Professional Documents

Culture Documents

Writing Legal Opinion

Uploaded by

Ahmedy POriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Writing Legal Opinion

Uploaded by

Ahmedy PCopyright:

Available Formats

Writing Legal Opinions Every so often, a client would seek your legal opinion on some matter of concern to him.

Before rushing into an opinion, however, you would do well to keep the following in mind: One. Ascertain the purpose for which your client seeks your opinion. Does he merely want to know his rights? Does he need to show your opinion to others? Does he have to make an important decision that could have deep repercussion for him and others? Is he facing a potential lawsuit? Your client is not a lawyer and, unless you go deep into his reason for seeking your opinion or try to understand his real problem, he could be posing the wrong questions to you. And, consequently, you could be giving him the wrong answers.

In a case, a client asked her lawyer his opinion regarding what constituted psychological incapacity for marriage. After her lawyer told her, she preoccupied herself with establishing evidence that her husband was psychologically incapacitated for marriage to the point that she strained to fit the facts of her case into what the law required. She gave this evidence to his lawyer. But the Court was unconvinced and did not grant annulment. Yet, as it turned out, the couple was in the first place married without a proper marriage license. Not being at fault, she was entitled to annulment on this ground but she had to go through so much expense and hardships in establishing a weak case based on another ground because, before responding to her query, her lawyer did not bother to find out what she needed his opinion for. Do not settle, therefore, for a hypothetical question. Try to get your clients trust. If you cannot, it might be preferable that you refrain from giving her an opinion or that you make it doubly clear to her that the opinion you give might be the wrong one for her. In this way, you avoid taking the blame for any mishap.

Second. Do pre-work. Get all the facts you need for forming a competent opinion. A wrong factual premise will naturally produce a wrong legal diagnosis. Go over the materials you got from your client, ascertain the legal dispute involved, and put down in writing the principal issue that it produces. Next, make a summary of the relevant facts of the case and put them in correct sequence. Identify the issues that have to be resolved and rough out the arguments that support your thesis. Third. After pre-work, do the write-ups, following what you learned earlier in this book. Introduce the issues by providing the background facts that are needed to understand those issues. You prevent a misunderstanding with your client when you summarize for him the facts on which you rely in rendering your opinion.

Illustrative case: Chan v. Century Bank Below is a sample legal opinion. Like similar examples in this book, do not consider it a prescribed form. Forms are hardly important. It is substance that matters although, in legal writing, substance must meet certain minimum requirements of content. These are: a) background facts that adequately introduce the issues in the case, b) a statement of what those issues are, c) the position you take on those issues, d) the arguments that may be made against you, e) the arguments in your favor, and f) what you want your reader to do under the circumstances. Format and style are up to you. September 14, 2009

Mr. Rogelio G. Chan Milan Furniture Company, Inc. 245 Juan Luna Street Binondo, Manila

Dear Mr. Chan: Here is the opinion that you requested. The facts, as I gather from you and your documents, are as follows:

On May 12, 2008 you applied with the Century Bank in Binondo, Manila, on behalf of Milan Furniture Co., Inc., for a letter of credit, Annex A covering its importation of hardwood from Vietnam. On arrival of the goods, the bank agreed to advance the payment of their price to your supplier. In turn, you executed a promissory note in the name of Milan Furniture, Annex B, undertaking to pay back the banks advance within three months of the date of the note. You also signed a trust receipt, Annex C, covering receipt of the goods. The trust receipt provided that, in case of the sale of the imported hardwood, Milan Furniture would turn over the proceeds of that sale to the bank to apply to your loan. Because Milan Furniture had been unable to pay its promissory note to the bank when it fell due, on October 17, 2008 the lawyers of the bank sent you a demand letter, Annex D, requesting full payment of the debt or return of the goods. I understand that, on receipt of the letter, you tried to negotiate with the manager of the bank, offering to return the imported hardwood that you were yet unable to sell or use. But the bank manager rejected your offer, stating that the bank did not accept goods in payment of debts owed it. Since further negotiations also failed, the bank sent you a final demand for payment on December 4 under a threat of filing a criminal complaint for estafa involving the trust receipt that you executed in its favor.

