value calculated in received or receivable and

step-A Annual value calculated in

step-A

Prepared by: CA. V.K. SAINI

(9999772095) 14

Self occupied House Property

If assessee have a single If assessee have more

house then Annual than one house then

value of such house valuation of one of

shall be NIL them shall be at NIL

and valuation of other

houses shall be as they

are let out.

Prepared by: CA. V.K. SAINI

(9999772095) 15

Partly let out House Property

Valuation of self occupied portion shall be

at NIL.

Valuation of let out portion as fully let out

But if assessee let out the property for

some period in the year and occupied for

the remaining period then there is no

deduction for the occupied period.

Prepared by: CA. V.K. SAINI

(9999772095) 16

Rules for the unrealized rent

If owner of Property cannot Tenancy is bona fide

realize the rent from the Tenant has vacated, or steps

tenant then such rent have been taken to compel

received rent shall be him

deemed the GAV. Tenant is not occupation of

But after fulfilling some any other property of the

conditions. assessee

All reasonable steps have

been taken to institute legal

proceedings for the

recovery of the unpaid rent

Prepared by: CA. V.K. SAINI

(9999772095) 17

Subsequent recovery of unrealized rent

Such recovery shall be taxable in the

previous year of receipt of unrealized rent

irrespective of the ownership if:

a deduction has been claimed and allowed

in respect of such unrealized rent

and no deduction u/s 24 shall be given on

this recovery

Prepared by: CA. V.K. SAINI

(9999772095) 18

Special provisions for arrears of rent

received

Where the assessee is the owner of House

Property

and received arrears of rent from such property,

not charged to income tax in any previous year

then such amount, after deducting 30% of such

amount, shall be deemed to be income from House

Property

irrespective of the ownership of the House

Property

Prepared by: CA. V.K. SAINI

(9999772095) 19

Deductions from Net Annual Value

Deduction u/s24

Standard Deduction u/s24(i) Interest on Loan u/s24(ii)

Prepared by: CA. V.K. SAINI

(9999772095) 20

Standard deduction u/s 24(i)

In case of let out In case of self

House Property occupied House

Property

30% of the NAV There will no deduction

This deduction is as NAV is NIL

notional deduction

irrespective of actual

expenditure for

realization of rent

Prepared by: CA. V.K. SAINI

(9999772095) 21

Deduction of interest on loan

In case of let out In case of self

House Property occupied House

Property

All the interest paid or Deduction is limited to

due Rs.30,000/- for each co-

owner separately

Prepared by: CA. V.K. SAINI

(9999772095) 22

Maximum Deduction of interest

In case of self occupied House Property

Maximum amount of deduction of

interest is Rs. 1,50,000/- if the following

conditions are satisfied:

1. Loan is taken on or after 01.04.1999

2. House Property was

acquired/constructed within three years

from the end of Financial Year in which

loan was taken

Prepared by: CA. V.K. SAINI

(9999772095) 23

Interest attributable to prior

construction/acquisition period

Interest from the date of borrowing

Till the end of the previous year prior to

the previous year in which the house is

completed

Interest of the previous year in which

construction was completed will be

deducted as normal interest

Prepared by: CA. V.K. SAINI

(9999772095) 24

Interest on loan taken for repayment of

loan

Such interest shall be allowed as

deduction

But interest on interest shall not be

allowed

Prepared by: CA. V.K. SAINI

(9999772095) 25

Income from the head Capital Gain

Prepared by: CA. V.K. SAINI

(9999772095) 26

Capital Asset

House Property is a Capital Asset if it is

Owned by the assessee

If holding period of house property is

more than 36 months then it is Long

Term Capital Asset otherwise Short Term

Capital Asset

Prepared by: CA. V.K. SAINI

(9999772095) 27

Chargeability of capital gain

On the transfer of Capital asset in the

previous year being house property

owned by the assessee

If the sale consideration is more than the

acquisition value of the house property

Prepared by: CA. V.K. SAINI

(9999772095) 28

What is transfer?

