Professional Documents

Culture Documents

Lecture 15 - Microfinance and Poverty Reduction

Uploaded by

Samara Chaudhury0 ratings0% found this document useful (0 votes)

206 views16 pagesOriginal Title

Lecture 15_ microfinance and poverty reduction.ppt

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

206 views16 pagesLecture 15 - Microfinance and Poverty Reduction

Uploaded by

Samara ChaudhuryCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 16

Role of microfinance in reduction of poverty

A program for supply of small loans to, and

mobilization of small savings from clients who do

not have access to formal financial markets.

The term was coined to describe the replication of

the Grameen Bank credit program in the

developing world.

It combines savings mobilization as a part of a

credit delivery system that supply of small amount

of loans (micro-credit) to low-income households

for generation of self-employment.

A socioeconomic study of credit operation in a village near

Chittagong University ( Zobra) by Professor M. Yunus laid the

foundation of micro-credit model in 1976

The study observed that many low-income households

operate tiny economic activities by taking loans from

moneylenders with very high rate of interest, often 10

percent per month.

After paying the interest and the principal, the borrower has

very little surplus left to accumulate savings to expand

business.

The operators are thus perpetually dependent on

moneylenders for high-interest loans that sustains the

vicious circle of poverty.

If credit could be extended to these households on easy

terms, they could save small amounts at the end of each loan

cycle, increase equity in the business, and move on a ladder

for poverty reduction.

But banks do not consider them credit-worthy since the size

of loan they demand is tiny, and they cannot offer any

collateral that could be invoked in case of default.

Dr. Yunus went to a nearby branch of a Krishi Bank and

pleaded to give them loans under his own personal

guarantee.

Since the borrowers are engaged in activities that generate

regular incomes (cottage industries, petty trade etc), he

developed a weekly loan repayment system that suits the

circumstances of low-income households.

The loans were all repaid in time to the surprise of the bank

officials. But, they thought that the borrowers behaved well

because of the personal influence of the professor.

The senior management of the Krishi Bank gave

him a challenge to replicate the experience in an

area outside Chittangong.

A low-cost loan fund (obtained from a grant from

IFAD) was offered to Professor Yunus to operate his

credit program in Tangail district where he is

unknown to local people.

With repeated experiments a loan delivery and

repayment system was developed appropriate to

the needs of poor people.

The success of Chittagong was repeated in Tangail.

In 1984, the Ministry of Finance was convinced of

the micro-credit model, and the Grammen Bank

was formally launched

Formation of a five member group with like-

minded people to act as peer pressure to ensure

proper utilization of the loan and repayment in

time.

A number of groups in the village was federated to

form a Village Organization called Centre which

meet once a week on fixed date and time.

The Centre is used as a platform to conduct bank

business, and bring credit services to the

doorsteps of the people

The credit was offered to households through

women members, as they are found more

responsible with money.

Giving control over money could help empowering

women

The weekly meetings was a venue to use credit as

an entry point for all round social development.

Sixteen decisions to prevent social ills and good

healthcare, hygiene and nutrition become the code

of conduct for members of the credit program. The

weekly meeting used to begin with chanting the

sixteen decisions

Members themselves propose economic activities

to be financed with the loan. The proposals are

scrutinized by the members in the weekly meeting

which are attended by a bank worker.

The loans are disbursed in the meeting, weekly

repayments are collected, and social issues

affecting the lives of the members are discussed

Loans are offered for a year with a schedule of repayment

with 50 equal weekly installments, and the repayment of

interest in the remaining two weeks.

Two members of the Group are offered loans in small

amounts. Other members receive loans when the first two

members maintain the repayment schedule. The Group

becomes ineligible for a new loan if one member defaults.

Five percent of the loan amount is deducted at the time

disbursement of each loan. The amount is deposited in a

savings fund along with the personal weekly savings.

The Group Fund thus accumulated was maintained with the

Grameen Bank as savings for the Group. The accumulated

savings could only be withdrawn when the member leaves the

Group.

An Emergency Fund was also instituted as an insurance

against loss of capital due to unforeseen circumstances.

The Grameen Bank model was accepted by many NGOs in

Bangladesh engaged in empowering the poor through

community development.

Some NGOs were established with sole purpose of providing

credit to the poor and making micro-credit as a self-

sustaining business, a model developed by ASA.

The Palli Karma Sahayak Foundation (PKSF) was established by

the government (with support from the World Bank) to

encourage local NGOs support generation of self-

employment with micro-credit.