The question you pose is whether or not, under the above facts, you may be held liable for estafa under PD 115, the Trust Receipt law, in relation to Section 1 (b) of Article 315 of the Revised Penal Code. In my opinion, since the bank opted not to accept the goods even when you offered to return them on behalf of Milan Furniture, it should be deemed to have withdrawn its earlier demand from you to pay or return the goods covered by said Trust Receipt. Effectively, the bank chose to consider Milan Furniture to have already bought those goods, although removing the transaction from the coverage of Section 13 of the Trust Receipt Law. I based my opinion on the following: The relevant provision of the Trust Receipt law or PD 115 provides: Sec. 13. Penalty Clause. The failure of an entrustee to turn over the proceeds of the sale of the goods, documents or instruments covered by a trust receipt to the extent of the amount owing to the entruster or as appears in the trust receipt or to return said goods, documents or instruments if they were not sold or disposed of in accordance with the terms of the trust receipt shall constitute the crime of estafa, punishable under the provisions of Article Three Hundred and Fifteen, Paragraph One (b), of Act Numbered Three Thousand Eight Hundred and Fifteen, as amended, otherwise known as the Revised Penal Code. x x x

The related provisions of Section 1 (b), Article 315 of the Revised Penal Code, under which the violation is made to fall, states: Art. 315. Swindling (estafa). Any person who shall defraud another by any of the means to fall, states: 1. With unfaithful or abuse of confidence, namely:

xxx

xxx

xxx

b. By misappropriating or converting, to the prejudice of another, money, goods, or any other personal property received by the offender in trust or on commission, or for administration, or under any other obligation involving the duty to make delivery of or to return the same, even though such obligation be totally or partially guaranteed by a bond; or by denying having received such money, goods, or other property.

From the above, the following are the elements of estafa involving a trust receipt: 1. The entrustee received the goods under a trust receipt from the entruster under an obligation to turn over the proceeds of the sale of the goods or to return said goods; 2. The entrustee misappropriated or converted the goods by failing to turn over the proceeds of their sale or to return said goods to the entruster; 3. The misappropriation or conversion is to the prejudice of the entruster; and 4. The entruster made a demand on the entrustee. One of the elements of estafa involving a trust receipt is that the entrustee [in this case, you or Milan Furmiture] received the goods under a trust receipt from the entruster [in this case, century Bank] under an obligation to turn over the proceeds of the sale of

the goods or to return said goods. The Trust Receipt law, PD 115, provides in Section 11 that the liability for estafa under paragraph 1(b) of Article 315 of the Penal Code arises in case of the failure of an entrustee to turn over the proceeds of the sale of the goods . . . Or to return said goods. The trust receipt in his case, Annex A, echoes the above provisions of the Trust Receipt Law. Under it Milan Furniture or you as its signatory, undertook to turn over to the BANK the proceeds of the sale of the goods or, in case of non-sale, to return the goods covered by this Trust Receipt to the BANK upon its demand. But the terms of the trust receipt does not end there. The trust receipts, Annex A, gives Century Bank an option not to accept the return of the goods. In effect, Century Bank chose to regard such goods already sold to Milan Furniture even though the latter could and wanted to return them. The seventh paragraph of the Trust Receipt, Annex A, thus reads:

We agree that the BANK is not obliged to accept any return of the goods under this Trust Receipt by us or to consider any return thereof if accepted or demanded by the BANK, as satisfaction of our indebtedness to the BANK. Century Bank in fact availed itself of the above option. It opted not to accept the goods even when you offered to return them. Consequently, Century Bank should be deemed to have withdrawn its earlier demand that you or Milan Furniture pay or return the goods covered by said Trust Receipt immediately. Effectively, Century Bank chose by its action to consider the subject goods sold to Milan Furniture, altogether removing the transaction from the coverage of Section 13 of the Trust Receipt Law. The essence of the crime of conversion or misappropriation is that the offender to whom money or goods has been entrusted has unfaithfully or with abuse of confidence failed to return what was merely entrusted to him and appropriated it for his own. Here, neither Milan Furniture nor you could be considered as having unfaithfully or with abuse of confidence misappropriate and converted the goods subject of the trust receipt. Century Bank did not want those goods back. It had regarded them sold outright to Milan Furniture. The latters liability for the goods should, therefore, be considered purely civil.