Transfer includes-

Sale, exchange or relinquishment

The extinguishment of any right in the

asset

Compulsory acquisition thereof under

any law

Conversion into stock in trade

Prepared by: CA. V.K. SAINI

(9999772095) 29

Computation of Capital Gain

Sale proceeds

xxxxx

Less: transfer expenses

xxxxx

Less: indexed cost of acquisition

xxxxx

Less: indexed cost of improvement

xxxxx

Capital Gain/Loss

xxxxx

Prepared by: CA. V.K. SAINI

(9999772095) 30

Special provision for full value of

Consideration Sec. 50 C

Where consideration received as a result of the

Transfer of a land or building or both,

-is less than the value adopted by stamp

valuation authority of State Government

-for the purpose of payment of stamp duty

-then such value adopted shall be deemed to be

full value of the consideration received.

Prepared by: CA. V.K. SAINI

(9999772095) 31

Special provision for full value of

Consideration Sec. 50 C

Assessee may claim before any Assessing Officer that

such value adopted exceeds the fair market value of the

property on the date of transfer.

The Assessing Officer may refer the valuation of

property to valuation officer

and if such value is less than value adopted by the A.O.

then

such value shall be taken for the computation of Capital

Gain

Prepared by: CA. V.K. SAINI

(9999772095) 32

Exemption from capital gain

Section 54 Section 54F

Prepared by: CA. V.K. SAINI

(9999772095) 33

Section 54

Exemption of capital gain on transfer of

residential house property

Conditions for avail exemption-

1. Owner must be an individual or HUF

2. There should be transfer of a House

Property which is Long Term Capital Asset

3. Income from such house should be taxable

in the head Income from house property

Prepared by: CA. V.K. SAINI

(9999772095) 34

Section 54

4. Assessee has purchase another residential

House Property one year before or two

years

after the date on which transfer took place

5. Or has within three years after that date

constructed

Prepared by: CA. V.K. SAINI

(9999772095) 35

What will be the amount of exemption?

