Professional Documents

Culture Documents

PMJDY

Uploaded by

Bhaskar Kalita0 ratings0% found this document useful (0 votes)

50 views8 pagesPradhan Mantri jan-dhan Yojana on a simple power point.( features)

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPradhan Mantri jan-dhan Yojana on a simple power point.( features)

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

50 views8 pagesPMJDY

Uploaded by

Bhaskar KalitaPradhan Mantri jan-dhan Yojana on a simple power point.( features)

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 8

PowerPoint Presentation

On

Pradhan Mantri Jan

Dhan Yojana

(PMJDY)

Presented To : Presented By:

Prof( Dr.) Narinder Kumar Bhasin Bhaskar Jyoti Kalita

Professor - Banking - ASIBAS ABYB 5th Batch

Former V.P - Axis Bank Limited Section A

Mail id : nkbhasin@amity.edu

1

CONTENT

INTRODUCTION

SPECIAL BENEFITS

INDIVIDUALS ELIGIBLE FOR THIS SCHEME

DOCUMENTS REQUIRED

FEES AND CHARGES

INTRODUCTION

Pradhan Mantri Jan-Dhan Yojana (PMJDY), was launched by

the Prime Minister of India Narendra Modi on 28 Aug 2014.

PMJDY is a National Mission on Financial Inclusion encompassing an

integrated approach to bring about comprehensive financial and to

ensure access to financial services, namely, Banking/ Savings &

Deposit Accounts, Remittance, Credit, Insurance, Pension in an

affordable manner.

Till date 30.26 cr bank accounts were opened and almost 666

billion were deposited under the scheme.

1.26 lakh Bank Mitras delivering branchless banking services in sub-

service areas.

Special Benefits under PMJDY Scheme

No minimum balance required ( to get cheque book,

he/she will have to fulfill minimum balance criteria)

Interest on deposit 3.5%

Accidental insurance cover of Rs. 1 lac

The scheme provide life cover of Rs. 30,000/- payable on death

of the beneficiary, subject to fulfillment of the eligibility

condition.

Easy Transfer of money across India

Beneficiaries of Government Schemes will get Direct Benefit

Transfer in these accounts.

After 6 months, an overdraft facility will be permitted

Overdraft facility upto Rs.5000/-

Access to Pension, insurance products.

Rupay Debit card

4 withdrawals a month (including ATM withdrawals) and

unlimited deposits

Avail mobile banking, without downloading an

application

Once mobile number is registered, use the MPIN to

access basic banking services like money transfer,

bill payments, balance enquiries, merchant

payments, etc. on a simple GSM mobile phone, and

basic handset without using any app.

Individuals eligible for PMJDY Account

Any individual above the age of 10 year

DOCUMENTS REQUIRED FOR PMJDY

Aadhaar Card/Aadhaar Number

If Aadhaar Card is not available, one of the following Officially Valid

Documents(OVD) is required:

Voter ID Card

Driving License

PAN Card

Passport

NREGA Card

If Officially Valid Documents are not available, and individual

is categorised as low-risk by banks, one of the following documents is

required:

Identity Card with applicants photograph issued by Central/State

government departments, statutory/regulatory authorities, public sector

undertakings, scheduled commercial banks and public financial institutions

Letter issued by a gazette officer, with a duly attested photograph of the

person

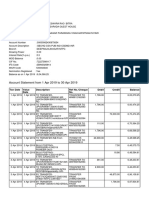

Fees and charges

No charges or account opening fees

No premium or charges for insurance

covers

For mobile banking, charges as applicable

by the telecom operator (not more that

Rs. 1.50 per transaction)

Interest amount of Base rate + 2% or 12%,

whichever is lower, charged on overdrafts

THANK YOU

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Cestui Que Vie Act (1666) - People Are Owned Under Old English LawDocument9 pagesThe Cestui Que Vie Act (1666) - People Are Owned Under Old English Lawzimaios100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Audit Program Liabilities Against AssetsDocument11 pagesAudit Program Liabilities Against AssetsRoemi Rivera Robedizo100% (3)