Moreover, Section 13 of the Trust Receipt Law provides that the failure of an entrustee to turn over the proceeds of the sale of the goods . . . . Or to return said goods . . . . If they were not sold or disposed of in accordance with the terms of the trust receipt shall constitute the crime of estafa. The essence of the penal provision of the law, therefore, is that the entruster [here, Century Bank] has entrusted the good to the entrustee [Milan Furniture or you] for him to sell. Once sold, the entrustee was to turn over the proceeds of the sale to the entruster. Section 13 does not embrace instances where the goods are turned over by the entrustor to the entrustee for the latters use in his own business. This is clear from the ruling of the Supreme Court in Colinares v. Court of Appeals that reads: Also noteworthy is the fact that Petitioners are not importers acquiring the goods for re-sale, contrary to the express provision embodied in the trust receipt. They are contractors who obtained the fungible goods for their construction project. At no time did title over the construction materials pass to the bank, but directly to the Petitioners from CM Builders Centre. This impresses upon the trust receipt in question vagueness and ambiguity, which should not be the basis for criminal prosecution in the event of violation of its provisions.

In this case, on May 12, 2008 Century Bank agreed with Milan Furniture to open a letter of credit (LC) on the latters behalf to cover a shipment of hardwood from Vietnam for use in its manufacture of furniture. Notwithstanding that Milan Furniture imported the hardwood in question so it could use them in manufacturing furniture, Century Bank made you, a representative of your company, sign a trust receipt that made it appear as if Century Bank had turned over the hardwood to Milan Furniture for it sell to others and to turn over to the bank he proceeds of the sale. The Supreme Court has long condemned such practice. Thus, it said in the Colinares case: The practice of banks of making borrowers sign trust receipts to facilitate collections of loans and place them under the threats of criminal prosecution should they be unable to pay it may be unjust and inequitable, if not reprehensible. Such agreements are contracts of adhesion which borrowers have no option but to sign lest their loan be disapproved. The resort to this scheme leaves poor and hapless borrowers at the mercy of banks, and is prone to misinterpretation, as had happened in this case. Eventually, PBC showed its true colors and admitted that it was only after collection of the money, as manifested by its Affidavit of Desistance.

That the transaction was a loan is made clear from paragraph 1 of the agreement for the opening of a letter of credit between Century bank and MHTI, Annex A. It provides that, in consideration of the opening of the letter of credit on behalf of Milan Furniture in the amount of US$39,060, the latter undertook to pay the bank on demand for all drafts drawn against such letter of credit, with interest at 13% per annum. The title to the goods never really passed to the bank. Century Bank did not import them from Vietnam; it merely opened a letter of credit for the benefit to Milan Furniture under the cover of that letter of credit. In short, Century Bank merely provided the loan that financed the shipment. Since the transaction was a loan, Milan Furnitures liability to Century Bank should only be regarded as civil. The criminal action against you must fail. It is but fair and the investigating prosecutor or the court should see the point. A word of reservation: I base my opinion on the language of the laws involved as well as on settled judicial precedent. But, in the event the bank files a criminal complaint against you, there is the chance, however small, that the public prosecutor may just decide to file it in court, subjecting you to the hassle, expense, and risk that criminal entail. But I am confident that, ultimately, you will be absolved.

Please let me know if I can be of further service to you in this matter. Very truly yours, ATTY. ANNA ELIZABETH A. DE DIOS There is one last point. Legal opinions have their limitations. You have to realize that not all disputes are best resolved through judicial remedies. Litigations are best avoided if the economics do not make sense as when your clients debtor is practically bankrupt. In such a case, your client would merely be throwing away good money after bad by incurring expenses for docket fees and attorneys fees with no hope of recovering anything. Further, a legal confrontation could irreparably damage relationships that may be far more valuable than the benefits derived from a judicial resolution of the dispute.

You might also like

- Sample Legal OpinionDocument2 pagesSample Legal Opinionjennifer yanto100% (1)

- Legal OpinionDocument4 pagesLegal OpinionJean Monique Oabel-Tolentino100% (3)

- Company Land Registration DeniedDocument2 pagesCompany Land Registration DeniedIvoryAthenaPalarcaPosposNo ratings yet

- Legal Opinion Sample Answer FinalDocument6 pagesLegal Opinion Sample Answer FinalArCee SantiagoNo ratings yet

- Bar Exam Legal Opinion on RemarriageDocument4 pagesBar Exam Legal Opinion on Remarriagefamigo45188% (26)

- Legal Writing - OpinionDocument4 pagesLegal Writing - OpinionOch Pua25% (4)

- Sample Legal OpinionDocument4 pagesSample Legal OpinionJohn Louie100% (1)

- How To Write A Legal OpinionDocument20 pagesHow To Write A Legal OpinionTagarda Lyra90% (10)

