Professional Documents

Culture Documents

Akhuwat Redefining Micro Finance by Prof. Ather Azeem

Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Akhuwat Redefining Micro Finance by Prof. Ather Azeem

Copyright:

Available Formats

By :

CENTER OF ISLAMIC BANKING & ECNOMICS

Held At:

Ather Azim Khan Professor of Finance University of Central Punjab

y Internationally microfinance is considered a viable

proposition to alleviate poverty but its sustainability is related to high interest rates. y It is said that for those poor people who have entrepreneurial skills but they do not have access to finance can come out of poverty by using microfinance but microfinance should be provided to them at a very high financial cost considering that micro businesses are more profitable than other commercial businesses.

y The argument in favor of high financial cost is the

importance of sustainability of Microfinance Institutions, which is related to high costs charged to the poor borrowers. y It is said that many of micro credit borrowers fail in their businesses and lose their money. This results into high percentage of bad debts, which again needs to be covered by the high financial cost.

y Further, it is said that the experience of the world has

proven that providing subsidized microfinance to poor does not work. Massive defaults are made and microfinance funds eradicate stopping the whole process. y Experiences of providing lost cost microfinance to poor people have failed. y This has resulted into making of such policies by fund providers, which require lending at high rates and pushing the poor to their limit.

y Akhuwat model is not less than a miracle as Ahuwat

has proven all the existing viewpoints regarding microfinance wrong. y Malcolm Harper says that many wrongs written in his book What is Wrong about Microfinance are corrected by Akhuwat. y Akhuwat has proven that poor borrowers are more trustworthy than the rich and it has achieved a phenomenal rate of recovery i.e. more than 99%

y Some of the important attributes of Akhuwat model

are absolutely opposite the general practices of the world. y Akhuwat has not only implemented this model but has seen a phenomenal growth in a short span of time. y Akhuwat is also replicated this model with the help of local community

y Akhuwat proves interest free financing, which on one

hand is total negation of the philosophy that microfinance is not viable without high financial cost and on the other hand is the true form of Islamic microfinance. y Akhuwat is done it by providing micro credit as Qarze-Hasna, which is an Islamic model and is cost free. y The world says that subsidized microfinance is not viable and Akhuwat gives extreme subsidy i.e. zero cost of financing.

y Akhuwat has revived the role of mosques in an Islamic

society. y Mosque was a center of many activities in the Muslim communities, which are unfortunately now just used to offer obligatory prayer. y Akhuwat holds its disbursement ceremonies of micro loans in mosques to revive the role of mosques and to inculcate the Islamic spirit in the society

y Students of many universities and people from other

walks of life work as volunteers for Akhuwat. This spirit of volunteerism provides new blood to the whole society.

y Another achievement of Akhuwat is converting

borrowers into contributors of funds i.e. lenders of microfinance. y Those borrowers who grew but effectively utilizing the money are now fund providers. Some have contributed extremely large sums of money to the Akhuwat fund. y Another unique way of converting borrowers into lenders is by asking them to divert their tiny amounts of charity to Akhuwat fund, which collectively becomes tens of millions.

y It is also a common criticism on microfinance that

loans are given for new businesses but are used for something else, hence the whole philosophy of providing microfinance to alleviate poverty eliminates. y Although, Akhuwat also provides microfinance for other purposes such as rebuilding of houses or shops, repayment of extremely expensive loans etc., but majority of the loans of Akhuwat are to start a new micro business. This does not only ensure increase in the income of poor people but also makes repayment possible in most effective manner.

y My interest in microfinance developed when I learnt about

Akhuwat. Analyzing the Akhuwat model I have come up with a new theory. y The Theory of Communal Viability as the Akhuwat model is based on community participation. Those who have money pay, those who need money borrow, those who do not have money but want to participate work as volunteers, use that place for the purpose which belongs to the whole community i.e. mosque.

y y y y

Funds are provided by the rich people of society Poor of the society are provided micro credit Mosques are used to provide microfinance People of the society work as volunteers in the process

CENTER OF ISLAMIC BANKING & ECNOMICS

Head Office: 192- Ahmad Block, New Garden Town , Lahore, Pakistan Ph: +92-42-35913096-8, 35858990, 38407850 Fax: +92 -42-35913056 E-mail : info@alhudacibe.com Web: http://www.alhudacibe.com