Professor Yunus set up Grameen Trust to replicate the

Grameen Bank model internationally. The World Bank set up a

consortium Consultative Group for Alleviation of Poverty

(CGAP) to support this effort internationally.

Since mobilization of savings was a part of the objectives of

micro-credit organizations, micro-credit was renamed as

microfinance by academic institutions.

Unemployment and under-employment of the

labor force are root causes of poverty

At low levels of income the size of the formal

sectors – manufacturing and services – is small.

Even a double digit growth rate cannot absorb all

additions to the labor force.

Those who cannot find employment in the formal

sectors are absorbed in agriculture and informal

sectors, creating massive under-employment and

disguised employment

Credit is a capital support. The unemployed worker

can combine capital with her/ his labor to produce

goods and services which can be sold in the

market.

Access to credit can lead to gradual reduction in poverty if

the rate of return on capital in the self-employed enterprise is

higher than the rate of interest charged on the loan

The speed of the process to poverty reduction depends on a)

the demand for goods and services produced with the loan,

b) the size of the loan, and c) the propensity to save the

additional income.

The payment of weekly installments made it easy for the

borrower household to save the income from the loan. At the

end of the loan cycle, the loan becomes equity. With a repeat

loan the size of the capital grows.

The larger the difference between the rate of return on

capital and the rate of interest charged on the loan, the faster

the income grows, and the household moves on the path of

virtuous circle of poverty reduction

Microfinance is suitable for activities that generates regular

incomes, because installments have to be paid on a weekly

basis.

Activities include rickshaw and van driving, small scale petty

trading, peddling, shop-keeping, poultry and dairy cow

raising, cottage industries such as rice husking and

handlooms operations, etc.

Activities that generates income on a seasonal and annual

basis such as crop farming or beef fattening were not suitable

for organization with micro-credit, unless the household had

a side business that generates regular income from which the

installment can be paid.

Many households became engaged in multiple enterprises to

suit micro-finance delivery system.

If the credit is properly utilized in an activity that gives high

return on investment, recovery of loans is not a problem.

Low opportunity cost of labor encouraged borrowers to

accept self-exploitation of labor as long as total income from

the enterprise is higher than the alternative wage earnings in

the market.

Human capital intensive delivery system and the small size of

loan make microfinance a high-cost operation.

The rate of interest charged on the loan must be high in order

to make the micro-finance organization self-sustaining.

Coercion is used by bank workers to get repayment from

unsuccessful borrowers which led them further into poverty.

Microfinance is no longer an entry point for social

development. With the ASA model to make Microfinance an

income earning business.

The experience was a gradual de-emphasize on social

development activities that accompanied microfinance

movement in the early years.

Microfinance has become a business with many financial institutions

interested in lending money to microfinance organization

Microfinance business has expanded vastly reaching market

saturation. Over the last few years microfinance business has been

expanding at a rate of over 20 percent per year

Grameen Bank, ASA and BRAC alone extends credit to nearly 18

million households. PKSF funds nearly 250 local NGOs that may

cover anther six t million households.

Bangladesh has only 30 million households, 25 million in rural areas

where most of the microfinance business is conducted.

Studies from household side however shows that not more than 50

percent households have been reached with credit services.

Overlapping has become a big problem. One household or different

members of the same household are served by a number of

microfinance organizations with adverse impact on credit discipline

and loan recovery.

Over supply of credit and too much competition among

microfinance borrowers have led reduction in the rate of return on

credit, leading to difficulty in maintaining repayment schedule.

Frequent natural disasters leading to loss of capital and disruption

of economic activity exacerbate the problem of maintaining

repayment schedule.

Coercion on getting the repayment in time has created a negative

image for microfinance among the civil society in Bangladesh.

Older microfinance organization have established better competitive

edge in the market due to accumulation of savings which is now

used as a low cost loan fund. For Grameen Bank the accumulation in

savings fund now exceeds the outstanding loan with the borrowers

Many older microfinance organizations with high accumulated

savings now allow savings to be used to pay regular repayment of

installments to show excellent recovery on paper.

We must recognize that traditional microfinance products (annual

loans with weekly repayments) has reached market saturation.

Further expansion will lead borrowers to poverty deepening than to

poverty reduction.