Exemption will be provide to the

maximum

amount invested into another house

property

Prepared by: CA. V.K. SAINI

(9999772095) 36

If assessee fails to invest the amount

If assessee fails to invest the amount of capital

gain into another residential house property

before the due date of filling the return of

income

Then he may deposit the amount into Capital

Gain account scheme 1988

The amount deposited shall be deemed to be

cost of another house property

Prepared by: CA. V.K. SAINI

(9999772095) 37

Withdrawal of exemption

Exemption granted on the capital gain shall be

withdrawn if-

the new house property purchased/constructed

is transferred within three years of

purchase/construction

Amount deposited in the capital gain scheme

1988 is not utilized for purchase/construction in

the stipulated time period

Prepared by: CA. V.K. SAINI

(9999772095) 38

Can amount deposited be used for any

purpose

No, the amount deposited cant be used

other than for purchase/construction of

house property

If amount is used for any other purpose

then such amount shall be treated Short

Term Capital Gain for that previous year

and liable to tax

Prepared by: CA. V.K. SAINI

(9999772095) 39

Section 54F

Exemption of capital gain on transfer of

capital asset other than house property

If an assess transfer a Long Term Capital

asset other than house property

and purchase house property then he can

avail exemption of this section

Prepared by: CA. V.K. SAINI

(9999772095) 40

Conditions for availing exemption

Assessee must be an individual or HUF

Transferred capital asset is not a

residential house property

Capital asset is a Long Term Capital Asset

On the date of transfer assessee has not

more than one house

Assessee has purchase another House

Property one year before or two years

after the date on which transfer took

place

Prepared by: CA. V.K. SAINI

(9999772095) 41

Amount of exemption

Exemption from Capital Gain shall be avail

in the proportion of amount of sale

consideration invested in the new House

Property

In other words amount of exemption

shall be

Capital gain* amount invested

sale consideration

Prepared by: CA. V.K. SAINI

(9999772095) 42

Other conditions are same

All other conditions of section 54 are

applied to this section as they applied in

section 54

Prepared by: CA. V.K. SAINI

(9999772095) 43

Some cases related to House Property

1. Incase of sale of land and building, capital gain

is bifurcated between long term capital gain

and short term capital gain

2. Construction of new floor in the same

building shall be entitled to exemption under

section 54

3. Release of share by one co-owner in the favor

of another co-owner shall be deemed

purchase by another co-owner

4. Amount of capital gain partly invested in

purchase of new house property and partly

amount used in construction of new floor is

allowed

Prepared by: CA. V.K. SAINI

(9999772095) 44

Wealth Tax Act,1957

Prepared by: CA. V.K. SAINI

(9999772095) 45

Charge of Wealth Tax (Sec.3)

Wealth Tax shall be charged on the net

wealth on the corresponding valuation

date

of every Individual, HUF and company

at the rate of 1% of the amount by which

net wealth exceeds Rs.15 lakhs

Prepared by: CA. V.K. SAINI

(9999772095) 46

What is Asset?

Section 2(ea)(i)

Asset means-

Any building or land appurtenant thereto,

whether used for

- residential purpose or

- commercial purpose (if it is vacant or let out)

or

- for the purpose of maintaining of guest house

Prepared by: CA. V.K. SAINI

(9999772095) 47

Not to be included

A House meant exclusive for residential

purpose

A house which is allotted by a company

to an employee or officer or whole time

director, having a gross salary of less than

Rs.5 lakhs

Any house for residential or commercial

purpose which form part of stock in

trade

Prepared by: CA. V.K. SAINI

(9999772095) 48

Not to be included

Any house used for the purpose of any

business or profession carried on by him

Any residential property that has been let

out for a minimum period of 300 days in

the previous years

Any property in the nature of commercial

establishment or complexes

Prepared by: CA. V.K. SAINI

(9999772095) 49

Taxability of farm house

Farm house shall be included in Asset if it

is

situated within 25 km from the local limit

of

any municipality or a cantonment board

Prepared by: CA. V.K. SAINI

(9999772095) 50

Computation of Net Wealth

Aggregate value of all assets wherever located

belonging to the assessee

Aggregate value of all asset required to be

included in the net wealth of the assessee

Less: Exemption u/s 5 of Wealth Tax Act

Less: Debts owed by the assessee on the

valuation date relating to asset included in his

wealth

Prepared by: CA. V.K. SAINI

(9999772095) 51

Exemption u/s 5 of Wealth Tax Act

Wealth Tax shall not be payable on the

following:

1. Any property held under trust or other

legal obligation for any public purpose of

a charitable or religious nature in India

[sec.5(i)]

2. The interest of the assessee in the

co-parcenary property of any HUF

[sec.5(ii)]

Prepared by: CA. V.K. SAINI

(9999772095) 52

Exemption u/s 5 of Wealth Tax Act

3. Any building in occupation of Ruler

being a building which was decleared as

his official residence by the Central Govt.

under Merged State Order [sec.5(iii)]

4. One house (whether residential or

commercial or whether let out or self

occupied) or part of a house or a plot of

land of 500 sq. metres or less [sec.5(vi)]

Prepared by: CA. V.K. SAINI

(9999772095) 53

Determination of value of Immovable

Property

Valuation of Property as per

Rules 3, 4 and 5 of Part B of

Schedule III

xxxxx

Add: Adjustment for unbuilt Area

As per Rule 6

xxxxx

Less: Adjustment for unearned

increase in the value of land

xxxxx

Prepared by: CA. V.K. SAINI

(9999772095) 54

Valuation of Property

Valuation of property shall be done as per

rules 3,4 and 5 of part B of schedule III

which is divided in 5 steps

Prepared by: CA. V.K. SAINI

(9999772095) 55

Step-1 Determination of actual rent

Actual rent received or receivable

Add:

1. Taxes in respect of the property agreed to be

borne by the tenant

2. 1/9th of actual rent received or receivable

where the repairs are to be borne by the

tenant

3. 15% interest on the deposit received reduced

by interest actually paid by the tenant (only if

such deposit is for more than three months)

Prepared by: CA. V.K. SAINI

(9999772095) 56

Step-1 Determination of actual rent

4. Non refundable deposit spread equally

over the period of the lease

5. Value of any perquisite or benefit

received by the assessee for leasing out

the property

6. Any obligation of the owner met by the

tenant

Prepared by: CA. V.K. SAINI

(9999772095) 57

Step-2 Determination of annual rent

Where property is let Where property is let

out for the entire year for part of the year

Actual Rent Actual rent*12

No. of month for which

property was let out

Prepared by: CA. V.K. SAINI

(9999772095) 58

Step-3 Determination of Gross Maintainable

Rent

Where property is not let out

Annual value as assessed by the Local Auth. Otherwise Fair Market Rent

Prepared by: CA. V.K. SAINI

(9999772095) 59

Step-3 Determination of Gross Maintainable

Rent

Where property is let out then higher of

Annual Rent Annual Value as assessed by Local Auth.

Prepared by: CA. V.K. SAINI

(9999772095) 60

Step-4 Determination of Net Maintainable

Rent

Gross Maintainable Rent

xxxxx

Less: 15% of GMR

xxxxx

Less: Municipal Taxes xxxxx

(on paid basis whether

by owner or tenant)

NET MAINTAINABLE RENT

xxxxx

Prepared by: CA. V.K. SAINI

(9999772095) 61

Step-5 Valuation of Property

CASE-1 CASE-2

Where property has Where property has

been acquired or been acquired or

constructed on or constructed after

before 31.03.1974 31.03.1974

Prepared by: CA. V.K. SAINI

(9999772095) 62

Case-1

Property constructed NMR * 12.5

on freehold land

Property constructed NMR * 10

on Lease hold Land and

unexpired Period of

Lease is 50 years or

more

Where unexpired NMR * 8

Period of Lease is less

than 50 years

Prepared by: CA. V.K. SAINI

(9999772095) 63

Case-2

Value of the property shall be higher of

the following:

1. NMR * Capitalization Factor (12.5/10/8)

2. Cost of acquisition /construction + cost

of improvement

Prepared by: CA. V.K. SAINI

(9999772095) 64

Remedy to assessee

Valuation of any one house property

which is constructed/acquired after

31.03.1974

and used for his own residential purpose

throughout the year

and whose cost of

acquisition/construction + cost of

improvement does not exceed :

Prepared by: CA. V.K. SAINI

(9999772095) 65

Remedy to assessee

-Rs.50 lakhs in case house is situated in

Delhi/Mumbai/Kolkata/Chennai

-Rs.25 lakhs in case of other cities

shall be the NMR * Capitalization Factor

(12.5/10/8)

Prepared by: CA. V.K. SAINI

(9999772095) 66

Adjustment for unbuilt area of plot of land

as per Rule-6

If unbuilt area > Specified area

then there shall be addition in the value of

property as per Rules 3, 4 & 5 of

as per % of default

Prepared by: CA. V.K. SAINI

(9999772095) 67

What is percentage of default?

Unbuilt Area - Specified Area

Aggregate Area

Prepared by: CA. V.K. SAINI

(9999772095) 68

What is Specified Area?