You might also like

- Two Days Specialized Training Workshop On Islamic Banking and Finance - RussiaDocument7 pagesTwo Days Specialized Training Workshop On Islamic Banking and Finance - RussiaAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Press Release - AlHuda CIBE Signed MOU With Uzbekistan Lessors AssociationDocument2 pagesPress Release - AlHuda CIBE Signed MOU With Uzbekistan Lessors AssociationAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Islamic Banking, Takaful and Islamic Microfinance TrainingDocument7 pagesIslamic Banking, Takaful and Islamic Microfinance TrainingAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- CIS - Islamic Banking and Finance ForumDocument9 pagesCIS - Islamic Banking and Finance ForumAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Two Days Specialized Training Workshop On Islamic Banking and Finance in RussiaDocument7 pagesTwo Days Specialized Training Workshop On Islamic Banking and Finance in RussiaAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Islamic Banking and Finance Training - UKDocument7 pagesIslamic Banking and Finance Training - UKAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Global Takaful Forum 2019Document10 pagesGlobal Takaful Forum 2019AlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Islamic Micro & Agriculture Finance Trainings - 2019Document7 pagesIslamic Micro & Agriculture Finance Trainings - 2019AlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Press Release - CIS Islamic Finance ForumDocument3 pagesPress Release - CIS Islamic Finance ForumAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Press Release - CIS Islamic Banking and Finance ForumDocument2 pagesPress Release - CIS Islamic Banking and Finance ForumAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Press Release - For The Promotion of Halal Industry, Islamic Finance Plays An Important Role: Zubair MughalDocument2 pagesPress Release - For The Promotion of Halal Industry, Islamic Finance Plays An Important Role: Zubair MughalAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Two Days Specialized Training Workshop On Islamic Banking and FinanceDocument7 pagesTwo Days Specialized Training Workshop On Islamic Banking and FinanceAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Islamic Banking Analysis 2019 by Mr. Zubair MughalDocument2 pagesIslamic Banking Analysis 2019 by Mr. Zubair MughalAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Islamic Banking, Takaful and Islamic Microfinance TrainingDocument7 pagesIslamic Banking, Takaful and Islamic Microfinance TrainingAlHuda Centre of Islamic Banking & Economics (CIBE)0% (1)

- Two Days Specialized Training Workshop On Islamic Banking & Finance in Washington, DC. USADocument8 pagesTwo Days Specialized Training Workshop On Islamic Banking & Finance in Washington, DC. USAAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Two Days Specialized Training Workshop On Islamic Banking & Finance at UKDocument8 pagesTwo Days Specialized Training Workshop On Islamic Banking & Finance at UKAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Islamic Banking, Takaful and Islamic Microfinance TrainingDocument7 pagesIslamic Banking, Takaful and Islamic Microfinance TrainingAlHuda Centre of Islamic Banking & Economics (CIBE)0% (1)

- Press Release - African Interest-Free Banking and Finance AwardsDocument3 pagesPress Release - African Interest-Free Banking and Finance AwardsAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Islamic Banking & Finance Training Workshop - UKDocument8 pagesIslamic Banking & Finance Training Workshop - UKAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- AlHuda CIBE Training Calendar 2019Document8 pagesAlHuda CIBE Training Calendar 2019AlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Press Release - 8th Global Islamic Microfinance ForumDocument3 pagesPress Release - 8th Global Islamic Microfinance ForumAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- African Interest-Free Banking and Finance Forum Inaugurated in Addis Ababa, EthiopiaDocument3 pagesAfrican Interest-Free Banking and Finance Forum Inaugurated in Addis Ababa, EthiopiaAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Press Release - 8th Global Islamic Microfinance ForumDocument2 pagesPress Release - 8th Global Islamic Microfinance ForumAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Press Release-Islamic Banking Is Rapidly Growing Industry in EthiopiaDocument2 pagesPress Release-Islamic Banking Is Rapidly Growing Industry in EthiopiaAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- 8th Global Islamic Microfinance ForumDocument18 pages8th Global Islamic Microfinance ForumAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Two Days Specialized Training Workshop On Islamic Banking & Finance in CanadaDocument7 pagesTwo Days Specialized Training Workshop On Islamic Banking & Finance in CanadaAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Press Release - Halal CertificationDocument2 pagesPress Release - Halal CertificationAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- AlHuda CIBE - International Event Calendar July - Dec, 2018Document1 pageAlHuda CIBE - International Event Calendar July - Dec, 2018AlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Two Days Specialized Training Workshop On Islamic Banking, Finance and Islamic Microfinance Training in PhilippineDocument7 pagesTwo Days Specialized Training Workshop On Islamic Banking, Finance and Islamic Microfinance Training in PhilippineAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Islamic Banking, Finance and Islamic Microfinance Training in UzbekistanDocument8 pagesIslamic Banking, Finance and Islamic Microfinance Training in UzbekistanAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Intraduction To Plastic MoneyDocument8 pagesIntraduction To Plastic MoneyArul KiranNo ratings yet