The microfinance organizations must seek vertical expansion with

larger loan size with different loan products, and different delivery

and recovery mechanism

It is not necessary to cover all landless households with micro-

credit. The expansion of micro-credit for generation of self-

employment in non-farm activities has led to tightness in the rural

labor market and rapid increase in rural wages. The micro-credit

movement thus has indirectly helped increase income for labor

selling households not reached by micro-credit

There is unmet demand for credit for many other economic activities

in rural areas. These include crop farming, beef fattening,

acquisition of agricultural machinery, financing land leasing, and

financing cost of international migration etc.

Traditional micro-credit model of delivery and recovery of loan

within a year is not suitable for servicing these loan demands.

Thinking “out of box” is necessary to extend supply of credit to

these directions.

You might also like

- H&M Chapter Solutions 6th Ed.Document122 pagesH&M Chapter Solutions 6th Ed.shibbyfooNo ratings yet

- Unit One Microfinance OverviewDocument15 pagesUnit One Microfinance OverviewCome-all NathNo ratings yet

- icrofinance: Providing Financial Access to Low-Income HouseholdsDocument13 pagesicrofinance: Providing Financial Access to Low-Income HouseholdsAsif IqbalNo ratings yet

- BancassuranceDocument15 pagesBancassuranceRakesh BhanjNo ratings yet

- Customer Bevaivir ARTICLEDocument47 pagesCustomer Bevaivir ARTICLEJavedIqbalNo ratings yet

- HR Chapter on Industrial Relations ConceptDocument11 pagesHR Chapter on Industrial Relations ConceptrhodaNo ratings yet

- ABM 508 Human Resource ManagementDocument13 pagesABM 508 Human Resource ManagementYogesh SharmaNo ratings yet

- Advisor Recruitment in Icici PrudentialDocument23 pagesAdvisor Recruitment in Icici PrudentialIsrar MahiNo ratings yet

- Unit 1 Introduction To StatisticsDocument14 pagesUnit 1 Introduction To StatisticsHafizAhmadNo ratings yet

- Performance Appraisal Methods - Traditional & Modern - Short NotesDocument4 pagesPerformance Appraisal Methods - Traditional & Modern - Short NotesHugh JackmanNo ratings yet

- A Financial System Refers To A System Which Enables The Transfer of Money Between Investors and BorrowersDocument8 pagesA Financial System Refers To A System Which Enables The Transfer of Money Between Investors and BorrowersAnu SingalNo ratings yet

- Revised Tobin's Demand For MoneyDocument4 pagesRevised Tobin's Demand For MoneySnehasish MahataNo ratings yet

- MainDocument18 pagesMaini_ahmed_nsuNo ratings yet

- Supply Chain ManagementDocument30 pagesSupply Chain ManagementSanchit SinghalNo ratings yet

- Bank Al-Habib Internship ReportDocument82 pagesBank Al-Habib Internship ReportAshif abaanNo ratings yet

- Comparative Study of Internet Banking Usage Among Youth and ElderlyDocument44 pagesComparative Study of Internet Banking Usage Among Youth and ElderlyPavanNo ratings yet

- Measuring Service Quality in BankingDocument16 pagesMeasuring Service Quality in BankingTar TwoGoNo ratings yet

- Research - A Way of Thinking: Chapter 1 - Research Methodology, Ranjit KumarDocument36 pagesResearch - A Way of Thinking: Chapter 1 - Research Methodology, Ranjit KumarAbhaydeep Kumar JhaNo ratings yet

- Scope of financial management and its objectivesDocument4 pagesScope of financial management and its objectivesgosaye desalegnNo ratings yet

- Quantitative Techniques in FinanceDocument31 pagesQuantitative Techniques in FinanceAshraj_16No ratings yet

- IcbDocument82 pagesIcbAl AminNo ratings yet

- Capital StructureDocument4 pagesCapital StructureNaveen GurnaniNo ratings yet

- A Study of The Factors Affecting Customer Satisfaction For Atm Services in Vellore DistrictDocument8 pagesA Study of The Factors Affecting Customer Satisfaction For Atm Services in Vellore DistrictRohit KerkarNo ratings yet

- Wealth Maximization ObjectiveDocument8 pagesWealth Maximization ObjectiveNeha SharmaNo ratings yet

- The Problem of Units and The Circumstance For POMPDocument33 pagesThe Problem of Units and The Circumstance For POMPamarendra123No ratings yet

- A Project Report Ramzan AhmedDocument9 pagesA Project Report Ramzan Ahmedsimanta bhuynNo ratings yet

- The Gauss Markov TheoremDocument17 pagesThe Gauss Markov TheoremSamuel100% (1)