Specified Area is in the sense of

permissible

unbuilt area

Therefore if Unbuilt Area > Specified

Area,

then addition shall be made as per Rule 6

Prepared by: CA. V.K. SAINI

(9999772095) 69

Specified Area mentioned in

Wealth Tax Act

Where property

situated in

Delhi, Mumbai, Kolkata, 60% of aggregate area

Chennai

Specified citied 65% of aggregate area

Other cities 70% of aggregate area

Prepared by: CA. V.K. SAINI

(9999772095) 70

Addition in the value of property as per

Rule -6

% of default Addition

Upto 5% NIL

5% to 10% 20% of value as per

rules 3 4 & 5

10%to 15% 30% of value

15% to 20% 40% of value

Above 20% FMV of property (Rule-

8)

Prepared by: CA. V.K. SAINI

(9999772095) 71

Adjustment for unearned increased in

value of land as per Rule-7

If the property is constructed on a land taken

on lease from Govt. Authority

and Govt. Authority is entitled to recover a

specified % of unearned increase in the value of

land at the time of transfer of property

then, the value determined as per Rules 3, 4, 5 &

6 shall be reduced by the least of the following :

Prepared by: CA. V.K. SAINI

(9999772095) 72

Adjustment for unearned increased in

value of land as per Rule-7

Amount of unearned increase liable to

be recovered by the Govt. Authority

50% of the value as per Rules 3, 4, 5 & 6

Prepared by: CA. V.K. SAINI

(9999772095) 73

What is unearned increase?

Unearned increase means the difference

between the :

value of such land as determined by the

Govt. Authority for the purpose of

calculating such increase

and the lease premium paid or payable to

the Govt. Authority for lease of land

Prepared by: CA. V.K. SAINI

(9999772095) 74

Rule-8

Notwithstanding contained in Rules 3 to

7 the value of the property shall be

estimated to be the price which, in the

opinion of the Assessing Officer,

it would fetch if sold in the open market

on the valuation date.

Prepared by: CA. V.K. SAINI

(9999772095) 75

Cases, where Rule-8 apply

1. Where the A.O. is of the opinion that it is not

practicable to the apply Rules 3 to 7

2. Where the difference between the unbuilt

area and the specified area exceeds 20% of

the aggregate area

3. Where the property is constructed on a

leasehold land and the lease expires within a

priod of less than 15 years and the deed of

lease does not give an option for the renewal

of the lease

Prepared by: CA. V.K. SAINI

(9999772095) 76

Prepared by: CA. V.K. SAINI

(9999772095) 77

You might also like

- 7 M&a Financial ModelingDocument39 pages7 M&a Financial ModelingAniket Gupta100% (1)

- TCS-Hedging Forex RiskDocument6 pagesTCS-Hedging Forex RiskAniket GuptaNo ratings yet

- Solar Proposal for Dan Glaser Saves $315K Over 25 YearsDocument13 pagesSolar Proposal for Dan Glaser Saves $315K Over 25 YearsAdewale BamgbadeNo ratings yet

- 1st Set Tax 1Document51 pages1st Set Tax 1dnel13No ratings yet

- Special Liabilities San Carlos CollegeDocument23 pagesSpecial Liabilities San Carlos CollegeRowbby Gwyn100% (1)

- IRR Foster Care Act of 2012Document25 pagesIRR Foster Care Act of 2012BabangNo ratings yet

- Income-Tax Banggawan2019 CR7Document10 pagesIncome-Tax Banggawan2019 CR7Noreen Ledda11% (9)

- Taxation PreweekDocument25 pagesTaxation Preweekschaffy100% (5)

- 07 Income From Property (50 59)Document11 pages07 Income From Property (50 59)jafferyasim100% (2)

- CIR v GENERAL FOODS INC. Test of ReasonablenessDocument2 pagesCIR v GENERAL FOODS INC. Test of ReasonablenessiptrinidadNo ratings yet

- Income TaxDocument20 pagesIncome Taxjuliaysabellepepitoaguilar100% (1)

- Filipino Estate Tax Calculation for Married IndividualDocument3 pagesFilipino Estate Tax Calculation for Married IndividualSharjaaah100% (2)