- Sample Legal OpinionDocument6 pagesSample Legal Opinionione salveron100% (1)

- Sample Legal Opinion 3Document1 pageSample Legal Opinion 3Dominic Quijada50% (4)

- Legal OpinionDocument2 pagesLegal OpinionColeenNo ratings yet

- Sample Legal Opinion PDFDocument5 pagesSample Legal Opinion PDFFredrick Fernandez100% (1)

- Sample Legal OpinionDocument2 pagesSample Legal OpinionMLee100% (1)

- Sample Legal Opinion FormatDocument2 pagesSample Legal Opinion FormatPaul Sarangaya50% (2)

- Legal Opinion Writing NotesDocument2 pagesLegal Opinion Writing Notesroomjdman50% (2)

- Powers of an OIC Municipal MayorDocument3 pagesPowers of an OIC Municipal MayorCharshii100% (1)

- Legal Opinion FormatDocument2 pagesLegal Opinion FormatUPDkath100% (4)

- Legal OpinionDocument2 pagesLegal OpinionpresjmNo ratings yet

- Term Paper in Statutory ConstructionDocument17 pagesTerm Paper in Statutory ConstructionMichelle VillamoraNo ratings yet

- Legal OpinionDocument3 pagesLegal OpinionshelNo ratings yet

- Sample Legal OpinionDocument3 pagesSample Legal OpinionkristinebaldeoNo ratings yet

- Sample Legal OpinionDocument2 pagesSample Legal Opinionjuleii0875% (4)

- Legal Opinion FinalDocument12 pagesLegal Opinion FinalLyan David Marty JuanicoNo ratings yet

- Legal Opinion Letter - SampleDocument2 pagesLegal Opinion Letter - SampleJozele Dalupang78% (9)

- Sample Legal OpinionDocument2 pagesSample Legal OpinionNonViolentResistance82% (34)

- Cover Letter For Legal OpinionDocument1 pageCover Letter For Legal OpiniondarL 15No ratings yet

- Qualified Rape Case OpinionDocument3 pagesQualified Rape Case OpinionDon So HiongNo ratings yet

- Legal Opinion - MidtermsDocument4 pagesLegal Opinion - MidtermseieipayadNo ratings yet

- Legal OpinionDocument20 pagesLegal Opinionniks1No ratings yet

- Legal OpinionDocument7 pagesLegal OpinionMiguel PillasNo ratings yet

- Legal Opinion SampleDocument3 pagesLegal Opinion SampleJosephine BercesNo ratings yet

- Legal OpinionDocument5 pagesLegal OpinionCarlo Jose BactolNo ratings yet

- Legal Writing #5 (Legal Opinion)Document3 pagesLegal Writing #5 (Legal Opinion)Victoria Denise MonteNo ratings yet

- Legal Opinion LetterDocument3 pagesLegal Opinion LetterLola LaRue100% (7)

- Legal Opinion For LegresDocument3 pagesLegal Opinion For LegresJester KutchNo ratings yet

- Legal Opinion TemplateDocument6 pagesLegal Opinion TemplateSha Vargas100% (2)

- Legal OpinionDocument2 pagesLegal OpinionDayanski B-mNo ratings yet

- Legal Opinion Sample FormDocument2 pagesLegal Opinion Sample FormAbdi NegaraNo ratings yet

- Beru Client Opinion LetterDocument5 pagesBeru Client Opinion LetterJay PowNo ratings yet

- Mendoza Law Office: P. Del Rosario ST., Cebu CityDocument2 pagesMendoza Law Office: P. Del Rosario ST., Cebu CityJuris Renier MendozaNo ratings yet

- Legal OpinionDocument3 pagesLegal OpinionNori Lola100% (1)

- Letter of Legal Opinion Sample 1Document2 pagesLetter of Legal Opinion Sample 1Justin Luis JalandoniNo ratings yet

- Legal Opinion Letter SampleDocument2 pagesLegal Opinion Letter SampleEC Caducoy100% (2)

- Strict and Liberal - Notes 4qDocument35 pagesStrict and Liberal - Notes 4qPatrick James TanNo ratings yet

- Inter Office MemoDocument6 pagesInter Office MemoTooter Kantuter0% (1)

- Legal Opinion 2Document1 pageLegal Opinion 2Stephen Jorge Abellana EsparagozaNo ratings yet