- Strategic Analysis of Reliance Industries LTD.: Guide - Dr. Neeraj SinghalDocument20 pagesStrategic Analysis of Reliance Industries LTD.: Guide - Dr. Neeraj SinghalPRITHIKA DASGUPTA 19212441No ratings yet

- Role of EntrepreneursDocument3 pagesRole of EntrepreneursRina Mae Sismar Lawi-anNo ratings yet

- Ghana - Rural BankDocument53 pagesGhana - Rural BankNeerajNo ratings yet

- Discriminant AnalysisDocument33 pagesDiscriminant AnalysisLokesh LaddhaNo ratings yet

- LIC Restructures Marketing StrategyDocument2 pagesLIC Restructures Marketing StrategyHajra ArifNo ratings yet

- Understanding Micro and Macro Economics ConceptsDocument11 pagesUnderstanding Micro and Macro Economics ConceptsmaeNo ratings yet

- Describe The Benefits of Having A Clear Mission and Vision StatementDocument2 pagesDescribe The Benefits of Having A Clear Mission and Vision StatementAlemayehu DemekeNo ratings yet

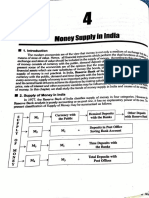

- Money Supply in India 1Document9 pagesMoney Supply in India 1Chaitanya ChoudharyNo ratings yet

- Law of Variable ProportionsDocument17 pagesLaw of Variable ProportionsAvinash SahuNo ratings yet

- Scope of HRMDocument1 pageScope of HRMVandana VermaNo ratings yet

- Assignment 4Document4 pagesAssignment 4sandeep BhanotNo ratings yet

- Chapter 8 Lecture NotesDocument7 pagesChapter 8 Lecture NotesnightdazeNo ratings yet

- Statistics SPSS ProjectDocument12 pagesStatistics SPSS Projectrishabhsethi1990No ratings yet

- Uganda Management Institute DPAM 2014/2015Document4 pagesUganda Management Institute DPAM 2014/2015Fred OchiengNo ratings yet

- Practice of Pension in Corporate Sector of BangladeshDocument10 pagesPractice of Pension in Corporate Sector of BangladeshA.M.SyedNo ratings yet

- Linear Programming ProblemDocument27 pagesLinear Programming Problemharshit_pandey_1100% (1)

- Economic IndicatorsDocument2 pagesEconomic IndicatorsShamsiyyaUNo ratings yet

- Indian Insight Into TQMDocument13 pagesIndian Insight Into TQMSrinivas Reddy RondlaNo ratings yet

- Business Statistics Module - 1 Introduction-Meaning, Definition, Functions, Objectives and Importance of StatisticsDocument5 pagesBusiness Statistics Module - 1 Introduction-Meaning, Definition, Functions, Objectives and Importance of StatisticsPnx RageNo ratings yet

- Mis Notes As Per Kannur University Syllabus Module 1Document17 pagesMis Notes As Per Kannur University Syllabus Module 1ROSEMARYNo ratings yet

- Abstract LifebuoyDocument9 pagesAbstract LifebuoyShlok MalhotraNo ratings yet

- 02 - Summary - Scientific Approach To Research in Physical and Management SciencesDocument1 page02 - Summary - Scientific Approach To Research in Physical and Management Sciencesvishal sinha0% (1)

- Wipro Started As A Vegetable Oil Company in 1947 From An Old Mill Founded by Azim PremjiDocument37 pagesWipro Started As A Vegetable Oil Company in 1947 From An Old Mill Founded by Azim PremjiPreetika SuriNo ratings yet

- Rural Marketing Research Process and ToolsDocument10 pagesRural Marketing Research Process and ToolsSyed MohdNo ratings yet

- Organization Behavior Solved Subjective QuestionsDocument6 pagesOrganization Behavior Solved Subjective QuestionsRaheel KhanNo ratings yet

- Functions of InsuranceDocument1 pageFunctions of InsuranceJenifer MaryNo ratings yet

- MGT 25 Challenges For Social Entrepreneurship PDFDocument9 pagesMGT 25 Challenges For Social Entrepreneurship PDFAneesh MalhotraNo ratings yet

- Work-Life Balance (Case Study)Document2 pagesWork-Life Balance (Case Study)Khairur RahimanNo ratings yet

- HRM Question Bank Answer Key-RejinpaulDocument18 pagesHRM Question Bank Answer Key-RejinpaulDrisya nair100% (1)

- WLB Hetero......Document55 pagesWLB Hetero......Shivakumar BijigiriNo ratings yet