- CHAPTER 13 A - Regular Allowable Itemized DeductionsDocument4 pagesCHAPTER 13 A - Regular Allowable Itemized DeductionsDeviane CalabriaNo ratings yet

- Chapter 3: Net-Operating Loss Carry-Over Net Operating Loss - The Excess ofDocument3 pagesChapter 3: Net-Operating Loss Carry-Over Net Operating Loss - The Excess ofMark Lawrence YusiNo ratings yet

- Welcome To Presentation On Taxability of House PropertyDocument77 pagesWelcome To Presentation On Taxability of House PropertyAtul BaliNo ratings yet

- Income From House PropertyDocument31 pagesIncome From House PropertyAarti SainiNo ratings yet

- House Property - Summary (PY 2020-21 AY 2021-22)Document5 pagesHouse Property - Summary (PY 2020-21 AY 2021-22)Aruna RajappaNo ratings yet

- Final PPT of Income From House PropertyDocument33 pagesFinal PPT of Income From House PropertyAzhar Ali100% (1)

- House PropertyDocument17 pagesHouse PropertySarvar PathanNo ratings yet

- House PropertyDocument17 pagesHouse PropertydeepaksinghalNo ratings yet

- HP and PGBP PDFDocument106 pagesHP and PGBP PDFRavi YadavNo ratings yet

- Annual value and taxation of house propertyDocument7 pagesAnnual value and taxation of house propertyGiri SukumarNo ratings yet

- Income From House Property: Section/Rule Subject MatterDocument21 pagesIncome From House Property: Section/Rule Subject Matterphanidhar varanasiNo ratings yet

- A Case Study: House Property Under Income Tax, Wealth Tax and FEMADocument8 pagesA Case Study: House Property Under Income Tax, Wealth Tax and FEMAManoj Nikumbh MKNo ratings yet

- Computation of Income From House PropertDocument20 pagesComputation of Income From House PropertSIDDHART BHANSALINo ratings yet

- House PropertyDocument7 pagesHouse Propertyatul.maurya0290No ratings yet

- Chapter 5 Income From House PropertyDocument19 pagesChapter 5 Income From House PropertysagarNo ratings yet

- House Property NotesDocument38 pagesHouse Property Notesshriram bhatNo ratings yet

- Income From House PropertyDocument32 pagesIncome From House PropertyhanumanthaiahgowdaNo ratings yet

- BY. Vinit Jain ERO0161104Document33 pagesBY. Vinit Jain ERO0161104Azhar AliNo ratings yet

- Chapter 6Document3 pagesChapter 6Shafaq Hamid RazaNo ratings yet

- B. in The Case of Oneself-Occupied House PropertyDocument4 pagesB. in The Case of Oneself-Occupied House PropertySeshanki ChaudhariNo ratings yet

- House PropertyDocument33 pagesHouse PropertypriyaNo ratings yet

- Income From House Property: Section/Rule Subject MatterDocument29 pagesIncome From House Property: Section/Rule Subject MatterRajesh NangaliaNo ratings yet

- 1491816804house Property, Othersources, Salary, Clubbing, Setoff, Tax Planning PDFDocument168 pages1491816804house Property, Othersources, Salary, Clubbing, Setoff, Tax Planning PDFPranav PuriNo ratings yet

- Income From House Property: After Studying This Chapter, You Would Be Able ToDocument38 pagesIncome From House Property: After Studying This Chapter, You Would Be Able ToAnkitaNo ratings yet

- Income From House PropertyDocument27 pagesIncome From House PropertyJames Anderson0% (1)

- House Property IncomeDocument4 pagesHouse Property IncomeVachanamrutha R.VNo ratings yet

- Income Tax Rules for Property IncomeDocument2 pagesIncome Tax Rules for Property IncomeSushil_Pandey_4297No ratings yet