- Decision Writing/12 Angry MenDocument5 pagesDecision Writing/12 Angry MenJaynie PajarillagaNo ratings yet

- Legal Opinion On RapeDocument3 pagesLegal Opinion On RapeJulo R. TaleonNo ratings yet

- Sample Legal Opinion For The 4th Sunday of The Bar ExamsDocument1 pageSample Legal Opinion For The 4th Sunday of The Bar ExamsRalf JOsef LogroñoNo ratings yet

- Property Law Moot Submission PDFDocument6 pagesProperty Law Moot Submission PDFAvitesh VikashNo ratings yet

- Sample Legal OpinionDocument2 pagesSample Legal Opinionfamigo451100% (1)

- Legal Writing Notes - Aug 24, 2016Document4 pagesLegal Writing Notes - Aug 24, 2016Ericha Joy Gonadan100% (1)

- Practicum Report Legal OpinionDocument19 pagesPracticum Report Legal OpinionCarmelie CumigadNo ratings yet

- Lee Vs RodilDocument6 pagesLee Vs RodilJing DalaganNo ratings yet

- TRL27 - G.R. No. 80544Document5 pagesTRL27 - G.R. No. 80544masterlazarusNo ratings yet

- 06 Ching vs. CADocument2 pages06 Ching vs. CAKelsey Olivar MendozaNo ratings yet

- ALFREDO CHING VS SECRETARY OF JUSTICEDocument5 pagesALFREDO CHING VS SECRETARY OF JUSTICEromanruizpugedaNo ratings yet

- Mercantile Law Q&ADocument6 pagesMercantile Law Q&ARay Anthony RilveriaNo ratings yet

- Prudential Bank vs. Ben CuevoDocument12 pagesPrudential Bank vs. Ben CuevoKatrina Quinto PetilNo ratings yet

- People VS CuervoDocument4 pagesPeople VS CuervoKeej Dalonos100% (1)

- CM x86 13.0 r1 Android x86Document2 pagesCM x86 13.0 r1 Android x86Ahmedy PNo ratings yet

- Falcon 4.0Document579 pagesFalcon 4.0Ahmedy PNo ratings yet

- Luz Vs Ermita Memorandum On Appeal FinalDocument35 pagesLuz Vs Ermita Memorandum On Appeal FinalAhmedy PNo ratings yet

- Intel Drivers ManualDocument13 pagesIntel Drivers ManualAhmedy PNo ratings yet

- Rem Law PreweekDocument24 pagesRem Law PreweekAhmedy P100% (1)

- Archaeology Quest For A Seat AnthropologyDocument17 pagesArchaeology Quest For A Seat AnthropologyAhmedy PNo ratings yet

- Mso Example Intl Setup File ADocument1 pageMso Example Intl Setup File AAkash NagarNo ratings yet

- 2004 Notarial LawDocument17 pages2004 Notarial LawAhmedy PNo ratings yet

- Mso Example Intl Setup File ADocument1 pageMso Example Intl Setup File AAkash NagarNo ratings yet

- Notary Petition Renewal InquiriesDocument1 pageNotary Petition Renewal InquiriesAhmedy PNo ratings yet

- Legal Ethics PreweekDocument11 pagesLegal Ethics PreweekClambeauxNo ratings yet

- Legal Forms NoPWDocument54 pagesLegal Forms NoPWAhmedy PNo ratings yet

- Opinion and MemorandumDocument13 pagesOpinion and MemorandumAhmedy P100% (1)

- Commercial Law Pre Week PDFDocument23 pagesCommercial Law Pre Week PDFAries MatibagNo ratings yet

- Crim Law PreweekDocument20 pagesCrim Law PreweekOna DlanorNo ratings yet

- Pre-Week Reviewer: Administrative Law and Public Officers LawDocument19 pagesPre-Week Reviewer: Administrative Law and Public Officers LawAgnes Anne GarridoNo ratings yet

- Civil Law PreweekDocument19 pagesCivil Law PreweekMarc Titus Cebreros100% (1)

- Presentation Fundamentals of Legal WritingDocument20 pagesPresentation Fundamentals of Legal WritingAhmedy PNo ratings yet

- Cantina Burritos...Document3 pagesCantina Burritos...Ahmedy PNo ratings yet

- Memorandum Writing EditDocument103 pagesMemorandum Writing EditAhmedy P100% (1)