- Introduction To Business MathematicsDocument44 pagesIntroduction To Business MathematicsAbdullah ZakariyyaNo ratings yet

- Management - Ch06 - Forecasting and PremisingDocument9 pagesManagement - Ch06 - Forecasting and PremisingRameshKumarMurali0% (1)

- The Four Walls: Live Like the Wind, Free, Without HindrancesFrom EverandThe Four Walls: Live Like the Wind, Free, Without HindrancesRating: 5 out of 5 stars5/5 (1)

- Solution (260) - Spring 2019 Mid Term PDFDocument3 pagesSolution (260) - Spring 2019 Mid Term PDFSamara ChaudhuryNo ratings yet

- Calculus Notes Covering BasicsDocument79 pagesCalculus Notes Covering BasicsSamara ChaudhuryNo ratings yet

- 18.100C Lecture 1 SummaryDocument2 pages18.100C Lecture 1 SummaryLionel CarlosNo ratings yet

- CheatSheet For Java BeginnersDocument6 pagesCheatSheet For Java BeginnersSamara ChaudhuryNo ratings yet

- Absalg 17Document6 pagesAbsalg 17Mohit GuptaNo ratings yet

- Euler's Method, Runge KuttaDocument27 pagesEuler's Method, Runge KuttaSamara ChaudhuryNo ratings yet

- Answer The Following Questions: (Total Marks: 20)Document1 pageAnswer The Following Questions: (Total Marks: 20)Samara ChaudhuryNo ratings yet

- Solution (260) - Spring 2019 Mid Term PDFDocument3 pagesSolution (260) - Spring 2019 Mid Term PDFSamara ChaudhuryNo ratings yet

- Assignment3 PDFDocument4 pagesAssignment3 PDFSamara ChaudhuryNo ratings yet

- Answer The Following Questions: (Total Marks: 20)Document1 pageAnswer The Following Questions: (Total Marks: 20)Samara ChaudhuryNo ratings yet

- Notes On Linear Algebra BasicsDocument21 pagesNotes On Linear Algebra BasicsSamara ChaudhuryNo ratings yet

- Econometric Modelling: Specification and Diagnostic Testing: Gujarati: Chapter 13Document7 pagesEconometric Modelling: Specification and Diagnostic Testing: Gujarati: Chapter 13Samara ChaudhuryNo ratings yet

- Solution (260) - Spring 2019 Mid Term PDFDocument3 pagesSolution (260) - Spring 2019 Mid Term PDFSamara ChaudhuryNo ratings yet

- Laplace transform elementary functionsDocument2 pagesLaplace transform elementary functionsSamara ChaudhuryNo ratings yet

- Time SeriesDocument10 pagesTime SeriesSamara ChaudhuryNo ratings yet

- Worksheet Maple IntroDocument138 pagesWorksheet Maple IntroSamara ChaudhuryNo ratings yet

- Group TheoryDocument135 pagesGroup TheoryZeref DagneelNo ratings yet

- Module 4: Fourier SeriesDocument6 pagesModule 4: Fourier SeriesMohammedHassanGomaaNo ratings yet

- Lec 02Document44 pagesLec 02Samara ChaudhuryNo ratings yet

- Short Notes On Complex VariablesDocument8 pagesShort Notes On Complex VariablesSamara ChaudhuryNo ratings yet

- CheatSheet For Java BeginnersDocument6 pagesCheatSheet For Java BeginnersSamara ChaudhuryNo ratings yet

- Homework ComplexdysyDocument6 pagesHomework ComplexdysyFABIANCHO2210No ratings yet

- KAIRODocument98 pagesKAIROসোহানNo ratings yet

- Euler's Method, Runge KuttaDocument27 pagesEuler's Method, Runge KuttaSamara ChaudhuryNo ratings yet

- A River in Darkness PDFDocument6 pagesA River in Darkness PDFSamara ChaudhuryNo ratings yet

- 11.2 Sturm-Liouville Boundary Value ProblemsDocument3 pages11.2 Sturm-Liouville Boundary Value ProblemsSamara ChaudhuryNo ratings yet

- Lec 02Document44 pagesLec 02Samara ChaudhuryNo ratings yet

- Differential EquationsDocument5 pagesDifferential EquationsSamara ChaudhuryNo ratings yet

- Absalg 17Document6 pagesAbsalg 17Mohit GuptaNo ratings yet

- Absalg 17Document6 pagesAbsalg 17Mohit GuptaNo ratings yet

- Arvind Goyal Final ProjectDocument78 pagesArvind Goyal Final ProjectSingh GurpreetNo ratings yet