- House Property-Income TaxDocument26 pagesHouse Property-Income TaxSwetaNo ratings yet

- S021 - Haroon Shaik DIT AssignmentDocument10 pagesS021 - Haroon Shaik DIT AssignmentHaroonNo ratings yet

- Income From House PropertyDocument26 pagesIncome From House PropertySuyash Patwa100% (1)

- Unit - 2: Income From House Property: After Studying This Chapter, You Would Be Able ToDocument47 pagesUnit - 2: Income From House Property: After Studying This Chapter, You Would Be Able Toadityaraj purohitNo ratings yet

- House PropertyDocument18 pagesHouse PropertyNidhi LathNo ratings yet

- Unit 2 (Income From House Property)Document13 pagesUnit 2 (Income From House Property)Vijay GiriNo ratings yet

- Heads of Income: Unit - 2: Income From House PropertyDocument40 pagesHeads of Income: Unit - 2: Income From House PropertyMaheswar SethiNo ratings yet

- II. Income Under The House Properties :: Basis of Charge Section 22Document4 pagesII. Income Under The House Properties :: Basis of Charge Section 22Akash Singh RajputNo ratings yet

- 56465bos45796cp4u2 PDFDocument49 pages56465bos45796cp4u2 PDFNarendra VasavanNo ratings yet

- Tax H.P CompilorDocument6 pagesTax H.P CompilorKaran GuptaNo ratings yet

- Computation of Income From Let Out HouseDocument5 pagesComputation of Income From Let Out HouseArpit GoyalNo ratings yet

- Chapter 5 Income From House Property PMDocument14 pagesChapter 5 Income From House Property PMMohammad Yusuf NabeelNo ratings yet

- Income From HP PDFDocument14 pagesIncome From HP PDFNanda NanduNo ratings yet

- Short Notes of House PropertyDocument3 pagesShort Notes of House PropertyutsavNo ratings yet

- Tax ProjectDocument12 pagesTax ProjectUtkarsh SinghNo ratings yet

- Income From House Property: After Studying This Chapter, You Would Be Able ToDocument35 pagesIncome From House Property: After Studying This Chapter, You Would Be Able ToLilyNo ratings yet

- 62289bos50449 Mod1 cp5Document41 pages62289bos50449 Mod1 cp5monicabhat96No ratings yet

- House PropertyDocument14 pagesHouse Property083 Ronak ShahNo ratings yet

- TAX 25-9-2020 DeductionsDocument3 pagesTAX 25-9-2020 DeductionsChitraNo ratings yet

- Income From House PropertyDocument7 pagesIncome From House PropertyDivya KakranNo ratings yet

- Income From House Property-6Document9 pagesIncome From House Property-6s4sahithNo ratings yet

- Income From Property IIUI Spring Semester 22Document13 pagesIncome From Property IIUI Spring Semester 22Wahaj AhmedNo ratings yet

- Income Tax 20220119Document56 pagesIncome Tax 20220119asadazhar002No ratings yet

- Lecture 11 - Determination of Annual Value PDF-converted NewDocument38 pagesLecture 11 - Determination of Annual Value PDF-converted NewK.NALININo ratings yet

- Module 2 - Completing The Accounting CycleDocument45 pagesModule 2 - Completing The Accounting CycleShane TorrieNo ratings yet

- Income From House Property: After Studying This Chapter, You Would Be Able ToDocument40 pagesIncome From House Property: After Studying This Chapter, You Would Be Able ToManoj GNo ratings yet

- Income From House Property PracticalDocument52 pagesIncome From House Property Practicalvivek raiNo ratings yet

- House Property IncomeDocument4 pagesHouse Property IncomeOnkar BandichhodeNo ratings yet

- Income from House PropertyDocument5 pagesIncome from House PropertyKaustubh BasuNo ratings yet

- Calculating income from house propertyDocument7 pagesCalculating income from house propertyKiran ChristyNo ratings yet