- SC Upholds BIR Levy of Marcos Properties to Cover Tax DelinquenciesDocument7 pagesSC Upholds BIR Levy of Marcos Properties to Cover Tax DelinquenciesGuiller C. MagsumbolNo ratings yet

- Life Skill Assignment - CompletedDocument2 pagesLife Skill Assignment - CompletedGabriel Cabrera PetroneNo ratings yet

- CALalas Vs CADocument10 pagesCALalas Vs CAQuennie Jane SaplagioNo ratings yet

- SASSA Affivadit For Disability GrantDocument1 pageSASSA Affivadit For Disability Grantolwethu moboNo ratings yet

- Class 5Document39 pagesClass 5Geoffrey MwangiNo ratings yet

- Chicago Title Insurance Corporation, A Missouri Corporation v. James A. Magnuson First American Title Insurance Company, C/o Timothy P. Sullivan, Registered Agent, 487 F.3d 985, 1st Cir. (2007)Document20 pagesChicago Title Insurance Corporation, A Missouri Corporation v. James A. Magnuson First American Title Insurance Company, C/o Timothy P. Sullivan, Registered Agent, 487 F.3d 985, 1st Cir. (2007)Scribd Government DocsNo ratings yet

- Termination of Employment Letter TemplateDocument4 pagesTermination of Employment Letter Templateprecious okpokoNo ratings yet

- 4.2022 SCSC Membership FormDocument2 pages4.2022 SCSC Membership FormLerbet SisonNo ratings yet

- Bill of Exchange MaybankDocument3 pagesBill of Exchange MaybankBuayaz GamingNo ratings yet

- Nego Special AssignDocument2 pagesNego Special AssignRupert VillaricoNo ratings yet

- Bus Crash Case Denies Moral DamagesDocument4 pagesBus Crash Case Denies Moral DamagesSylina AlcazarNo ratings yet

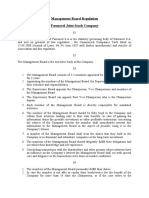

- Management Board RegulationDocument6 pagesManagement Board RegulationaviktorNo ratings yet

- AcFn LL Unit 4Document22 pagesAcFn LL Unit 4Khalid MuhammadNo ratings yet

- Iso 9001 2015 v01Document5 pagesIso 9001 2015 v01Vanderlei RinaldiNo ratings yet

- Notice of Termination of AgencyDocument2 pagesNotice of Termination of AgencyAnonymous xAvEmBKzE100% (1)

- Plain Language LeaseDocument15 pagesPlain Language Leaseccandsinc100% (1)

- DONATIONDocument13 pagesDONATIONJusty LouNo ratings yet

- Convertible Loan AgreementDocument30 pagesConvertible Loan AgreementBernard Chung Wei Leong86% (21)

- IC Compiler II Application Options and Attributes: Version K-2015.06-SP4, December 2015Document1,119 pagesIC Compiler II Application Options and Attributes: Version K-2015.06-SP4, December 2015amu100% (1)

- Partnership Law - English Law NotesDocument24 pagesPartnership Law - English Law NotesUmair_Nazeer_5430100% (2)

- DownloadDocument4 pagesDownloadAriz LapuzNo ratings yet

- Advocates For Truth Vs Bangko SentralDocument2 pagesAdvocates For Truth Vs Bangko SentralSamuel Terseis100% (4)

- Albi TF UL CoverageDocument1 pageAlbi TF UL CoverageJacqueline WarrenNo ratings yet

- Ifrs 9 QuestionsDocument10 pagesIfrs 9 QuestionsKiri chrisNo ratings yet

- Bisig NG Manggagawa Sa Tryco, Et Al. vs. NLRCDocument11 pagesBisig NG Manggagawa Sa Tryco, Et Al. vs. NLRCZereshNo ratings yet

- SHULTZYS Bill Notice-First Letter 27-02-2023Document3 pagesSHULTZYS Bill Notice-First Letter 27-02-2023Michael SchulzeNo ratings yet

- COMPTEUR DE GAZ G4-10 BesselDocument5 pagesCOMPTEUR DE GAZ G4-10 BesselMohamed SomaiNo ratings yet

- Food Fiesta Franchise AgreementDocument4 pagesFood Fiesta Franchise AgreementLea May Asuncion100% (3)

- Sale of Goods Act, 1930Document48 pagesSale of Goods Act, 1930Khushboo ParikhNo ratings yet

- Administration Bond, 2006Document13 pagesAdministration Bond, 2006tiugandaNo ratings yet