- Factors Affecting Exclusive BreastfeedingDocument7 pagesFactors Affecting Exclusive BreastfeedingPuput Dwi PuspitasariNo ratings yet

- ICS ModulesDocument67 pagesICS ModulesJuan RiveraNo ratings yet

- Jesu, Joy of Mans DesiringDocument6 pagesJesu, Joy of Mans DesiringAleksandar TamindžićNo ratings yet

- March 3, 2014Document10 pagesMarch 3, 2014The Delphos HeraldNo ratings yet

- Ecommerce Product: Why People Should Buy Your Product?Document3 pagesEcommerce Product: Why People Should Buy Your Product?khanh nguyenNo ratings yet

- Guide to Sentence Inversion in EnglishDocument2 pagesGuide to Sentence Inversion in EnglishMarina MilosevicNo ratings yet

- Narcotic Drugs (Control Enforcement and Sanctions) Law, 1990Document32 pagesNarcotic Drugs (Control Enforcement and Sanctions) Law, 1990Kofi Mc SharpNo ratings yet

- Disadvantages of PrivatisationDocument2 pagesDisadvantages of PrivatisationumamagNo ratings yet

- GST English6 2021 2022Document13 pagesGST English6 2021 2022Mariz Bernal HumarangNo ratings yet

- Y-Chromosome Analysis in A Northwest Iberian Population: Unraveling The Impact of Northern African LineagesDocument7 pagesY-Chromosome Analysis in A Northwest Iberian Population: Unraveling The Impact of Northern African LineagesHashem EL-MaRimeyNo ratings yet

- Document 6Document32 pagesDocument 6Pw LectureNo ratings yet

- Form No. 32: Medical Examination Results Therefore If Declared Unfit For WorkDocument1 pageForm No. 32: Medical Examination Results Therefore If Declared Unfit For WorkchintanNo ratings yet

- Intern Ship Final Report Henok MindaDocument43 pagesIntern Ship Final Report Henok Mindalemma tseggaNo ratings yet

- Navarro v. SolidumDocument6 pagesNavarro v. SolidumJackelyn GremioNo ratings yet

- The War Against Sleep - The Philosophy of Gurdjieff by Colin Wilson (1980) PDFDocument50 pagesThe War Against Sleep - The Philosophy of Gurdjieff by Colin Wilson (1980) PDFJosh Didgeridoo0% (1)

- MC71206A Practices of The Culture IndustryDocument24 pagesMC71206A Practices of The Culture IndustrykxNo ratings yet

- Gonzaga vs. CA DigestDocument1 pageGonzaga vs. CA DigestStephanie Reyes GoNo ratings yet

- A Level Economics Paper 1 MSDocument25 pagesA Level Economics Paper 1 MSYusuf SaleemNo ratings yet

- Accounting Time Allowed - 2 Hours Total Marks - 100: You Are Required To Calculate TheDocument3 pagesAccounting Time Allowed - 2 Hours Total Marks - 100: You Are Required To Calculate TheNew IdNo ratings yet

- Philippine LiteratureDocument75 pagesPhilippine LiteratureJoarlin BianesNo ratings yet

- Advocacy PresentationDocument13 pagesAdvocacy Presentationapi-459424184No ratings yet

- History of Brunei Empire and DeclineDocument4 pagesHistory of Brunei Empire and Declineたつき タイトーNo ratings yet

- 27793482Document20 pages27793482Asfandyar DurraniNo ratings yet

- Straight and Crooked ThinkingDocument208 pagesStraight and Crooked Thinkingmekhanic0% (1)

- Allotment Order 2022-23 - FIRST Round Arts - 52212302 - KARUNRAJ MDocument2 pagesAllotment Order 2022-23 - FIRST Round Arts - 52212302 - KARUNRAJ MKarun RajNo ratings yet

- The Call of CthulhuDocument15 pagesThe Call of CthulhuCerrüter LaudeNo ratings yet

- Stores & Purchase SopDocument130 pagesStores & Purchase SopRoshni Nathan100% (4)

- Baker Jennifer. - Vault Guide To Education CareersDocument156 pagesBaker Jennifer. - Vault Guide To Education Careersdaddy baraNo ratings yet

- Niela Marie H. - GEC105 - SLM7 - MPHosmilloDocument4 pagesNiela Marie H. - GEC105 - SLM7 - MPHosmilloNiela Marie HosmilloNo ratings yet