- DEDUCTIONS FOR UNOCCUPIED HOUSE PROPERTYDocument34 pagesDEDUCTIONS FOR UNOCCUPIED HOUSE PROPERTYMohd. Shadab khanNo ratings yet

- CA INTER CompilerDocument12 pagesCA INTER CompilernehajnvniwarsiNo ratings yet

- The Tax-Free Exchange Loophole: How Real Estate Investors Can Profit from the 1031 ExchangeFrom EverandThe Tax-Free Exchange Loophole: How Real Estate Investors Can Profit from the 1031 ExchangeNo ratings yet

- Volatility of USDINRDocument4 pagesVolatility of USDINRAniket GuptaNo ratings yet

- Retail Management AssignmentDocument6 pagesRetail Management AssignmentAniket GuptaNo ratings yet

- Deductions from Gross Total Income under Income Tax ActDocument29 pagesDeductions from Gross Total Income under Income Tax Actgaganhungama007No ratings yet

- BIR RULING (DA-545-04) : Atty. Miguel Romualdo T. SanidadDocument3 pagesBIR RULING (DA-545-04) : Atty. Miguel Romualdo T. SanidadRod Ralph ZantuaNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnramnik20098676No ratings yet

- Session 26 - Income TaxDocument23 pagesSession 26 - Income TaxUnnati RawatNo ratings yet

- Everything You Need To Know About Tax in Singapore (By PWC)Document64 pagesEverything You Need To Know About Tax in Singapore (By PWC)sathappan100% (1)

- Form 13.1 - Financial StatementDocument10 pagesForm 13.1 - Financial StatementRobert GradNo ratings yet

- INDIAN INCOME TAX RETURN FOR SALARY AND OTHER SOURCESDocument5 pagesINDIAN INCOME TAX RETURN FOR SALARY AND OTHER SOURCES2020MSM022 NilabjaSahaNo ratings yet

- 1701Q Jan 2018 Final Rev2Document2 pages1701Q Jan 2018 Final Rev2Balot EspinaNo ratings yet

- Salary Statement Assessment for Financial Year 2021-22Document4 pagesSalary Statement Assessment for Financial Year 2021-22PriyanshuNo ratings yet

- Financial Report 2013 Ghandhara NissanDocument123 pagesFinancial Report 2013 Ghandhara NissanSarfraz AliNo ratings yet

- Value-Added Tax: Vat On Sale of Goods or PropertiesDocument12 pagesValue-Added Tax: Vat On Sale of Goods or PropertiesWin TambongNo ratings yet

- Items and Concept of IncomeDocument48 pagesItems and Concept of Incomejeff herradaNo ratings yet

- Salient Features of Income Tax Act 2023Document79 pagesSalient Features of Income Tax Act 2023Md. Abdullah Al ImranNo ratings yet

- Kerala Water Authority: Office of The Executive EngineerDocument32 pagesKerala Water Authority: Office of The Executive EngineerKkrkollam KrishnaKumarNo ratings yet

- Latest Income Tax Exemptions FY 2017-18 - AY 2018-19 - Tax DeductionsDocument90 pagesLatest Income Tax Exemptions FY 2017-18 - AY 2018-19 - Tax DeductionsTambi ThambiNo ratings yet

- CAPITAL GAINS TAXDocument6 pagesCAPITAL GAINS TAXMuskanDodejaNo ratings yet

- Meeting Your Life's Money NeedsDocument55 pagesMeeting Your Life's Money NeedsAll India VideoNo ratings yet

- Application Form: General Information: Selection Criteria For AccommodationDocument5 pagesApplication Form: General Information: Selection Criteria For AccommodationSIDDIG HASSAN SALAMAMNo ratings yet

- UntitledDocument4 pagesUntitledHassan SabiNo ratings yet

- RES 317 Study GuideDocument34 pagesRES 317 Study GuideBronwyn LesetediNo ratings yet