- Subprime Meltdown Case Analysis on US Housing CrisisDocument3 pagesSubprime Meltdown Case Analysis on US Housing Crisiscstellou22No ratings yet

- Guidelines Baseline 4 - Without TTDocument297 pagesGuidelines Baseline 4 - Without TTdarin.vasilevNo ratings yet

- Percents 20 NotesDocument12 pagesPercents 20 Notesapi-234882812No ratings yet

- Sps Lantin Vs Lantion Digested CaseDocument1 pageSps Lantin Vs Lantion Digested CaseEarl LarroderNo ratings yet

- Hampton MachineDocument7 pagesHampton MachineMurali SubramaniamNo ratings yet

- 003 Bonnevie v. Court of Appeals, G.R. No. L-49101, October 24, 1983 PDFDocument2 pages003 Bonnevie v. Court of Appeals, G.R. No. L-49101, October 24, 1983 PDFRomarie AbrazaldoNo ratings yet

- The Books OF AccountingDocument37 pagesThe Books OF AccountingediwowNo ratings yet

- Capital Structure: Overview of The Financing DecisionDocument68 pagesCapital Structure: Overview of The Financing DecisionHay JirenyaaNo ratings yet

- Crossing of checks prevents holder from being holder in due courseDocument3 pagesCrossing of checks prevents holder from being holder in due courseMonicaSumangaNo ratings yet

- Name of Secty AgencyDocument3 pagesName of Secty Agencytisay12100% (1)

- Working Capital FinancingDocument44 pagesWorking Capital FinancingShoib ButtNo ratings yet

- 2005 11 03 - DR3Document1 page2005 11 03 - DR3Zach EdwardsNo ratings yet

- Fixed and Floating Exchange RatesDocument22 pagesFixed and Floating Exchange Ratesmeghasingh_09No ratings yet

- A Study On E-Banking Service Quality and Customer SatisfactionDocument9 pagesA Study On E-Banking Service Quality and Customer Satisfactionmohak bettercalmemonuNo ratings yet

- 15624702052231UoGssBO9TQOUnD5 PDFDocument5 pages15624702052231UoGssBO9TQOUnD5 PDFvenkateshbitraNo ratings yet

- Sol. Man. - Chapter 19 - Borrowing Costs - Ia Part 1B 1Document7 pagesSol. Man. - Chapter 19 - Borrowing Costs - Ia Part 1B 1Rezzan Joy Camara Mejia100% (2)

- Early Illinois Paper MoneyDocument36 pagesEarly Illinois Paper MoneyJustin100% (1)

- Sample - Gap Analysis IndonesiaDocument101 pagesSample - Gap Analysis IndonesiapalmkodokNo ratings yet

- Shivam Thakar SIPDocument93 pagesShivam Thakar SIPabinash pasayatNo ratings yet

- An Evaluation of Capital Structure and Profitability of Business OrganizationDocument16 pagesAn Evaluation of Capital Structure and Profitability of Business OrganizationPushpa Barua0% (1)

- Gap Analysis Model AssignmentDocument10 pagesGap Analysis Model Assignmentsamia suktaNo ratings yet

- Finance TOPICDocument29 pagesFinance TOPICAdil HafeezNo ratings yet

- Atal Pension YojanaDocument2 pagesAtal Pension YojanakrithikNo ratings yet

- RFBT Topics CpaleDocument4 pagesRFBT Topics CpaleRuffa TagalagNo ratings yet

- June 2017 Revitalize Bank Statement PDFDocument10 pagesJune 2017 Revitalize Bank Statement PDFTiffanyNo ratings yet

- Commercial Law Bar Exam 2012Document11 pagesCommercial Law Bar Exam 2012Eileen TanNo ratings yet

- Indian Economy and Basic Economics 1Document239 pagesIndian Economy and Basic Economics 1ठलुआ क्लब100% (1)

- @enmagazine 2021 08 07 IFR AsiaDocument52 pages@enmagazine 2021 08 07 IFR AsiaWaising PwunNo ratings yet