- Doorstep BankingDocument2 pagesDoorstep BankingWilson Dsouza100% (1)

- United States District Court: Northern District of Illinois, Eastern DivisionDocument5 pagesUnited States District Court: Northern District of Illinois, Eastern DivisionChicago TribuneNo ratings yet

- ACIO Grade II Executive 19th Feb 2021 exam questionsDocument25 pagesACIO Grade II Executive 19th Feb 2021 exam questionspratik sangaleNo ratings yet

- Pricing of IPOs: Is Underpricing Justified OftenDocument65 pagesPricing of IPOs: Is Underpricing Justified OftenPritam Umar K DasNo ratings yet

- Ibs JLN Maktab, KL SC 1 31/01/23Document1 pageIbs JLN Maktab, KL SC 1 31/01/23faezahNo ratings yet

- Research DesignDocument5 pagesResearch DesignanishNo ratings yet

- Barclays 2007Document79 pagesBarclays 2007Cetty RotondoNo ratings yet

- Final Report of Uttara BankDocument55 pagesFinal Report of Uttara BankImdadul Haque SohanNo ratings yet

- BillDesk Payment GatewayDocument1 pageBillDesk Payment GatewayDeba MalikNo ratings yet

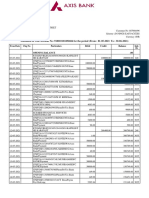

- Account STMTDocument3 pagesAccount STMTDhanush KumarNo ratings yet

- FinancDocument170 pagesFinancthanhcvaNo ratings yet

- Topic 5 - Cash and Cash Equivalent - Rev (Students)Document31 pagesTopic 5 - Cash and Cash Equivalent - Rev (Students)Novian Dwi Ramadana0% (1)

- DtonDocument122 pagesDtonUtkarsh SinhaNo ratings yet

- RBI and Its Currency ManagementDocument17 pagesRBI and Its Currency ManagementAbhinav Prasad100% (2)

- 16 e Chapter 10Document29 pages16 e Chapter 10Yuki MiharuNo ratings yet

- Response To First Comments On DCTV Show Last NightTwitter3.20.19Document39 pagesResponse To First Comments On DCTV Show Last NightTwitter3.20.19karen hudesNo ratings yet

- Usage Patterns of Credit Card Holders in AhmedabadDocument141 pagesUsage Patterns of Credit Card Holders in AhmedabadAshraj_16No ratings yet

- Landman Right of Way Agent in Oklahoma City OK Resume David ManningDocument2 pagesLandman Right of Way Agent in Oklahoma City OK Resume David ManningDavid ManningNo ratings yet

- Fin 072 P1 Exam With AkDocument9 pagesFin 072 P1 Exam With AkCyrille MirandaNo ratings yet

- EMI Calculator BreakdownDocument12 pagesEMI Calculator BreakdownHemant Singh TanwarNo ratings yet

- Sample Chapter5Document5 pagesSample Chapter5zoltan2014No ratings yet

- Icici BankDocument108 pagesIcici Bankmultanigazal_4254062100% (3)

- Car finance schemes evolveDocument92 pagesCar finance schemes evolveneoratm100% (1)

- Credit Operations in PakistanDocument157 pagesCredit Operations in PakistanAdnan Adil HussainNo ratings yet

- Community Reinvestment Act Assessment Area Expansion by CBSI, After ICP CommentsDocument6 pagesCommunity Reinvestment Act Assessment Area Expansion by CBSI, After ICP CommentsMatthew Russell LeeNo ratings yet

- Lok Adalats, DRT, Sarafesi ActiDocument17 pagesLok Adalats, DRT, Sarafesi ActiRaman Kumar SrivastavaNo ratings yet

- IRCTC E Wallet User GuideDocument8 pagesIRCTC E Wallet User GuideVikas PatelNo ratings yet

- Postilion Diagram ElementsDocument12 pagesPostilion Diagram Elementsnzobya50% (2)

- FM - MCQ - Part 2Document7 pagesFM - MCQ - Part 2Vivek SolankiNo ratings yet